“Serious about shopping for extra bitcoin,” posted Michael Saylor on Thursday morning highlighting Technique’s popularity as one of the aggressive company accumulators of BTC.

Serious about shopping for extra bitcoin.

— Michael Saylor (@saylor) January 22, 2026

The X publish follows the corporate’s newest disclosure that it added 22,305 bitcoin to its stability sheet, spending roughly $2.13 billion as a part of its ongoing accumulation technique. The acquisition was accomplished at a mean worth of $95,284 per BTC, inclusive of charges and bills.

Newest Buy Expands Technique’s Bitcoin Conflict Chest

The acquisition disclosed on January 20 was funded via proceeds from Technique’s at-the-market fairness and most well-liked inventory gross sales performed between January 12 and January 19.

The method mirrors the corporate’s prior capital-raising playbook, which has repeatedly transformed fairness issuance into bitcoin publicity in periods of market consolidation.

As of January 19, Technique holds 709,715 bitcoin acquired for roughly $53.92 billion at a mean worth of $75,979 per BTC.

Bitcoin Worth Motion Exhibits Consolidation

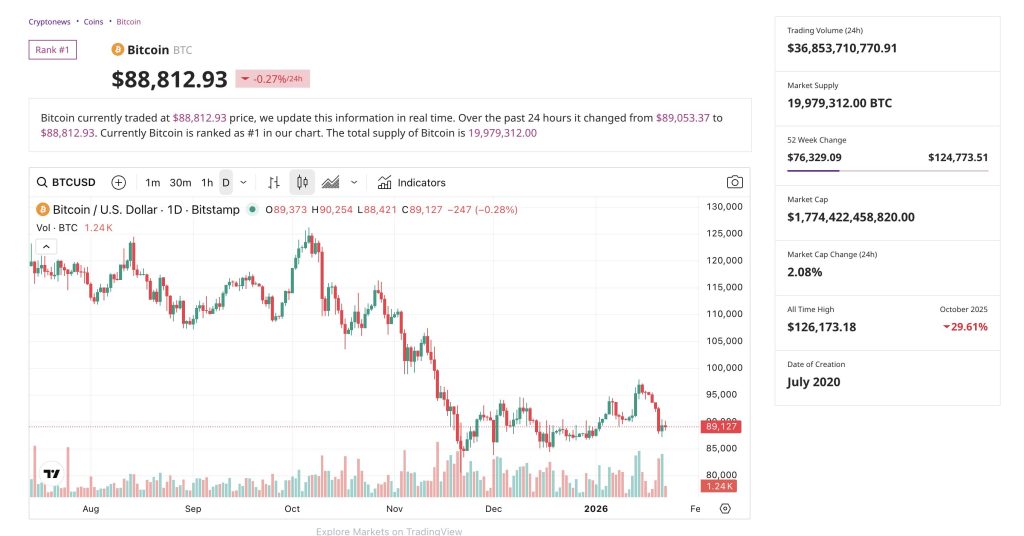

Bitcoin is buying and selling round $88,800 on Thursday, down roughly 0.3% over the previous 24 hours, in response to CryptoNews knowledge. The asset has retreated from latest highs above $95,000 and stays nicely beneath its October 2025 all-time excessive close to $126,000.

Current worth motion reveals bitcoin transferring inside a broad consolidation vary, with consumers stepping in close to the $85,000–$90,000 zone whereas upside momentum has stalled beneath $100,000.

Buying and selling volumes have moderated, suggesting market individuals are ready for contemporary catalysts amid tightening monetary situations and shifting macro expectations.

Regardless of the pullback bitcoin stays up on a year-over-year foundation with its market capitalisation hovering close to $1.77 trillion highlighting its place as the biggest digital asset by a large margin.

Markets convulsed after President Donald Trump threatened steep tariffs on eight European nations until Denmark cedes Greenland, with rhetoric together with hints the U.S. may seize the territory by drive, triggering a world risk-off transfer on January 20.

Gold surged to report highs whereas Bitcoin plunged into the low-$90K vary, with some intraday trades dipping as little as $87K.

Technique’s Lengthy-Time period Conviction Stays Intact

Saylor has framed bitcoin as a long-duration treasury reserve asset relatively than a short-term commerce. Technique’s accumulation tempo has proven little sensitivity to near-term volatility with purchases persevering with throughout each rising and falling markets.

The newest X publish and purchase earlier this week reveals the corporate’s view that durations of consolidation characterize accumulation alternatives relatively than alerts of weak spot.

Whereas the technique has drawn each reward and criticism from market observers, Saylor has repeatedly argued that bitcoin’s long-term shortage and financial properties outweigh interim drawdowns.

The publish Billionaire Michael Saylor Hints at Extra Bitcoin Shopping for in Mid-Week Submit appeared first on Cryptonews.