Bitcoin continues to indicate shocking resilience because it pushes again round $90K amidst rising geopolitical tensions. With the Center East battle intensifying and world markets reacting cautiously, BTC is seemingly being handled as a macro hedge. The market narrative is shifting, with rising institutional consideration across the ETF developments and elevated volatility throughout risk-on belongings.

Bitcoin Value Evaluation: The Every day Chart

On the each day chart, BTC just lately broke out of the descending channel it had been buying and selling inside for months. The breakout occurred after a interval of accumulation close to the $80K help zone, adopted by a strong push into the $95K resistance. Nevertheless, after reaching that zone, the value confronted robust rejection, printing bearish each day candles.

The asset is now prone to retest the higher boundary of the damaged channel, which may flip into help. The RSI has cooled off from almost overbought ranges and stays round 50, indicating the potential for continuation if patrons step in quickly. The 100 and 200-day shifting averages are nonetheless above the value, performing as dynamic resistances above the $95K space.

BTC/USDT 4-Hour Chart

On the 4-hour chart, BTC was shifting inside a rising wedge sample and just lately received rejected beneath the higher resistance band close to $95K. After failing to interrupt above, the value dropped again towards the decrease boundary of the wedge construction and is at the moment approaching the $90K help zone.

If patrons defend this degree, we may see one other try towards $95K. Nevertheless, if the $90K psychological degree breaks, a transfer towards the decrease boundary of the wedge close to $88K is probably going. The RSI has additionally sharply dropped beneath 50, displaying a transparent lack of momentum within the brief time period. For now, the value is leaning bearish till a robust bounce confirms new energy.

Sentiment Evaluation

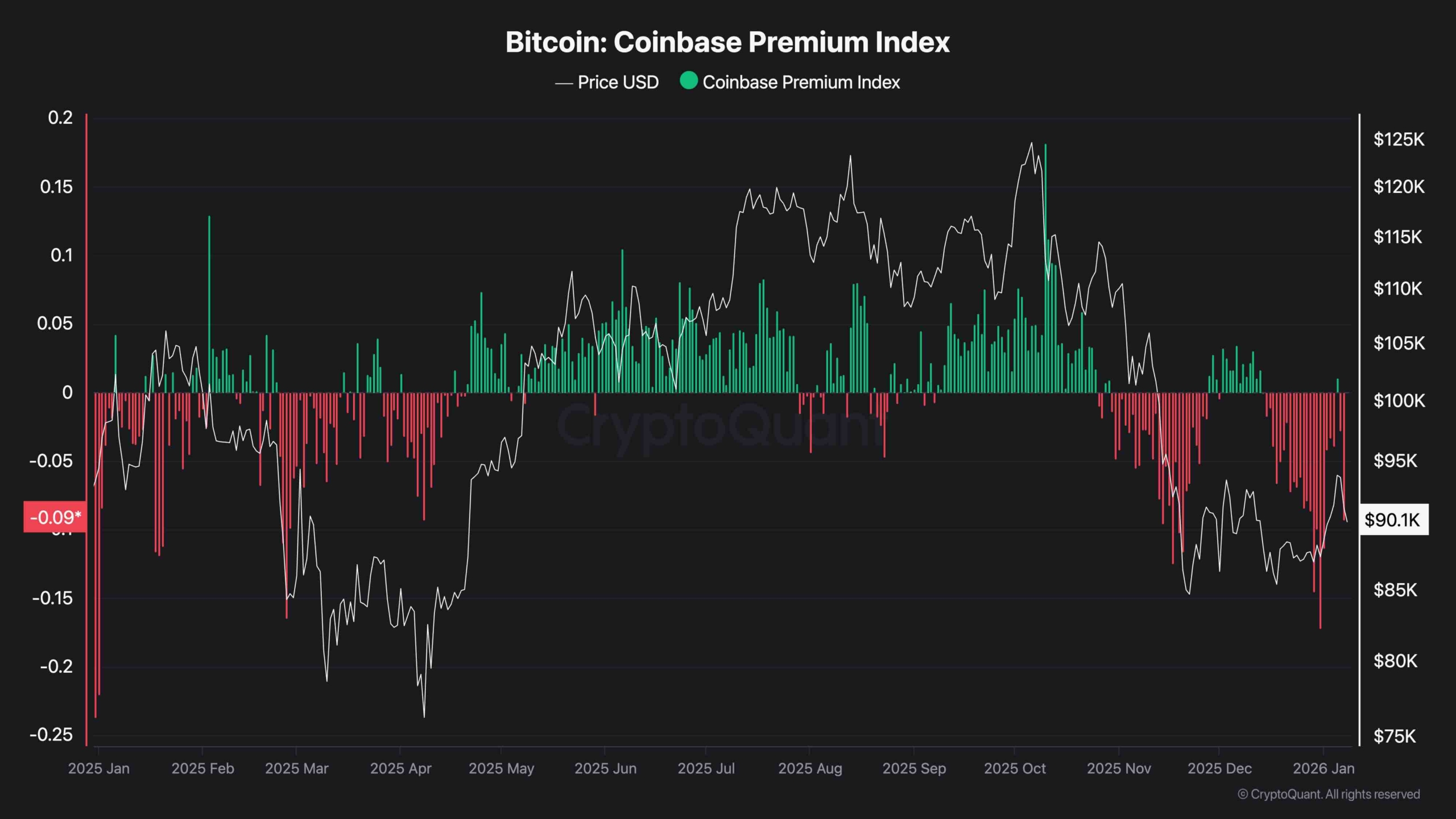

Sentiment indicators are blended. The Coinbase Premium Index remains to be in destructive territory, which suggests there’s comparatively extra promoting strain from U.S.-based buyers. This reveals an absence of robust spot-driven demand on the present worth.

That stated, excessive worry shouldn’t be current, and the broader derivatives market stays regular, which suggests merchants are nonetheless holding their positions regardless of the current correction. If BTC holds the $90K degree, sentiment may shift quick, particularly if ETF information turns bullish or geopolitical instability deepens.

The publish Bitcoin Value Evaluation: What Will Occur to BTC if Essential $90K Assist Cracks? appeared first on CryptoPotato.