After one of the vital turbulent weekends in months, U.S. spot Bitcoin and Ethereum exchange-traded funds (ETFs) staged a dramatic turnaround on October 14, recording a mixed internet influx of $338.8 million.

The rebound comes only a day after the identical funds noticed over $755 million in withdrawals, suggesting that institutional traders could also be shifting again into accumulation mode.

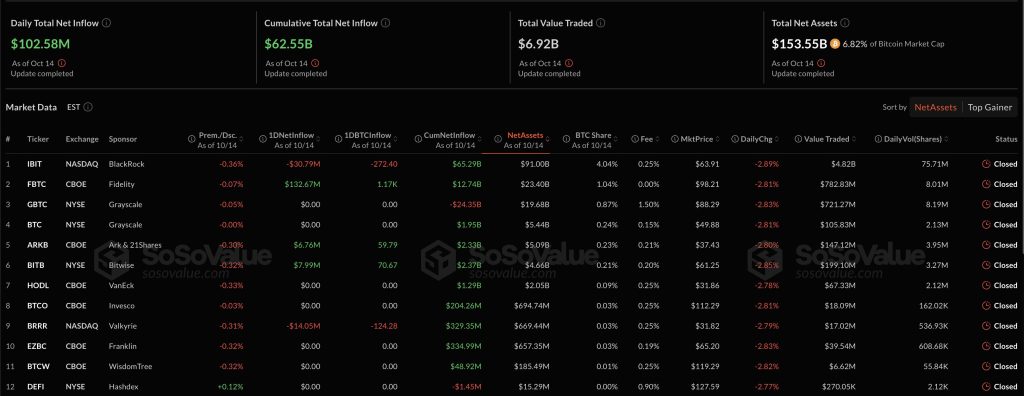

In response to knowledge from SoSoValue, Bitcoin spot ETFs pulled in a complete of $102.58 million in internet inflows on Monday, whereas Ethereum ETFs attracted $236.22 million.

The restoration follows a weekend sell-off that erased greater than $500 billion from the crypto market amid renewed U.S.–China commerce tensions and a wave of liquidations throughout exchanges.

With the reversal after the brutal weekend and days that observe, is it an indication for accumulation or only a blip?

Chatting with CryptoNews, Kevin Lee, Chief Enterprise Officer at Gate, described the rebound as “encouraging however untimely.”

“One sturdy influx day is a constructive sign, not a verdict,” he mentioned. “To name it sturdy, we want constant internet creations throughout issuers and normalization in futures and choices.”

Lee added that sustained ETF inflows and diversification throughout each BTC and ETH merchandise would affirm a real return of institutional confidence.

“ETF consumers are price-insensitive allocators who rebalance into weak point,” he famous. “This reversal exhibits danger urge for food stays intact, although knowledge will drive This autumn flows.”

Siraaj Ahmed, CEO at Byrrgis, took a extra optimistic view: “I’d name this the primary actual signal of early accumulation somewhat than a random blip. Establishments don’t chase panic—they purchase worry—and that’s precisely what this seems like heading into This autumn.”

With ETF inflows rebounding, on-chain accumulation rising, and macro circumstances stabilizing, analysts counsel that markets could possibly be getting into a renewed build-up section after final week’s sharp correction.

Bitcoin and Ethereum ETFs See Renewed Demand After $900M Outflow Week

Constancy’s Sensible Origin Bitcoin Fund (FBTC) led the cost with $132.67 million in new inflows, bringing its complete historic internet inflows to $12.74 billion. Bitwise’s BITB adopted with $7.99 million in inflows, whereas BlackRock’s iShares Bitcoin Belief (IBIT) noticed $30.79 million in redemptions.

As of October 14, Bitcoin spot ETFs collectively maintain $153.55 billion in property underneath administration, representing 6.82% of Bitcoin’s complete market capitalization.

Cumulative inflows have now reached $62.55 billion, whereas day by day buying and selling volumes stood at $6.92 billion, reflecting sturdy investor exercise even amid ongoing volatility.

