Bitcoin’s worth made a brand new document excessive simply above the $124K mark a couple of days in the past, earlier than printing two consecutive bearish each day candles and dropping again to a key space. Traders at the moment are rigorously monitoring the market to seek out any early indicators of reversal.

By ShayanMarkets

The Day by day Chart

On the each day chart, Bitcoin is as soon as once more testing the decrease boundary of its long-term ascending channel, elevating the opportunity of a draw back breakout after months of holding inside the construction. Ought to the breakdown materialize, the $110K area, backed by the close by 100-day shifting common, might function a powerful assist space.

Conversely, if the channel manages to include the value, the bullish momentum could proceed, paving the best way for brand new highs towards $130K and probably additional.

The 4-Hour Chart

On the 4-hour timeframe, BTC not too long ago tried a breakout above the $123K resistance however rapidly didn’t maintain it, leading to a pointy decline that additionally broke the short-term trendline constructed over the previous few weeks. This rejection alerts weak point on the highs and has shifted the market’s short-term construction.

In the meanwhile, the $116K space stands out as the important thing assist that would set off one other bounce. If this degree provides approach, nevertheless, a deeper drop towards the $111K area turns into more and more possible. With the RSI recovering after dipping under 50, the value motion suggests a doable retest of $116K earlier than confirming the following transfer. Whether or not this assist holds or breaks will set the tone for Bitcoin’s short-term development.

On-chain Evaluation

Bitcoin Open Curiosity

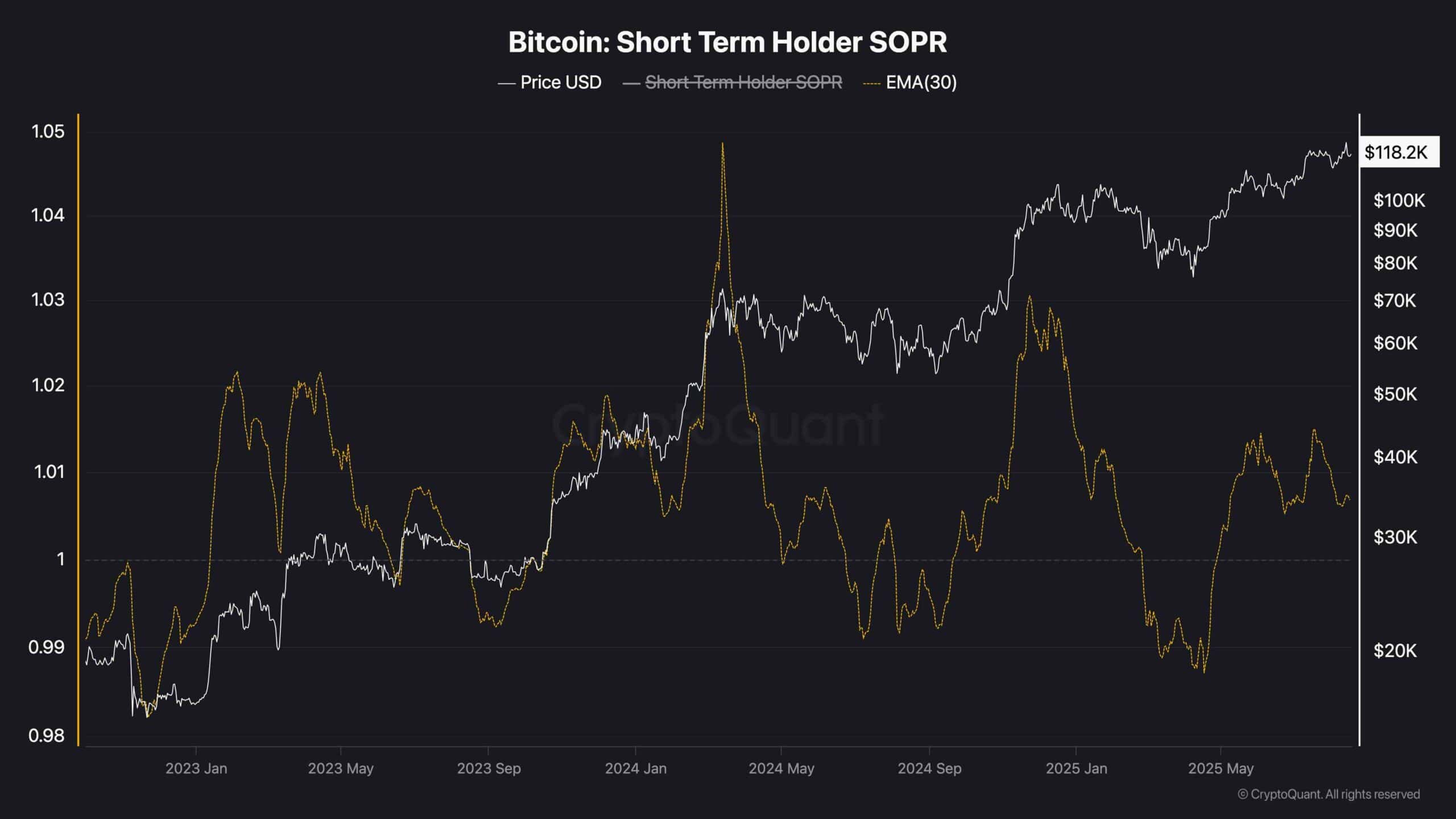

This chart exhibits Bitcoin’s Brief-Time period Holder SOPR with its 30-day EMA in comparison with worth. SOPR above 1 means short-term holders are promoting at a revenue, whereas under 1 alerts promoting at a loss.

Throughout rallies like early 2023, SOPR stayed above 1, confirming profit-taking. In distinction, dips under 1 mark short-term capitulation throughout corrections. Now, with Bitcoin round $118K and SOPR hovering above 1, short-term holders are taking earnings.

Nonetheless, the magnitude of the revenue taking has been declining in the course of the latest worth highs for the reason that starting of 2024. This remark is clear as there’s a clear divergence between the value highs and STH-SOPR highs. With the revenue margins shrinking for the short-term holders, the market would possibly quickly be in hassle, as this may be one of many early indicators of reversal.

The publish Bitcoin Worth Evaluation: BTC Exams Essential Help After Newest ATH appeared first on CryptoPotato.