The choice concerning the final rates of interest in the US got here in yesterday and the Federal Reserve didn’t actually shock the market. Bitcoin continues combating for $105,000, going by means of some very average volatility within the interim, all of the whereas altcoins are additionally stagnating.

The Fed did word some adjustments in its financial outlook, although, so let’s take a better have a look at the occasions that transpired all through the previous 24 hours.

Bitcoin Worth Battles for $105,000

On the time of this writing, Bitcoin’s worth is buying and selling at round $104,800, marking a really slight enhance of round 0.2% on the day by day chart seen beneath.

It’s price noting that the cryptocurrency had declined to round $103,600 however the bulls have been fast to intercept the transfer and pushed the worth again in direction of $105K.

This comes instantly after the US Federal Reserve determined to maintain the final rates of interest unchanged within the vary between 4.25% and 4.5%. That is what the vast majority of the merchants have been anticipating. The truth is, in accordance with Polymarket, there was lower than 1% likelihood for the establishment to go together with a 25bps minimize.

Nonetheless, the FOMC replace additionally included just a few extra remarks, which do mark a slight change of tone. Most notably:

- Ups inflation forecast to three%

- Cuts 2025 GDP forecast to 1.4%

- Sees 50bps in cuts this yr

- Charges projected at 3.6% in 2026 and three.4% in 2027

On the identical time, president Donald Trump continues along with his hostile rhetoric in direction of Fed Chairman Powell, calling him “silly,” and insisting that the nation is shedding billions of {dollars} due to the establishments refusal to chop charges. The political strain appears to be mounting.

Altcoins Stagnate

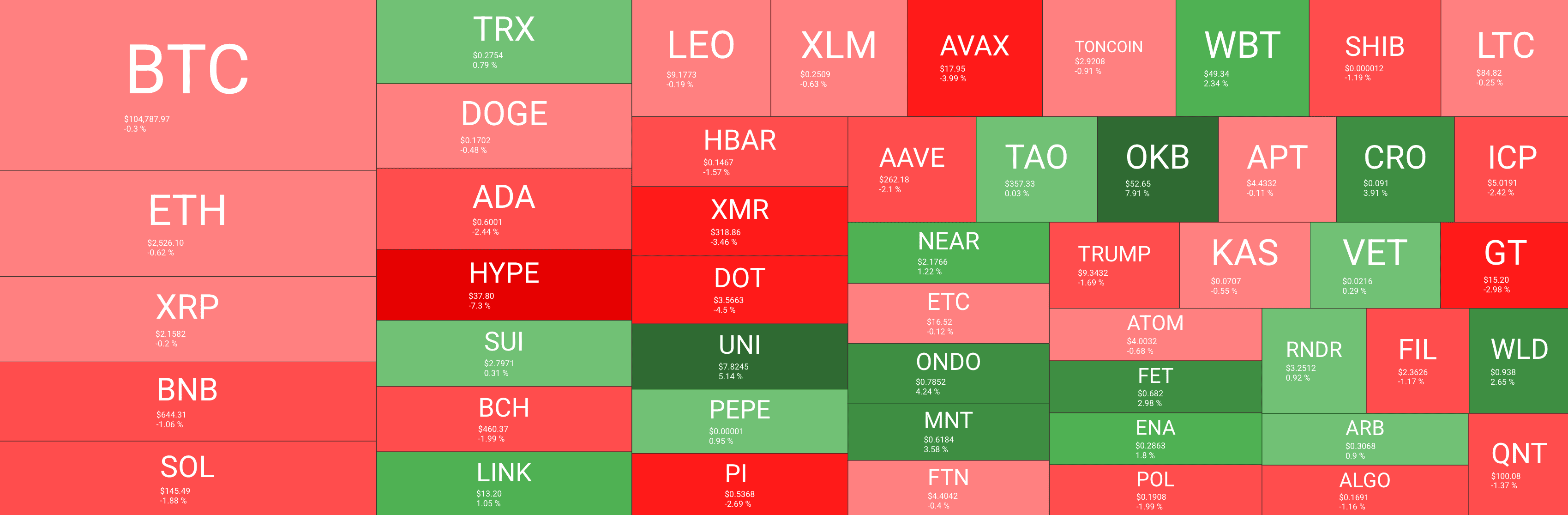

Maybe considerably expectedly, the altcoins market can be stagnating and didn’t chart any notable strikes all through the previous 24 hours.

As you’ll be able to see within the heatmap beneath, a lot of the various cryptocurrencies are buying and selling at roughly breakeven, with just a few notable exceptions, in fact.

For instance, Uniswap’s native token – UNI – managed to extend by greater than 5%, defying the market slowdown, in addition to OKB, which is up by nearly 8%.

Then again, Hyperliquid’s HYPE continues crashing and is down one other 7% prior to now 24 hours, at the moment buying and selling beneath $38.

The publish Bitcoin Battles for $105K Following Fed’s Determination, Altcoins Stagnate (Market Watch) appeared first on CryptoPotato.