After a number of failed makes an attempt to interrupt above the $108K resistance, Bitcoin is consolidating inside a tightening vary, displaying indicators of distribution. The market is caught between two liquidity zones: the buy-side above $108K and the sell-side beneath $100K, whereas the worth slowly gravitates towards the decrease boundary.

Momentum has weakened as seen within the RSI drop under 50 on each every day and 4H timeframes, suggesting bearish strain is gaining management.

By ShayanMarkets

The Every day Chart

Bitcoin stays caught in a broader consolidation sample, forming a descending triangle slightly below a serious resistance stage. The RSI is holding round 46, and the worth continues to be above the important thing trendline depicted in orange. This construction displays a basic re-accumulation or distribution part.

If the bulls fail to reclaim $108K with conviction, the ascending trendline turns into a possible magnet. Furthermore, the orange 100-day MA and the blue 200-day MA are nonetheless pointing up however have narrowed close to the $95K area, indicating a slowdown in pattern energy.

The every day vary between $100K–$108K is vital. To this point, patrons have absorbed dips into the $101K–$103K zone, however continued decrease highs and failure to flip the $108K space into help counsel the market could also be getting ready for a deeper sweep of liquidity.

The 4-Hour Chart

On the 4-hour timeframe, the worth motion has shaped a transparent descending channel. The decrease highs present constant bearish strain, whereas help at $103.5K is being examined repeatedly.

That is usually a bearish continuation sample, and with RSI round 41, the momentum leans towards the draw back. The failure to interrupt by the truthful worth hole (FVG) round $106K, and even failing to check it, confirms that sellers are defending the premium ranges effectively.

At the moment, market individuals can count on a fast sweep of the double sell-side liquidity ranges marked round $102K and $103K. A break and shut under these ranges may open up a run towards the important thing every day demand on the $100K space. In the meantime, any upside breakout above $110K should start with a reclaim of the FVG zone convincingly to flip short-term sentiment.

On-Chain Evaluation

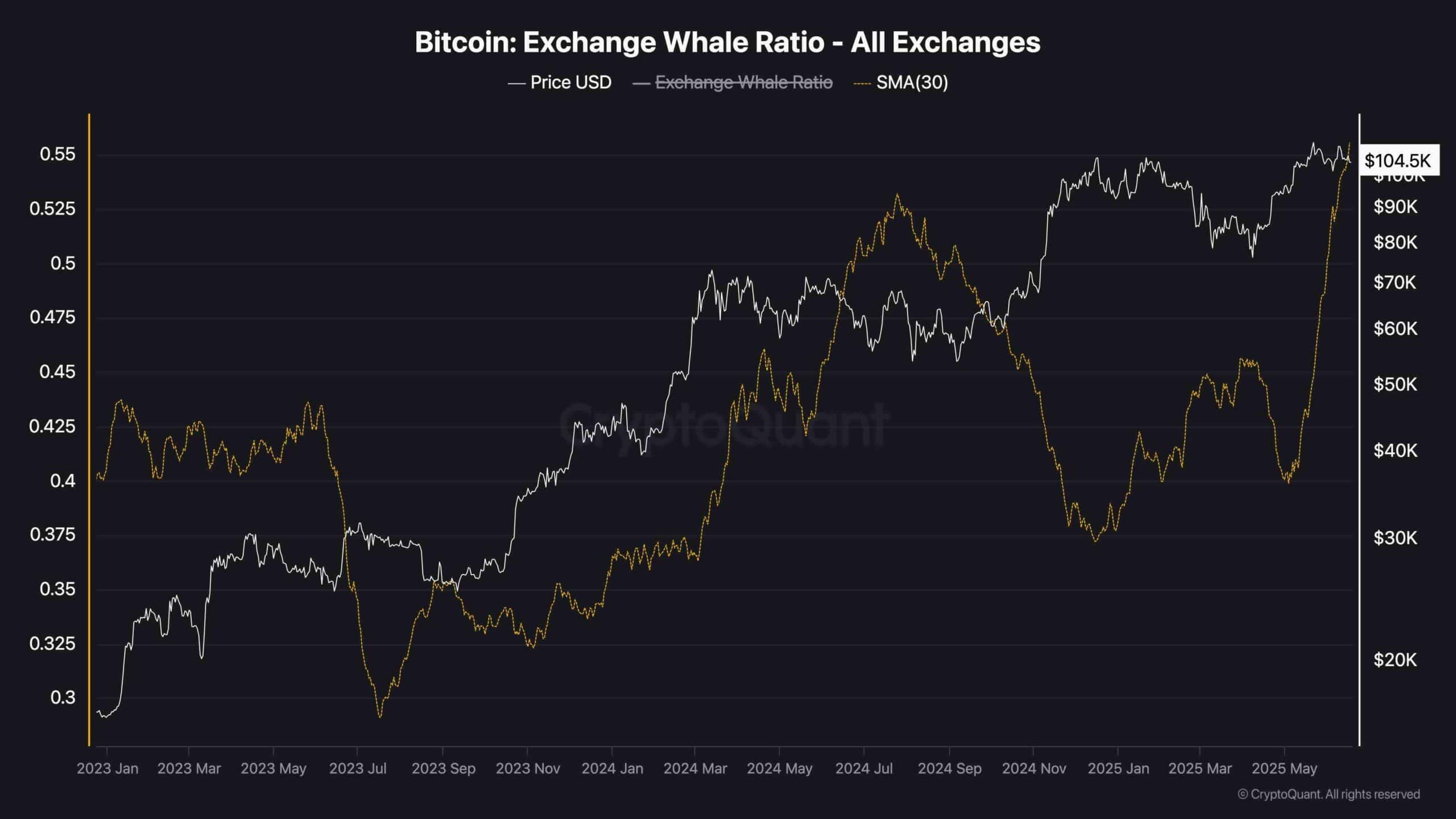

Change Whale Ratio

The whale ratio on exchanges has surged above 0.55, its highest level in over a yr, which is usually thought-about a warning sign. This metric measures the proportion of the highest 10 inflows to complete inflows on exchanges. Traditionally, a rising whale ratio means giant holders are more and more lively on exchanges, probably getting ready to promote. This shift usually precedes corrections or sharp volatility, particularly when retail exercise is cooling off.

Combining this with stagnant value motion under key resistance, the present whale conduct suggests cautious distribution slightly than aggressive accumulation. If the whale ratio stays elevated whereas BTC trades sideways or drops additional, it strengthens the case for a liquidity sweep under $100K earlier than any potential continuation larger.

The submit Bitcoin Worth Evaluation: BTC Consolidation Continues however Bearish Indicators Flash appeared first on CryptoPotato.