Ethereum ETFs noticed even stronger momentum. Constancy’s FETH led the pack with $154.62 million in inflows, adopted by Grayscale’s ETH with $34.78 million and Bitwise’s ETHW with $13.27 million.

Whole property underneath administration throughout Ethereum ETFs climbed to $28.02 billion, equal to roughly 5.6% of Ethereum’s market capitalization.

The swift turnaround follows three consecutive days of redemptions that started on October 10. Throughout that stretch, Bitcoin ETFs misplaced $331 million, whereas Ethereum ETFs noticed $611 million in outflows.

The renewed inflows counsel a shift in sentiment towards accumulation somewhat than retreat.

“It seems institutional confidence by no means actually pale,” mentioned Ivo Georgiev, CEO and founding father of Ambire, talking to CryptoNews.

Information helps that view. Regardless of market turbulence and greater than $20 billion in leveraged positions liquidated throughout exchanges, CoinShares reported $3.17 billion in inflows final week, whilst over $20 billion in leveraged positions have been liquidated throughout exchanges. Analysts say this resilience factors to sustained institutional demand.

Digital asset funds logged $3.17 billion in inflows final week, defying market turbulence triggered by renewed US–China tariff tensions. #Funds #Inflowshttps://t.co/0BSiRhgdtW

— Cryptonews.com (@cryptonews) October 13, 2025

Regardless of the turbulence, each Bitcoin and Ethereum confirmed indicators of resilience. At press time, Bitcoin is buying and selling round $113,054, up 1.1% up to now 24 hours however down 7.2% over the week. Ethereum rose 4.3% on the day to $4,180.55, although it stays about 15% under its all-time excessive of $4,946.

The short rebound in ETF flows and value motion means that, whereas retail sentiment stays cautious, institutional demand for crypto publicity is way from over.

Institutional Confidence Quietly Rebuilds as Crypto ETFs Close to $1 Trillion in Belongings

Market knowledge signifies that institutional confidence could also be quietly rebuilding.

ETF analyst Eric Balchunas famous that total crypto ETF property are nearing the $1 trillion milestone, with an estimated $30 billion in inflows recorded in simply the previous seven days.

ETFs are going to hit $1T by the top of the week prob given their $30b every week tempo these days, and digital lock to interrupt final yr's $1.1T haul. Additionally take a look at the $180b in 1M.. if it have been calendar month could be all-time document. Only a torrent of money. pic.twitter.com/kBRQTLTRsv

— Eric Balchunas (@EricBalchunas) October 13, 2025

Bitcoin ETFs alone added over $1 billion in new capital throughout that interval, underscoring sustained institutional demand whilst costs consolidated.

In response to Ivo Georgiev, the current liquidation occasion did little to shake long-term institutional confidence.

“It seems establishments are merely profiting from this era to extend their spot positions,” he mentioned, including that the muted value response relative to the dimensions of liquidations suggests deeper accumulation underneath the floor.

In the meantime, macroeconomic indicators are turning extra favorable for danger property. Federal Reserve Chair Jerome Powell instructed this week that the central financial institution might quickly finish its steadiness sheet discount program and put together for doable fee cuts, citing weakening labor knowledge.

On-chain metrics additionally assist the concept accumulation is underway. CryptoQuant knowledge exhibits that short-term Bitcoin holders, these proudly owning cash for lower than a month, have elevated their provide from 1.6 million BTC to over 1.87 million BTC in current days.

Analysts interpret this as recent capital getting into the market and forming a brand new demand ground following the correction.

Ethereum knowledge tells an identical story. Alternate knowledge exhibits that the Ethereum provide held on Binance has dropped to a multi-month low of 0.33, signaling that traders are shifting cash to self-custody.

Traditionally, such withdrawals have preceded upward value actions as out there change provide tightens.

The publish Bitcoin and Ethereum ETFs Stage Dramatic $340M Reversal After Brutal Promote-Off — Accumulation Section Starting? appeared first on Cryptonews.