The worth of the main digital asset has misplaced some steam after hitting a brand new all-time excessive above $126,000. Nevertheless, one essential indicator suggests a brand new parabolic transfer may very well be knocking on the door.

Main Transfer within the Subsequent 100 Days?

The technical evaluation device in query is Bitcoin’s weekly Bollinger Bands, which encompass higher and decrease boundaries that present how far the value strikes away from its common. Based on X consumer Tony “The Bull” Severino, the traces have just lately tightened to document ranges.

Such a improvement means that BTC’s value has consolidated and may very well be poised for an enormous transfer in both route. The analyst assumed it could take roughly 100 days to “get a legitimate breakout or breakdown.”

“No matter route is chosen will result in a trending transfer accompanied by excessive volatility,” he predicted.

Severino additionally warned buyers that increasing from such a setup might lead to “head fakes.” In different phrases, the value might briefly nosedive earlier than taking off or vice versa.

“This has the potential to ship Bitcoin parabolic, or put an finish to the three-year mature bull rally,” he concluded.

Greatest-Case and Worst-Case Situations

The vast majority of analysts on X seem optimistic that BTC has but to achieve new peaks throughout this cycle. Friedrich and BitBull envisioned a pump to a recent all-time excessive of $150,000 within the following months. The latter argued that “massive cash is now ready for gold to kind a neighborhood prime,” predicting that the first cryptocurrency will outperform the yellow metallic in This fall.

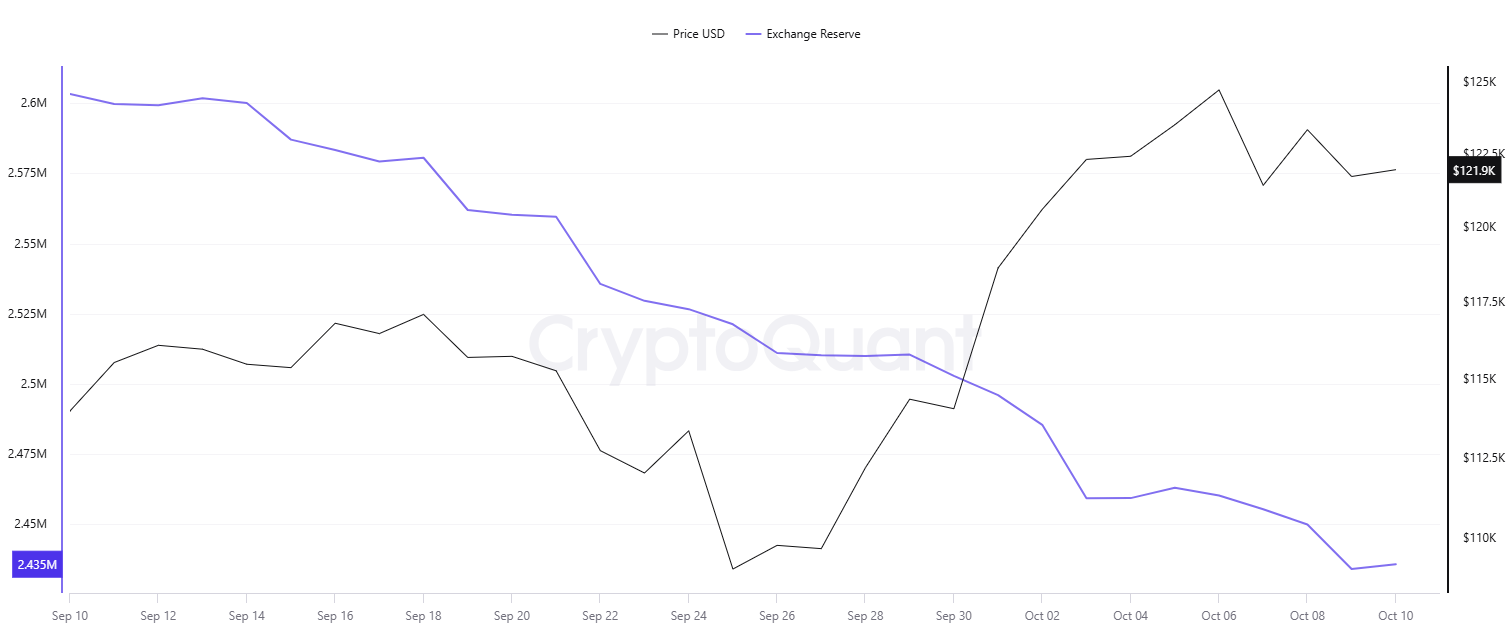

The spectacular inflows towards spot BTC ETFs for the reason that starting of the month, mixed with the declining alternate reserves, help the bullish thesis. Only in the near past, the quantity of belongings saved on such platforms dipped to roughly 2.4 million, or a seven-year low. Which means that an growing variety of buyers are shifting their holdings to self-custody wallets, which reduces the rapid promoting stress.

On the identical time, some analysts consider a painful crash can also be a believable choice. One instance is Ali Martinez, who mentioned that the worst-case situation for BTC is to get rejected at $124,000 after which plummet to $96,000 and later collapse to $70,000.

The put up Bitcoin (BTC) Has 100 Days: Increase or Doom After That? (Analyst Weighs in) appeared first on CryptoPotato.