Bitcoin simply broke beneath a multi-week consolidation vary as issues get much more heated within the Center East. Whereas the long-term pattern stays bullish, short- to mid-term momentum is weakening because the market exhibits indicators of decrease highs and decrease lows forming.

By Shayan

Bitcoin Value Evaluation: Technicals

The Day by day Chart

The every day timeframe paints a extra regarding image for consumers. BTC was caught in a tightening vary for a number of weeks, forming a descending triangle. This construction broke to the draw back briefly with a wick, as the worth aggressively examined the demand zone between $98K and $100K. This are had beforehand acted as a launchpad for the Could rally.

The response right here has been sharp: BTC printed a protracted decrease wick, indicating the presence of aggressive consumers. Whereas follow-through stays restricted, the every day candle closed again contained in the sample, suggesting that this habits may simply be a sell-side liquidity sweep.

Furthermore, the RSI on the every day has now dropped to the 40 stage, hovering simply above the oversold threshold. This isn’t but bullish divergence, but it surely does present that momentum is now not within the consumers’ favor.

If the $98K–$100K zone fails to carry on a closing foundation, BTC might rapidly drop towards the subsequent main help round 96K, which additionally aligns with the 100-day and 200-day shifting averages, and the decrease boundary of the massive ascending channel.

The 4-Hour Chart

Zooming into the 4H timeframe, we will clearly see the breakdown construction and the way BTC has been respecting bearish order flows. After the sell-side liquidity seize just under $100K, the worth bounced sharply and stuffed the FVG that fashioned between 100K and $102K. This honest worth hole is now appearing as resistance, capping any bullish makes an attempt to push greater.

There are two FVGs now in play: the current one simply above 100K and the older one close to $106K, which beforehand pushed the worth decrease. Until BTC reclaims the current excessive close to the $103K mark with conviction, it’s extra more likely to revisit decrease help ranges than to retest the $106K space.

Notably, the 4H RSI has bounced from oversold situations (close to 30) to the 40–45 vary, indicating a short-term aid, however that is nonetheless removed from a pattern reversal. Market construction stays bearish with decrease highs and decrease lows being printed constantly since mid-June.

Briefly, the 4H bias stays bearish beneath $103K, and value is at the moment buying and selling inside a response zone. Bitcoin wants to interrupt and shut above this FVG for any potential reversal to realize momentum.

On-Chain Evaluation

Bitcoin Miners Place Index

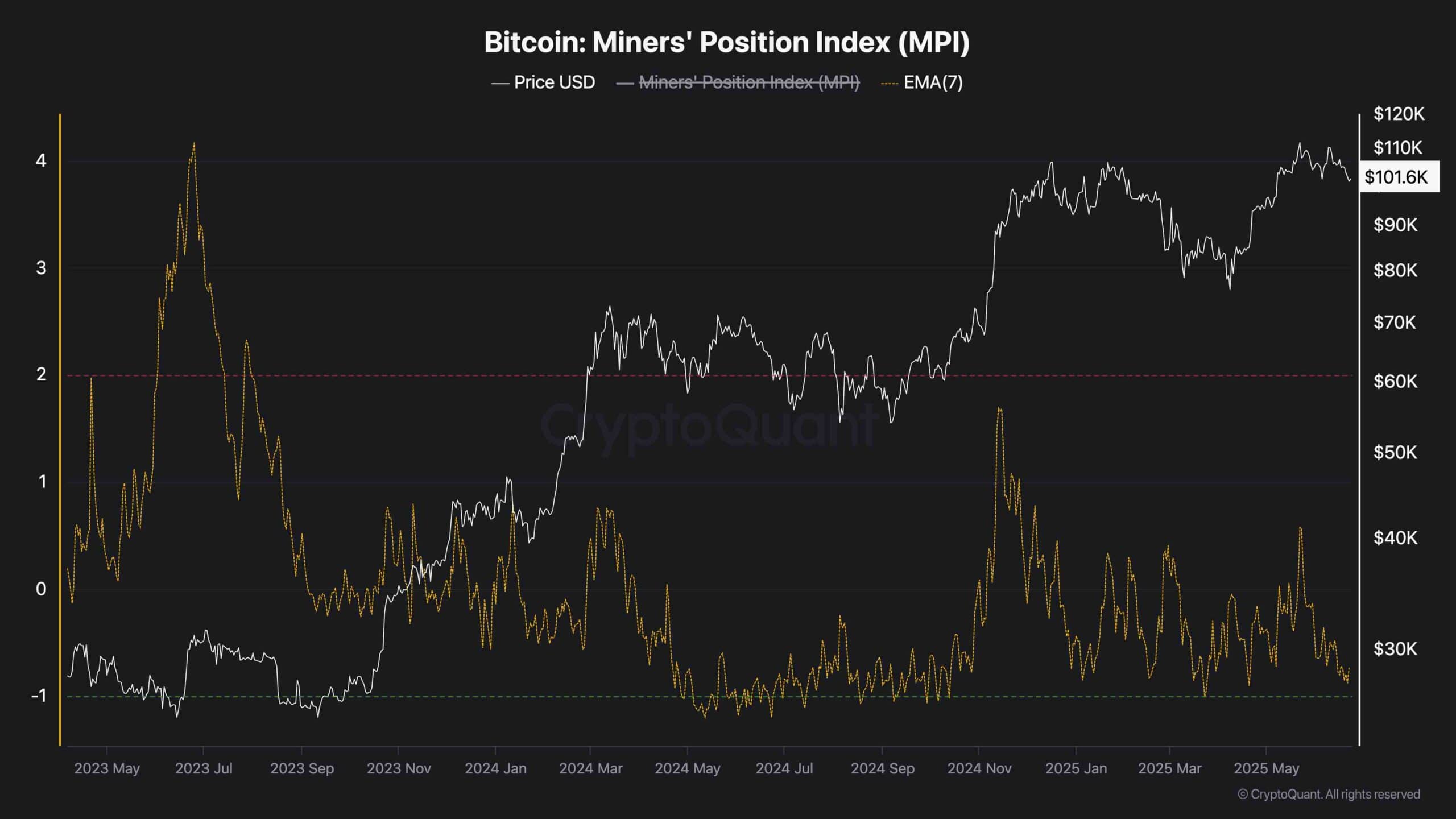

The onchain panorama gives a little bit of aid for long-term holders. The most recent studying of the Miners’ Place Index (MPI) exhibits that miner promoting strain is minimal. Traditionally, elevated MPI values (above 2) have preceded sturdy market corrections, as miners have a tendency to dump giant quantities of BTC into rallies. Nevertheless, present MPI values stay nicely beneath 1, signaling that miners are holding their cash fairly than promoting them aggressively.

This implies that the current drop is extra possible pushed by market construction, liquidity grabs, and short-term derivatives strain, fairly than long-term basic shifts. Mixed with steady alternate reserves and rising accumulation wallets, the info leans impartial to barely bullish from an onchain perspective.

The publish Bitcoin Transfer to $96K or $106K Subsequent? (BTC Value Evaluation) appeared first on CryptoPotato.