Key Takeaways:

- Market sentiment is softening as technical indicators shift.

- Accumulation patterns and ETF strikes sign broader hesitance.

- Indicators recommend this isn’t a routine pullback however a deeper recalibration.

- Underlying vulnerabilities might reshape long-term developments.

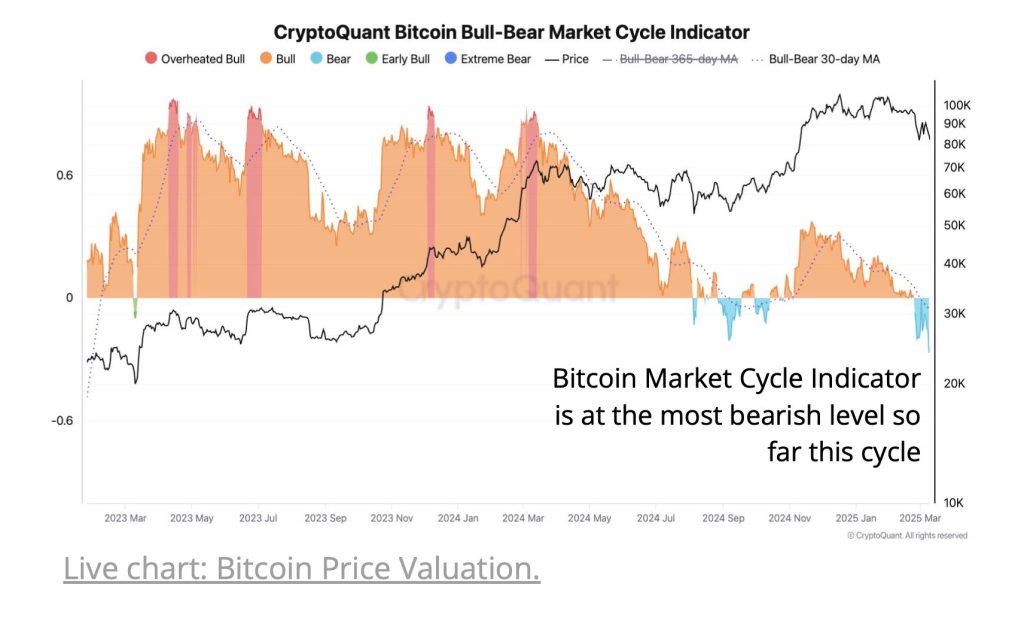

Bitcoin’s valuation metrics are pointing to bearish territory, and based on a CryptoQuant analyst, the market could also be teetering between deep worth ranges and the onset of a bear market.

ryptoQuant’s evaluation, printed on March 11, reveals that almost each main indicator now indicators warning.

The Bitcoin Bull-Bear Market Cycle Indicator is at the moment at its most bearish stage this cycle—a stage that, in earlier cycles, has both preceded a pointy correction or marked the start of a downturn.

In parallel, the MVRV Ratio Z-score has fallen beneath its 365-day transferring common, suggesting that Bitcoin’s beforehand sustained upward momentum has markedly dissipated.

This shift in sentiment will be seen by the noticeable contraction in Bitcoin demand.

Just lately, the obvious demand progress for Bitcoin dropped by 103,000 BTC in a single week, representing the quickest tempo of contraction noticed since July 2024.

Bitcoin Whales Gradual Accumulation, Signaling Lowered Demand

This steep decline signifies clear purchaser hesitation and weakening market assist.

Main whales, who’ve historically performed a job in driving market actions by their big accumulations, have additionally slowed their charge of Bitcoin acquisition.

U.S.-based spot ETFs have transitioned into internet sellers of Bitcoin this yr, additional including downward strain on costs.

Whereas Bitcoin’s present 22% value drawdown might sound in step with corrections skilled throughout earlier bull market cycles, the valuation metrics paint a extra regarding image.

The metrics point out that this isn’t a typical pullback however relatively a deeper, extra basic correction.

Bitcoin is buying and selling round $81,000 as of writing—a spread barely beneath the dealer’s on-chain realized value decrease band, a key assist stage.

This precarious place was compounded Tuesday because the broader crypto market shed 6% amid investor nervousness triggered by President Donald Trump’s newest commerce insurance policies.

Heightened tensions over tariffs focusing on main U.S. buying and selling companions—Canada, Mexico, and China—have rattled markets, prompting a wave of sell-offs throughout threat belongings

Ought to Bitcoin fail to keep up this assist, its subsequent main goal is round $63,000.

This stage corresponds with the Dealer’s minimal on-chain realized value band, a threshold that has traditionally acted as the last word security internet throughout extreme value corrections.

The insights supplied by the CryptoQuant analyst spotlight a convergence of things which might be amplifying market uncertainty.

Given the bearish indicators, diminished demand, slowing whale accumulation, and ETFs changing into internet sellers, Bitcoin’s market stands at a vital juncture.

Traders face an important query: Are these indicators merely short-term anomalies, or do they signify deeper, structural vulnerabilities within the Bitcoin market?

How stakeholders interpret these indicators within the coming weeks might decide whether or not Bitcoin rebounds strongly or slips additional into bearish territory.

Regularly Requested Questions (FAQs)

What might a deeper correction imply for Bitcoin’s long-term outlook?

A deeper correction might sign a market reset, exposing underlying vulnerabilities whereas providing strategic entry factors. This part can recalibrate inflated valuations and probably foster a extra sturdy, sustainable long-term Bitcoin pattern.

How may institutional actions affect the present Bitcoin pattern?

Shifts in institutional habits, like modifications in ETF methods and slower accumulation, can drive broader market sentiment. Their actions have an effect on liquidity and should form Bitcoin’s value trajectory considerably.

What broader financial elements might amplify Bitcoin’s present market dynamics?

Wider financial shifts, like political unrest and modifications in commerce guidelines, could make markets extra unpredictable. These exterior pressures usually make Bitcoin extra reactive to investor moods, dashing up value modifications.

The submit Bitcoin May Be at Deep Worth Ranges or Begin of a Bear Market: CryptoQuant appeared first on Cryptonews.