The U.S.–China commerce alignment and the Federal Reserve’s current charge lower have eased macroeconomic pressures, creating favorable situations for threat belongings. But, Bitcoin’s subsequent transfer will rely upon whether or not it may affirm a breakout above the 100-day MA or maintain the 200-day MA as structural help.

Till one aspect of this equilibrium breaks, the market stays in accumulation and consolidation mode, with volatility compression seemingly previous the following main impulse transfer.

Technical Evaluation

By Shayan

The Each day Chart

On the every day timeframe, Bitcoin has been oscillating between the 100-day MA close to $114K and the 200-day MA round $109K, making a well-defined equilibrium zone. The repeated rebounds from the 200-day MA sign that the $108K–$109K space continues to draw institutional demand, whereas the $114K–$116K vary serves as a robust distribution zone.

This construction highlights the market’s present state of steadiness between patrons and sellers. The continued stabilization section might characterize an accumulation sample, as proven by the clustered value motion between the 2 key shifting averages.

A confirmed every day shut above the 100-day MA would seemingly set off a breakout towards $120K–$122K, whereas a breakdown under $108K might expose the $102K–$104K institutional demand zone as soon as once more.

Enhancing macro sentiment from the FOMC’s dovish coverage pivot and the U.S.–China cooperation framework might help a bullish continuation if on-chain and quantity metrics affirm accumulation.

The 4-Hour Chart

The 4-hour timeframe reinforces the range-bound nature of Bitcoin’s current conduct. The value has repeatedly reacted from the $108K–$109K help zone, forming greater lows and trying to reclaim short-term construction. Nonetheless, the $115K–$116K resistance band stays a ceiling that has capped a number of upward makes an attempt.

This setup outlines a symmetrical consolidation inside an ascending construction, suggesting that volatility is tightening earlier than a possible breakout.

A bullish breakout above $116K might mark a structural shift towards $120K–$122K, whereas a failure to carry the $108K space would affirm a deeper retest towards the $102K liquidity pocket.

Till both aspect of the vary is breached, the market is predicted to oscillate between these ranges, with low volatility previous the following growth.

On-Chain Evaluation

By Shayan

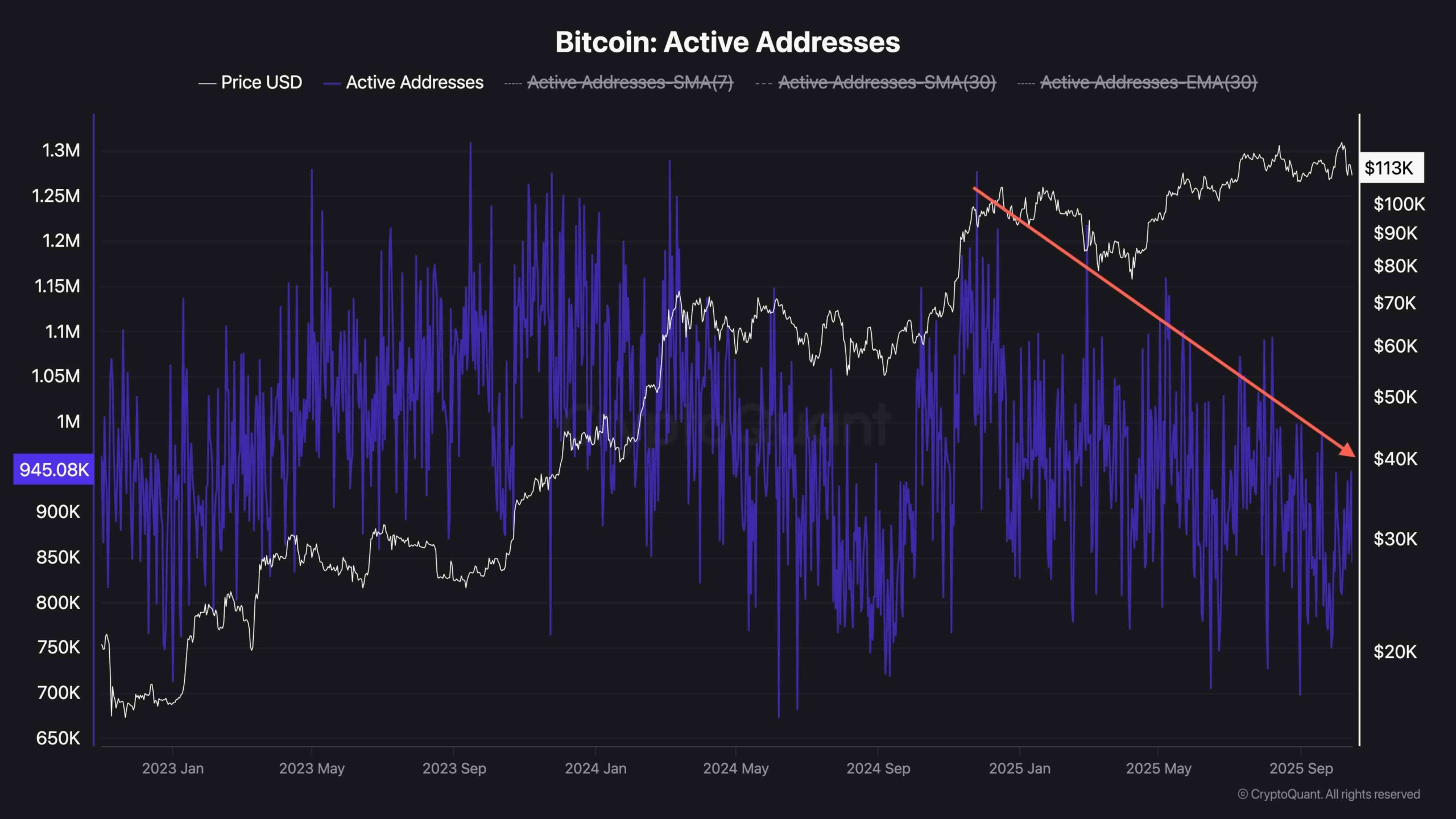

Bitcoin Lively Addresses presents an necessary sign about market participation and community well being. Over current months, the variety of lively addresses has step by step declined, whilst Bitcoin’s value maintained its place close to file highs. Traditionally, such a decline in on-chain exercise usually displays market fatigue or short-term distribution, significantly following prolonged rallies.

Nonetheless, the present degree of exercise, whereas subdued, stays above the 2024 accumulation baseline, implying that the market shouldn’t be experiencing full capitulation.

Durations of decreased tackle exercise close to key help ranges have usually preceded large-scale accumulation and development reversals, as seen in late 2023 and mid-2024.

If lively tackle development stabilizes whereas value holds the $108K–$110K help vary, it could strengthen the case for an accumulation-driven backside formation, aligning with the macro atmosphere of elevated world liquidity and enhancing investor sentiment after the Fed’s charge lower.

The submit Bitcoin Value Evaluation: BTC’s Subsequent Transfer Will Rely on This Key Degree appeared first on CryptoPotato.