Bitcoin had a comparatively sturdy week, which helped it finish the second quarter with nearly 30% features and buying and selling round $109,000 by July 4th – fairly near its all-time highs. The value briefly dipped to round $105K midweek following the Senate’s approval of Donald Trump’s huge funds laws but it surely was fast to rebound.

Analysts stay cut up on the short-term outlook: Customary Chartered maintains a optimistic view with a $200,000 year-end goal, whereas BitMEX co-founder Arthur Hayes warns of a potentail dip to $90K earlier than one other rally.

The foremost political improvement throughout this week was the passage of Trump’s $5 trillion laws “One Massive Lovely Invoice,” which makes the 2017 particular person tax cuts everlasting, lifts the debt ceiling, and rolls again applications corresponding to Medicaid growth and inexperienced vitality incentives. After a slender vote within the Senate on July 1st, the Home accepted the invoice on July third, following a prolonged Democratic nailbiter. Trump is predicted to signal the invoice on July 4th.

The crypto market reacted with a brief weak spot. Nevertheless, many see the invoice’s inflationary affect, in addition to the ballooning US debt as a long-term bullish signal for Bitcoin. Related fiscal stimulus packages previously (recall the 2020 COVID aid efforts) led to sharp crypto market rallies. Therefore, some analysts imagine that this might be a comparable setup.

In the meantime, Tesla CEO Elon Musk criticized the invoice’s cuts to scrub vitality and its affect on federal debt. He even went thus far to recommend that he would possibly create a 3rd political celebration in response. Trump, in fact, fired again, suggesting Musk may even face deportation, which escalated tensions between each of them.

Different notable developments embody the removing of a crypto tax aid modification, which upset miners and stakers. Nevertheless, the discussions round a US strategic Bitcoin reserve proceed to achieve second.

Whereas Bitcoin is at present holding sturdy, regulatory uncertainty, macro shifts, and political dangers stay a few of the key variables for the approaching weeks.

