Bitcoin has damaged under the important thing 200-day shifting common of $83K, exhibiting a notable bearish signal. Nonetheless, the worth encounters consumers’ final defence line at $80K, with a possible breakout resulting in a considerable decline towards $75K.

Technical Evaluation

By Shayan

The Each day Chart

Bitcoin was rejected on the $92K resistance, triggering a robust sell-off that led to a break under the important thing 200-day MA at $83K and the 0.5 Fibonacci retracement degree. This zone was anticipated to supply robust demand, however bearish stress overpowered consumers, leading to lengthy liquidations and a unfavourable shift in market sentiment.

At the moment, Bitcoin is testing the final line of defence from the consumers on the $80K area, which aligns with the ascending channel’s decrease boundary and the 0.618 Fibonacci retracement degree. If this degree fails, one other sell-off may drive costs towards $75K, marking a deeper market correction.

The 4-Hour Chart

Within the decrease timeframe, Bitcoin’s worth consolidates between $80K and $92K. A latest rejection on the higher finish of this vary underscores the market’s hesitation. A transparent breakout from this zone is required to ascertain a definitive development.

Furthermore, a liquidity pool exists slightly below the latest low of $78K, the place quite a few sell-stop orders have collected.

This pool could function a gorgeous goal for sensible cash, rising the probability of a bearish breakout within the mid-term. Consequently, Bitcoin’s worth motion within the coming weeks is predicted to stay unstable, with additional consolidation possible earlier than any decisive transfer.

On-chain Evaluation

By Shayan

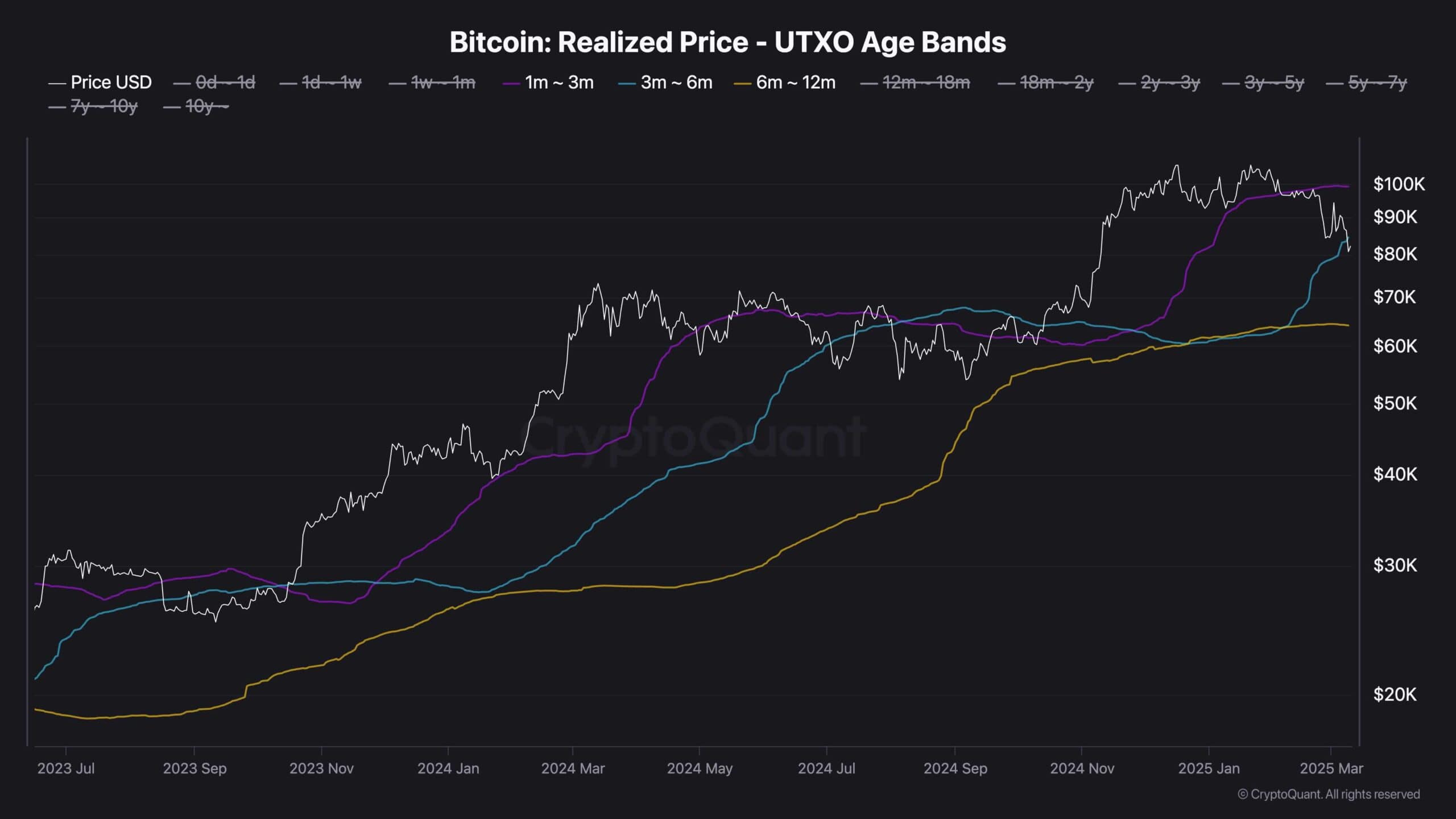

Traditionally, Bitcoin’s interplay with the Realized Worth of 3-6 Month UTXOs has performed a pivotal function in defining market route. This metric usually serves as a robust assist or resistance zone, reflecting the typical acquisition worth of mid-term holders.

At the moment, Bitcoin is testing the realized worth of 3-6 month holders at $83K. Holding above this zone would point out robust market confidence, reinforcing bullish sentiment and rising the probability of additional upside momentum.

Nonetheless, if Bitcoin fails to take care of assist at this threshold and breaks under, it may set off a shift in sentiment towards concern. This situation could result in a distribution section, the place quick to mid-term traders offload their holdings, probably pushing the worth right into a deeper correction and offering the chance for sensible cash to build up at low costs.

Thus, Bitcoin’s worth motion across the $83K degree will likely be important in shaping its short- to mid-term trajectory. Whether or not it rebounds or breaks down will possible decide the following main development available in the market.

The put up Bitcoin Worth Evaluation: How Low Will BTC Drop This Week Following Lack of $80K appeared first on CryptoPotato.