Bitcoin (BTC) has bounced again above $80,000 after dipping to $76,000, signaling renewed investor curiosity. The most recent rally follows softer-than-expected U.S. inflation information, which eased issues over aggressive Federal Reserve insurance policies.

In the meantime, Bitcoin open curiosity surged previous $46 billion, reflecting rising speculative exercise and setting the stage for potential volatility.

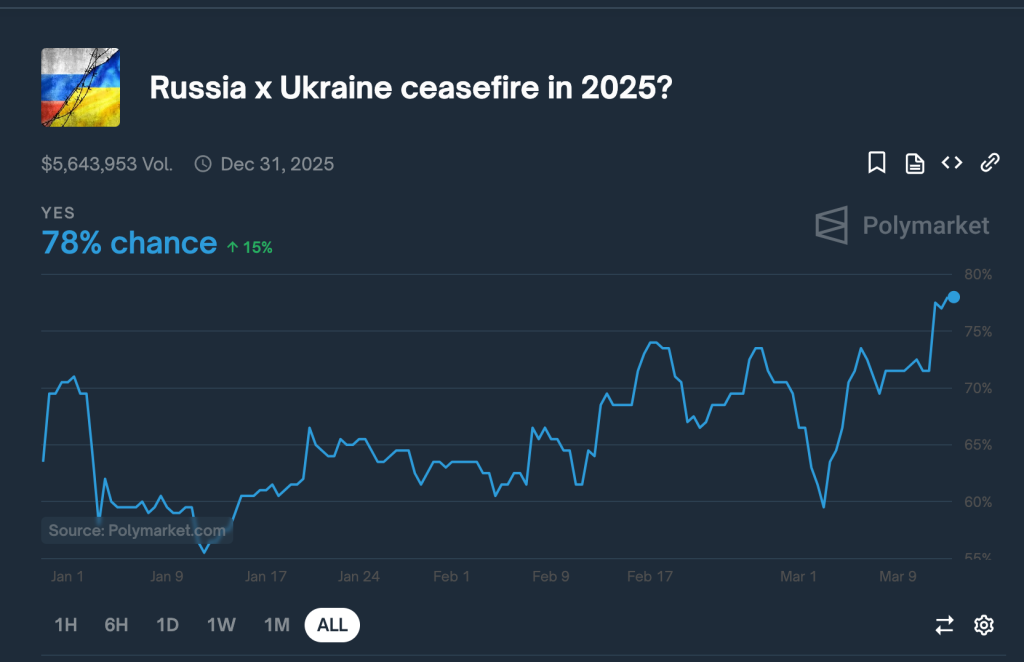

Including to the momentum, markets responded positively to progress in Russia-Ukraine ceasefire talks. Betting odds on Polymarket for a ceasefire earlier than 2025 climbed to 78%, suggesting merchants anticipate diminished geopolitical uncertainty—an element that might drive contemporary capital inflows into Bitcoin and different digital belongings.

How a Russia-Ukraine Ceasefire Might Influence Bitcoin

The potential of a ceasefire between Russia and Ukraine has triggered optimism in world markets. If carried out, the reintegration of Russian power provides might decrease operational prices for BTC miners, probably boosting mining profitability.

Moreover, relaxed monetary restrictions might enable capital from Russian traders to re-enter world crypto markets, growing liquidity and institutional demand.

Polymarket information signifies that crypto bettors are betting on a ceasefire deal earlier than the tip of 2025, with over $5.6 million in lively trades.

Traditionally, such geopolitical developments have influenced Bitcoin’s value by shaping investor sentiment.

Bitcoin Worth Outlook: Key Resistance at $85K in Focus

Regardless of its latest positive aspects, the BTC/USD faces sturdy resistance close to $85,000, a degree it has struggled to interrupt. The cryptocurrency stays in a consolidation part, with help ranges round $78,500 and $75,200 offering a cushion towards potential pullbacks.

- BTC buying and selling quantity fell 22.6% to $102.2 billion, indicating diminished speculative exercise.

- Choices open curiosity climbed 1.89% to $33.1 billion, signaling elevated bullish positioning.

- Lengthy/Brief ratio on main exchanges stays above 2.0, reflecting a tilt towards shopping for curiosity.

If Bitcoin manages to interrupt and maintain above $85,000, it might pave the best way for a rally towards $89,000 and past. Nevertheless, failure to take action could result in a deeper correction, probably bringing BTC again towards the $73,000-$75,000 vary.

Breakout or Rejection Forward?

Bitcoin (BTC/USD) is buying and selling round $81,580, up 0.62%, after rebounding from key help close to $78,500. The value stays beneath a descending trendline, with resistance at $83,800 performing as a serious barrier.

A breakout above this degree might push BTC towards $86,900 and $91,000, signaling a bullish shift.

Nevertheless, failure to carry present positive aspects might even see BTC retesting help ranges at $78,500 and $75,200. The 50-period EMA at $82,500 is performing as a dynamic resistance, reinforcing bearish sentiment.

Merchants ought to look ahead to a decisive shut above $83,800 to substantiate upward momentum, whereas rejection might set off additional draw back stress.

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is gaining traction as a community-driven token that rewards holders with actual Bitcoin. In contrast to standard meme tokens, BTCBULL airdrops BTC robotically when Bitcoin reaches key value milestones, providing a powerful incentive for long-term traders.

Staking & Passive Earnings Alternatives

BTC Bull options high-yield staking, permitting customers to earn passive revenue with a powerful 154% APY. This staking system has already seen sturdy neighborhood participation, with thousands and thousands of BTCBULL tokens staked.

- Present Presale Worth: $0.002405 per BTCBULL

- Whole Raised: $3.4M / $3.66M goal

With investor curiosity surging, this presale presents a possibility to safe BTCBULL at early-stage costs earlier than the following value soar.

The put up Bitcoin Worth Rebounds – However Is a Crash to $73K or a Rally to $90K Subsequent? appeared first on Cryptonews.