U.S.-traded spot Bitcoin ETFs noticed whole web outflows of $869.86 million on Thursday, recording the second-largest for the reason that launch.

Per SoSoValue information, Grayscale Mini Belief (BTC) recorded the biggest outflow of $318.2 million, adopted by BlackRock (IBIT), which noticed $256.6 million bleed. In the meantime, Constancy (FBTC) and Bitwise (BITB) had $119.93 million and $47.03 million in web outflows, respectively.

Buyers have pulled out round $2.64 billion previously three weeks, signalling industry-wide warning as a consequence of looming regulatory developments, market corrections, and macroeconomic occasions.

The Thursday outflow coincides with Bitcoin slipping under $100K mark for the primary time in 188 days.

Bitcoin closes under $100k for the primary time in 188 days pic.twitter.com/krP9Xp0HuF

— Bitcoin Archive (@BitcoinArchive) November 14, 2025

Liquidations Hit Over $300M Amid BTC ETFs Selloff

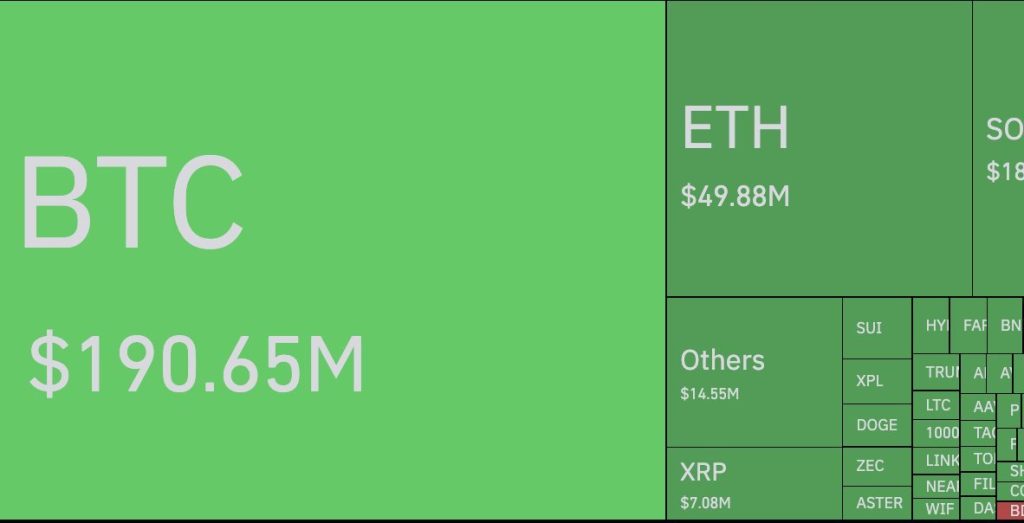

The entire quantity of liquidations within the cryptocurrency market reached $316 million in leveraged lengthy positions, Per Coinglass information. This prompted a number of merchants to exit their positions.

Liquidations in crypto are primarily tied to lengthy positions which can be leveraged bets that anticipate value will increase.

Information famous that Bitcoin liquidations amounted to $190.65 million in a single hour, whereas Ethereum liquidations reached $49.88 million.

In the meantime, Ether ETFs additionally registered an outflow of $259.72 million, the very best since Oct. 13.

Bitcoin Plunge – Lowest in Over 6 Months

Bitcoin slumped under $100K on Friday, reaching its lowest in over six months. The biggest crypto by whole market worth dropped to $96,682.00 throughout Asia hours, and is at the moment buying and selling at $96.94K at press time.

BTC fell 6.2% over the previous 24 hours, underperforming the broader crypto market’s 6.15% drop. BTC broke under crucial Fibonacci retracement ranges of 23.6% at $111,958.

In the meantime, the Worry & Greed Index (22/100) suggests sentiment stays fragile.

Buyers have famous that the slip under $100K “has erased weeks of optimism.”

“Until institutional consumers step again in, we may very well be caught transferring sideways… or sliding decrease,” wrote one person.

Tim Enneking, managing accomplice of Psalion, mentioned that a number of contributing components have pulled down the BTC value. This contains continued skepticism in lots of quarters, the ‘bubble’ feeling from all of the treasury corporations, the expected finish of the bull market within the present four-year cycle and considerations a couple of macroeconomic slowdown.

Enneking instructed Forbes that traders want to regulate to only how a lot the digital asset’s worth has climbed all these years.

The publish Bitcoin ETFs Bleed $870M in One Day, Marking Second-Largest Outflow on File appeared first on Cryptonews.