Bitcoin continues to hover close to the $82,000–$85,000 vary as patrons wrestle to regain momentum, whereas key on-chain information hints at attention-grabbing underlying dynamics.

Technical Evaluation

By Edris Derakhshi

The Each day Chart

On the each day timeframe, BTC is making an attempt to defend the $80K help zone after one other rejection from the $88,000 resistance and the 200-day shifting common close by, which now acts as a dynamic barrier. The value stays range-bound between $80,000 and $88,000, with no clear directional decision but.

The RSI has additionally pulled again beneath the midline after failing to interrupt above 60, displaying an absence of robust momentum. Consumers must see a confirmed each day shut above $88,000 to invalidate the current decrease highs and reattempt the $92,000 stage. On the draw back, any clear break beneath $80,000 could open the trail towards $74,000 and even $68,000.

The 4-Hour Chart

On the 4-hour chart, BTC was lately rejected sharply from the crimson resistance zone round $88,000 after consolidating beneath it for a number of days. This robust rejection, adopted by a swift drop again into the $82K vary, signifies short-term provide stays robust.

Furthermore, the RSI has cooled off from overbought ranges and is now trending close to 40, suggesting a loss in bullish momentum. For now, $80,000 stays the road within the sand, whereas the realm between $86,500–$88,000 continues to cap upside makes an attempt. A break from both facet of this vary is more likely to set off the following impulsive transfer.

On-Chain Evaluation

By Edris Derakhshi

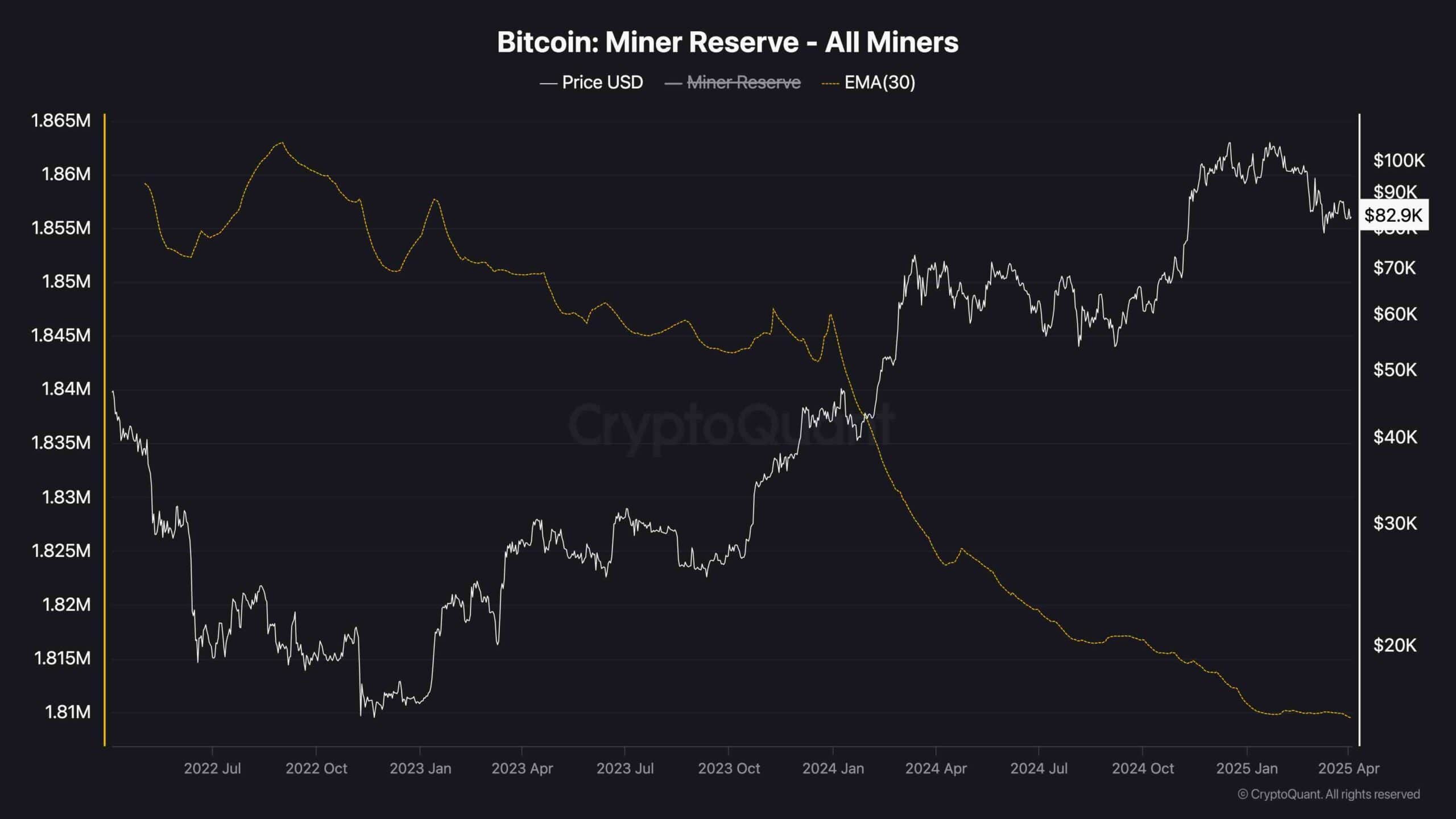

Miner Reserve (EMA 30)

The Miner Reserve continues its long-term decline, marking one of the crucial sustained distribution developments by miners in years. This regular sell-side strain from miners suggests they’ve been taking revenue constantly all through the rally, with the reserve now at multi-year lows close to 1.81M BTC.

Whereas this persistent discount hasn’t brought on a structural breakdown in value, it does add a layer of provide strain that would weigh on rallies, particularly if retail demand softens. It additionally implies miners could also be anticipating decrease costs or just making ready liquidity forward of the halving, making this a key metric to watch within the coming weeks.

The put up Bitcoin Value Evaluation: BTC Might Drop to $68K if $80K Help Fails appeared first on CryptoPotato.