Bitcoin did not proceed its rally and uncover new all-time highs above $126,000, resulting in a pointy correction that has unsettled the market. Buyers are exhibiting indicators of worry because the latest drop invalidated the breakout momentum that many anticipated to increase the bull run, and the market could be on the verge of a bearish shift.

By Shayan

The Every day Chart

On the day by day timeframe, BTC did not proceed past $126K and has fallen sharply to the $100K space, earlier than rebounding rapidly. The rejection from the ATH zone, mixed with the breakdown beneath the 100-day transferring common, indicators a lack of bullish momentum.

The following main assist sits across the $100K vary, which additionally aligns with the trendline assist and the 200-day transferring common. The RSI close to 41 means that whereas the market is cooling off, there’s nonetheless room for additional draw back if consumers don’t step in quickly.

The 4-Hour Chart

The 4-hour chart reveals that BTC discovered short-term assist across the $110K zone after the extreme sell-off. This space beforehand served as an accumulation zone earlier than the final leg up, making it a important short-term stage.

The RSI stays weak round 32, exhibiting restricted energy from consumers. Rapid resistance lies round $117K, the place earlier assist flipped into resistance. A rejection from this zone might set off one other leg down, presumably towards the $105k area, which aligns with the decrease boundary of the big ascending channel. A breakdown of this channel would doubtless finish the bull market, and Bitcoin would enter a long-term downtrend alongside the entire crypto market.

Sentiment Evaluation

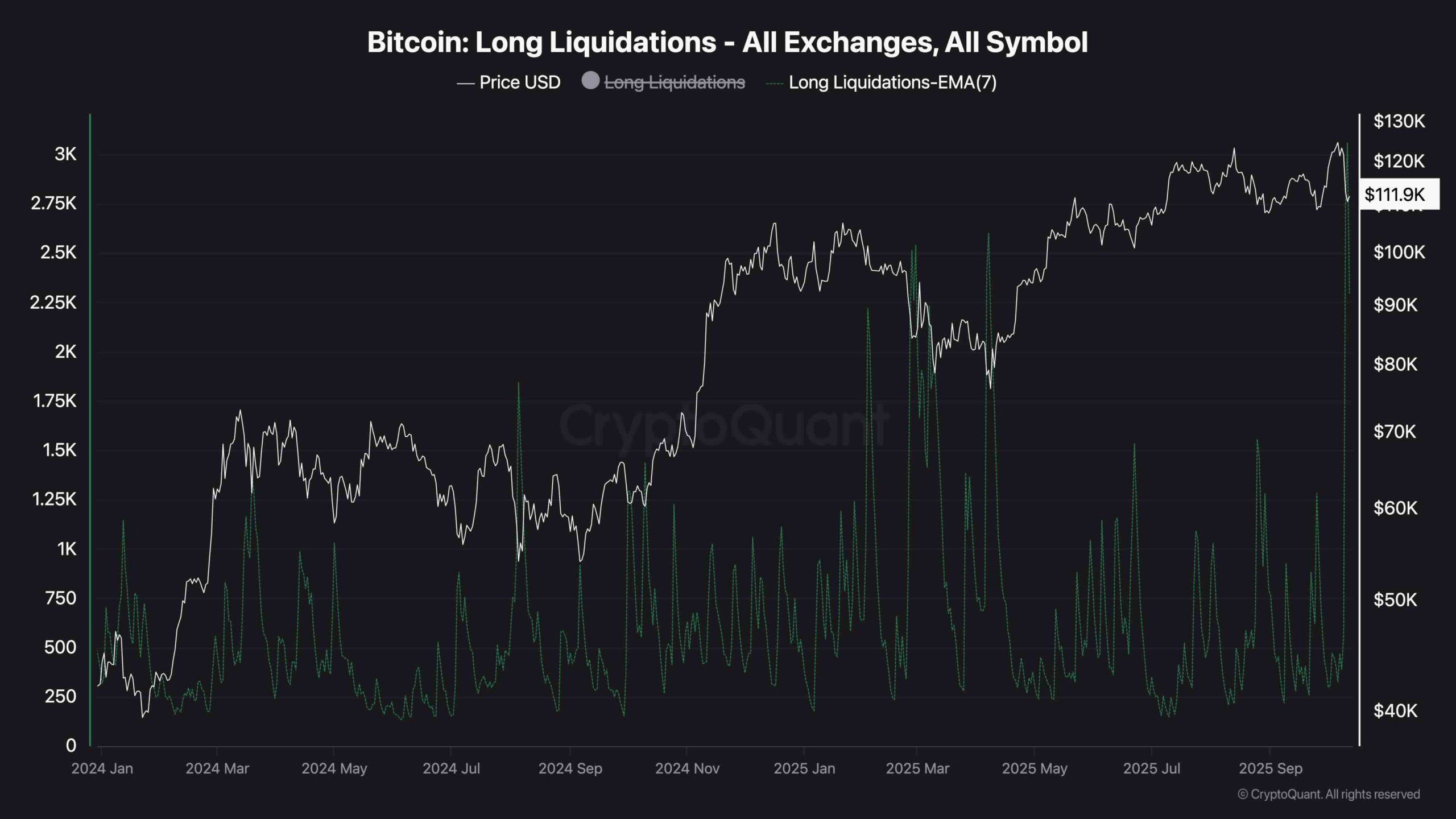

Lengthy Liquidations (7-day MA)

The liquidation chart highlights an enormous spike in lengthy liquidations, the biggest one ever, coinciding with Bitcoin’s failure to set a brand new excessive. This cascade has compelled overleveraged merchants out of the market and considerably diminished open curiosity.

Traditionally, such liquidation flushes typically mark short-term bottoms, however given the delicate sentiment, buyers stay hesitant to re-enter aggressively. The market’s fear-driven tone means that whereas a reduction bounce is feasible, confidence within the uptrend has clearly weakened. This could possibly be the start of the tip for this cycle’s bullish market, particularly if the worth closes beneath $100K.

The put up Bitcoin Worth Evaluation: Is BTC’s Momentum Leaning Bearish After the Crash? appeared first on CryptoPotato.