The flagship product will allow prospects to make superior purchases of cryptocurrency in markets with decrease volatility.

There will likely be a number of doable eventualities for putting orders, all of that are speculated to work within the consumer’s favor.

Pre-Order Your Crypto

In a press launch shared with CryptoPotato, Binance, the corporate behind one of many largest blockchain ecosystems and exchanges, introduced the launch of Low cost Purchase at this time.

This can be a new product from Binance’s Earn portfolio, enabling patrons to lock in future cryptocurrency purchases at pre-defined costs beneath the present market fee, or earn a hard and fast Annual Share Charge (APR) if the acquisition doesn’t execute.

Low cost Purchase presents a versatile option to accumulate belongings like Bitcoin, Ethereum, BNB, or Solana in low-volatility markets, eliminating the necessity to monitor costs or time your orders.

“Low cost Purchase is well-suited for customers who anticipate restricted value fluctuations and need to accumulate crypto at a reduction with no need to time the market or monitor costs intently,” mentioned Jeff Li, VP of Product at Binance.

“It presents flexibility throughout funding eventualities, giving customers extra decisions and alternatives in how they need to take part within the crypto market.”

How It Will Work

Shoppers can subscribe to the characteristic by utilizing stablecoins (like USDC or USDT) and choosing a fixed-term product with preset circumstances.

The acknowledged circumstances embrace the Goal Purchase Value (the worth at which you need to purchase crypto), a Knockout Value (a value ceiling that determines reward eligibility), a hard and fast APR, and a Settlement Date.

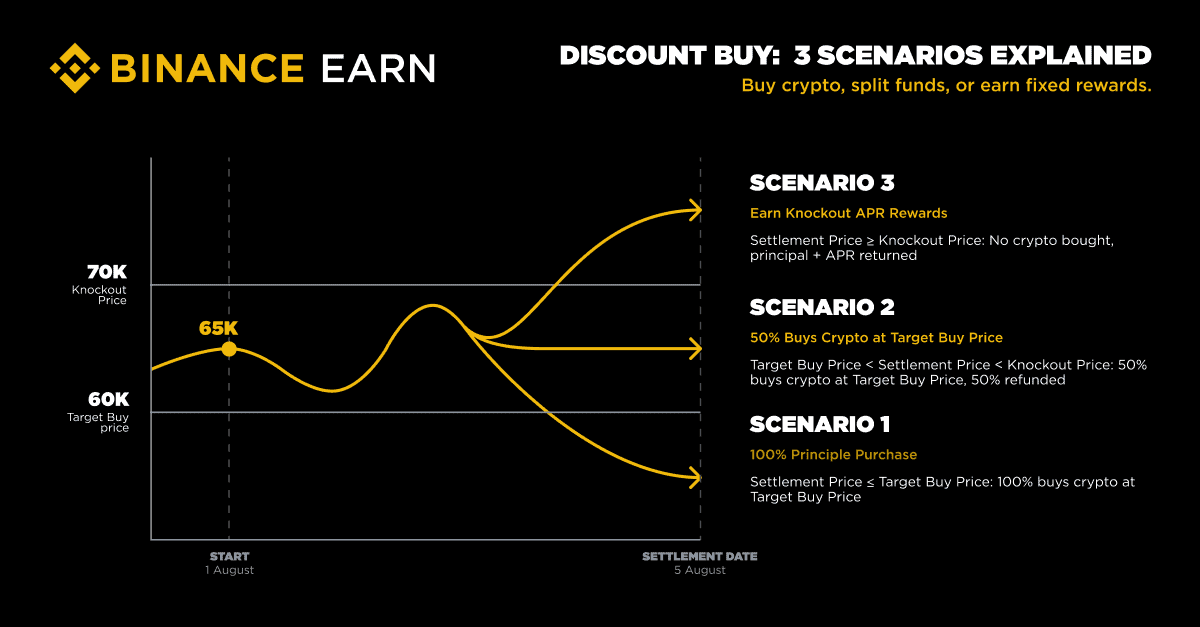

The Settlement Value is outlined as the typical market value over a 30-minute window on the Settlement Date (07:30–08:00 UTC), and is used to find out which end result applies. The consequence will depend on how the market value compares to those ranges:

- Situation 1: 100% Principal Purchases — If the Settlement Value is lower than or equal to the Goal Purchase Value, 100% of the consumer’s funding is used to purchase crypto on the Goal Purchase Value.

- Situation 2: 50% Principal Purchases — If the Settlement Value is larger than the Goal Purchase Value however lower than the Knockout Value, 50% of the consumer’s funds are used to purchase belongings on the Goal Purchase Value, and the remaining 50% is returned in stablecoins.

- Situation 3: Obtain Principal and APR — If the Settlement Value is larger than or equal to the Knockout Value, the consumer receives their full funding again, together with APR rewards.

There are not any buying and selling charges for purchases, and the at the moment supported currencies are BTC, ETH, BNB, and SOL. As soon as the subscription has been set, the Buy Value, Knockout Value, period, and APR are fastened and can’t be modified.

The put up Binance Earn Unveils Characteristic Letting Customers Purchase Crypto at a Low cost appeared first on CryptoPotato.