Binance, the present chief in centralized change buying and selling quantity, has cemented a number one place within the derivatives market as effectively.

Whereas these numbers are robust, different benchmarks recommend that person exercise could also be dwindling.

Vital Dominance

Information analytics agency CryptoQuant shared a report from a neighborhood analyst, @JA_Maartun,

showcasing how the most important centralized change (CEX) is at the moment effectively forward in futures buying and selling quantity.

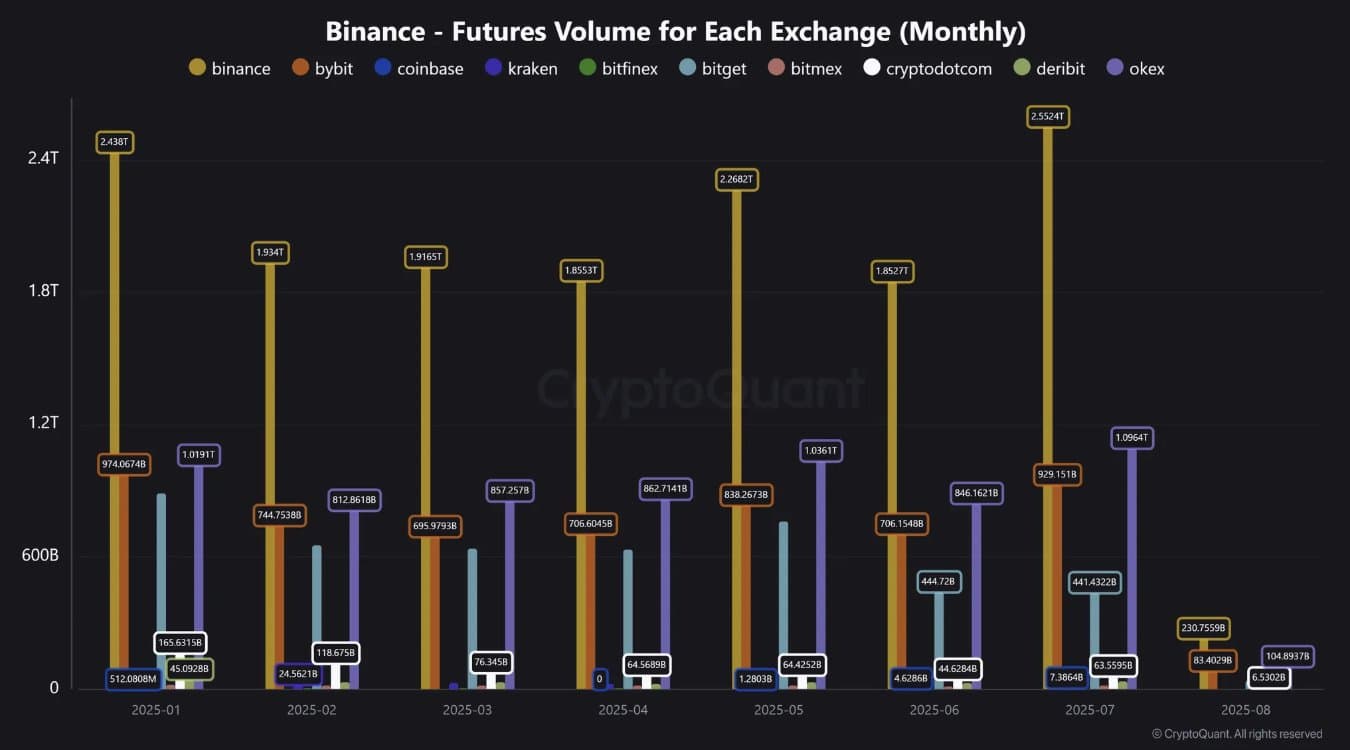

The $2.55 trillion in futures quantity was reached final month and is the best degree recorded for Binance this yr, in response to CQ’s graph. The earlier peaks had been in January, when it hit $2.43T, and Might, which recorded $2.26 trillion. This soar adopted a month of volatility and value data for each Bitcoin and some altcoins, which probably introduced in additional merchants.

OKX and Bybit additionally reported marginal volumes, with $929 billion and $1.09 trillion, respectively, and these figures have remained comparatively related all year long to this point. The Changpeng Zhao-founded change remained the chief, by a large margin, accounting for over half of the full quantity throughout different main exchanges, together with Kraken, Coinbase, Bybit, and others.

CryptoPotato reported that Binance was main the cost within the derivatives market in April, and it’s evident that the momentum has remained robust. The elevated ranges of buying and selling recommend that extra customers are taking part in these markets, leveraging riskier methods.

“The rise in buying and selling suggests extra customers are lively once more, probably as a result of current value breakout,” – famous Maartun.

What About Different Metrics?

Futures quantity could also be booming, however different key metrics level in a unique course. As CryptoPotato outlined on Monday, a Bitcoin sell-off resulted in $1.5 billion in liquidations, and the funding charges, a price exchanged periodically between lengthy and quick positions in a perpetual futures contract, turned unfavorable.

Unfavorable funding charges point out that there are extra shorts than longs, which might be interpreted as extra folks betting on costs to fall reasonably than rise, which is extra “danger off” sentiment.

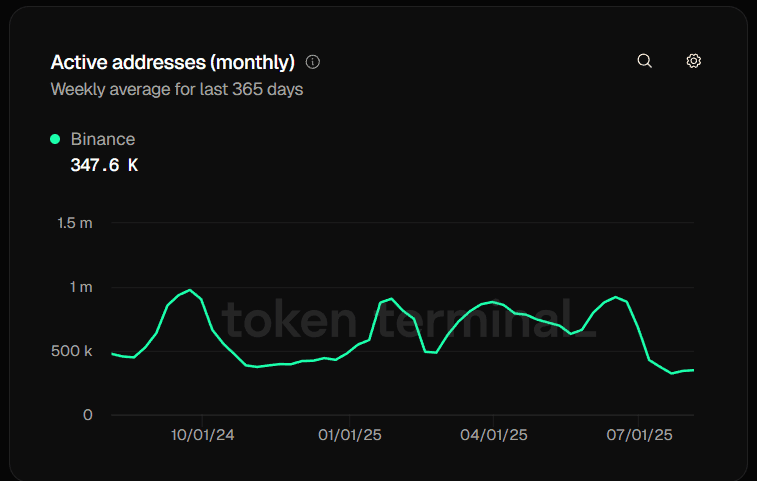

Information collected at print time from the Token Terminal additionally suggests a decline in interplay with Binance, with lively month-to-month addresses dropping from roughly 800,000 at the beginning of June to round 340,000 initially of August, representing a 57.5% lower.

This conflict of positives in negatives appears to be in keeping with present market sentiment, which is in a “impartial” state. It has been a blended bag of ups and downs for cryptocurrency costs as effectively, with the general crypto market cap dropping to $3.7 trillion, from the $4T it reached in July, in response to information from CoinMarketCap.

The put up Binance Futures Quantity Soars to Yearly Highs: What Does it Imply for BTC’s Value? appeared first on CryptoPotato.