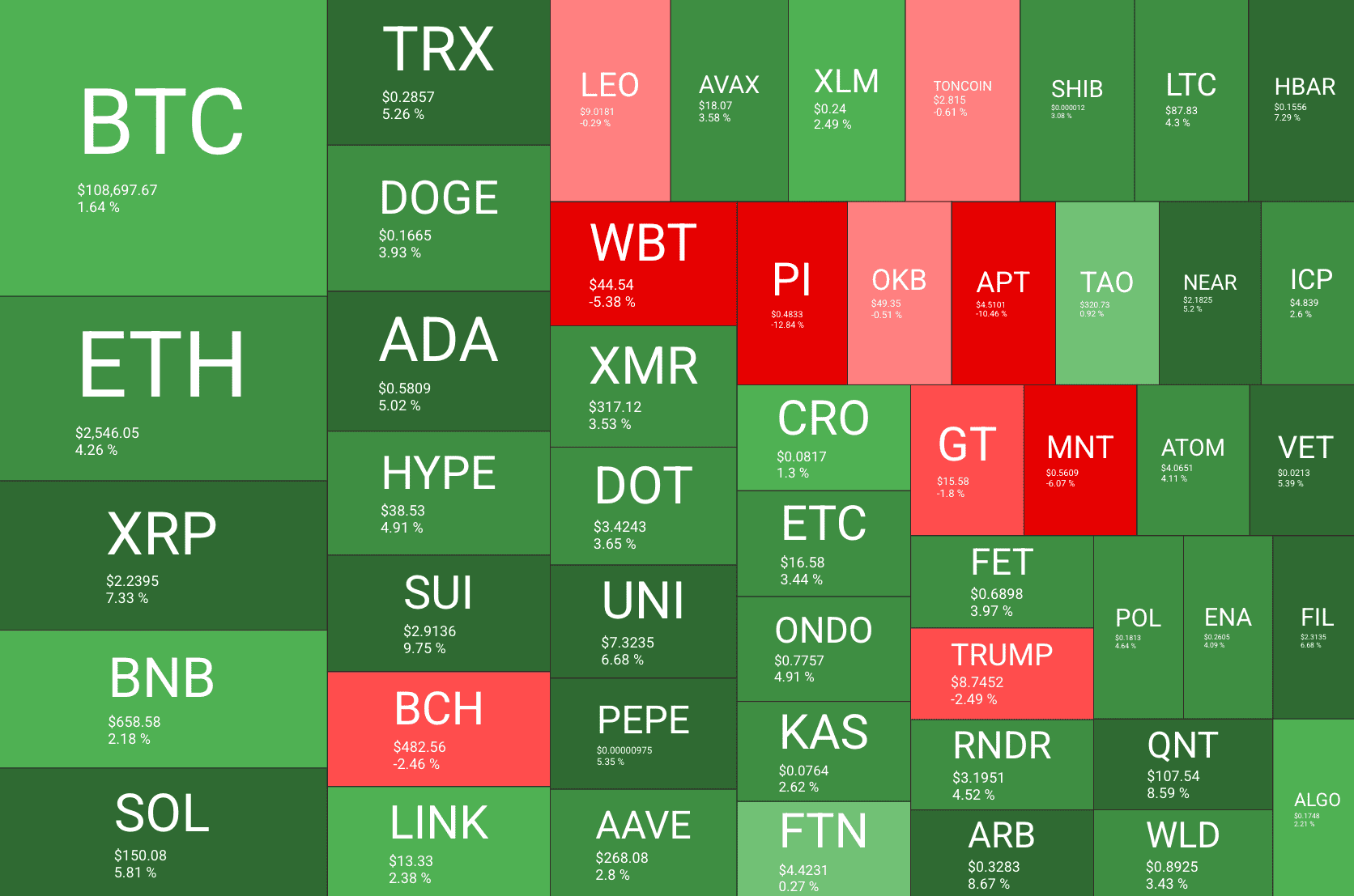

Market Information

Market Cap: $3.43T | 24H Vol: $88B | BTC Dominance: 63%

BTC: $108,793 (+1.7%) | ETH: $2,549 (+4.2%) | XRP: $2.24 (+7.3%)

This Week’s Crypto Headlines You Can’t Miss

Consultants Optimistic on Crypto Altcoin ETFs This Yr: Will XRP, ADA, and SOL Profit? Consultants imagine that the US Securities and Alternate Fee will seemingly approve the functions for spot-based XRP, SOL, and ADA ETFs later this 12 months. The query is that if this can have a optimistic affect on these altcoins.

Does Ethereum Have an Benefit over Bitcoin for Company Treasuries? There’s little doubt that public corporations are have been stacking Bitcoin all year long. However firms could as nicely begin shopping for Ethereum subsequent and trade specialists like Tom Lee and Joseph Lubin are betting large on it.

Trump’s One Massive Lovely Invoice TLDR: Good or Dangerous for Bitcoin? Donald Trump’s ‘One Massive Lovely Invoice” has handed Congress voting and will probably be signed into existence very quickly. Here’s a condensed rationalization of what it means for the cryptocurrency trade and whether or not or not we should always anticipate an explosive rally.

BlackRock’s Bitcoin ETF ‘Machine’ Outearns Legendary S&P 500 Fund: Particulars. The BlackRock iShares Bitcoin Belief (IBIT) has managed to attain an extremely spectacular milestone. It’s now producing extra annual payment income than the agency’s legendary and flagship S&P 500 monitoring, regardless of being tremendously smaller in measurement.

Combat for 40,000 BTC Continues: Choose Permits Celsius’s Lawsuit In opposition to Tether to Proceed. The battle over near 40,000 BTC between Celsius and Tether will proceed. A U.S. chapter choose has dominated that the previous can go on with its lawsuit, at present value round $4.3 billion, in opposition to the world’s largest issuer of stablecoins. Ought to we be fearful?

When Will Bitcoin’s Worth Attain its High This Cycle? Analysts Give Key Insights. The most important query: is the cycle’s high already in or are we going to see an outsized blow-off bull run within the second half of 2025? An on-chain knowledge professional from CryptoQuant shares his views on the issues and divulges some very fascinating findings.

Charts

This week, we’ve a chart evaluation of Ethereum, Ripple, Cardano, Solana, and Binance Coin – click on right here for the whole worth evaluation.

The submit Bitcoin Climbs as Trump’s $5 Trillion Invoice Sparks Market Volatility and Political Tensions: Your Weekly Crypto Market Replace appeared first on CryptoPotato.