Aster (ASTER), some of the mentioned decentralized alternate (DEX) tokens in latest weeks, dropped greater than 20% previously 24 hours, wiping out a lot of the rally that adopted Binance founder Changpeng Zhao’s (CZ) endorsement.

The decline delivered large features to a dealer often called the “Anti-CZ Whale,” who now holds over $21 million in unrealized income from shorting ASTER throughout two wallets.

The downturn follows a risky stretch for ASTER, which surged final week after CZ revealed he had personally bought greater than $2 million price of the token.

Changpeng Zhao posted on Sunday that he purchased Aster protocol’s token (ASTER) utilizing his personal cash on Binance.#ChangpengZhao #ASTER #Binancehttps://t.co/uzYZOHcXQD

— Cryptonews.com (@cryptonews) November 3, 2025

CZ’s submit instantly triggered buys, pushing ASTER from round $0.91 to a excessive of $1.26 earlier than reversing sharply as whales started growing their brief publicity.

‘Anti-CZ Whale’ Nets $18.4M as ASTER Drops Beneath $0.90 After CZ’s Purchase

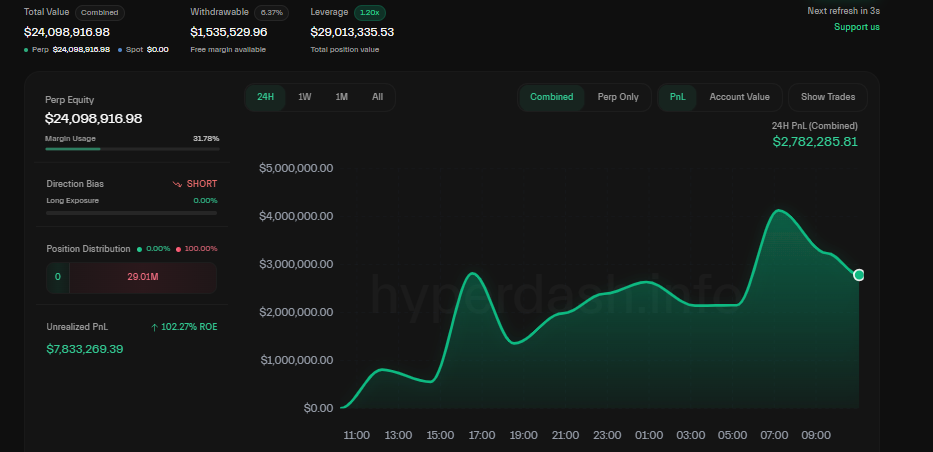

In response to on-chain information compiled by Lookonchain and Hyperliquid, two wallets linked to the so-called Anti-CZ Whale opened substantial brief positions in ASTER shortly after CZ’s announcement.

As the value falls, the Anti-CZ Whale who added to his $ASTER shorts after CZ's purchase submit is now sitting on over $21M in unrealized revenue throughout 2 wallets.

He's additionally shorting $DOGE, $ETH, $XRP, and $PEPE, all in revenue.

His whole revenue on #Hyperliquid is now near $100M!… pic.twitter.com/vfmAPf9ke6— Lookonchain (@lookonchain) November 4, 2025

Collectively, the wallets management greater than $51 million in ASTER shorts, producing about $18.4 million in unrealized revenue because the token slid again beneath $0.90.

One of many wallets, recognized as 0xbadb, holds roughly $24.6 million in fairness with positions centered on ASTER and Dogecoin (DOGE).

The account exhibits an unrealized revenue of $8.38 million, primarily pushed by its ASTER brief from an entry of $1.16 to a present value of $0.88, a 25% decline.

The second pockets, 0x9eec9, carries an excellent bigger e book of $73.7 million throughout a number of belongings, together with ASTER, DOGE, ETH, XRP, and PEPE. It has logged over $29 million in unrealized features, with ASTER alone contributing round $14 million.

Each accounts preserve full brief publicity utilizing leverage between 3x and 20x, bringing the dealer’s whole unrealized revenue on Hyperliquid near $100 million.

CZ Admits “Poor Timing” After Aster’s 57% Month-to-month Drop; Analysts Eye Technical Rebound

Aster’s 24-hour buying and selling quantity has fallen sharply to round $1.35 billion, down 47% from yesterday, signaling fading market exercise after the preliminary rally.

The token, as soon as buying and selling as excessive as $2.41, is now down over 63% from its all-time excessive. It has declined 13.3% previously day, 17.8% over the week, and almost 57% within the final 30 days.

In response to DefiLlama information, Aster’s whole worth locked (TVL) has dropped from $2.5 billion in early October to about $1.47 billion.

CZ reacted to the market stoop by admitting his historical past of poor timing in crypto buys. “Each time I purchase cash, I get caught in a shedding place,” he wrote on X.

我每次买币都被套,100percent的记录。

2014年,均价$600买了BTC,一个月内跌倒$200,持续了18个月。

2017年,买了BNB,也跌了20-30%,持续了几周。

这次。。。还说不准呢。

昨天又加了点仓。所以大家要注意风险啊。以后不再披露了。免得影响大家的行情。https://t.co/jezvlAbXax

— CZ

BNB (@cz_binance) November 4, 2025

He recalled shopping for Bitcoin at $600 in 2014 earlier than it fell to $200 and BNB in 2017 earlier than it dropped 30%. He added that he just lately elevated his ASTER holdings however warned others to “watch out of dangers.”

CZ additionally hinted he might cease publicly revealing future purchases to keep away from influencing market sentiment.

Regardless of the downturn, some analysts imagine ASTER may very well be approaching a short-term rebound.

Chart watchers say the ASTER/USDT pair is forming a falling wedge sample on the four-hour chart, a technical sign typically linked to potential reversals.

The worth is hovering close to $0.95, the place promoting stress seems to be easing. A breakout above $1.01 may set off a short-term restoration towards $1.20 or $1.50 if momentum returns.

Nonetheless, a drop beneath $0.85 may expose the token to additional losses, with assist close to $0.76.

The submit ASTER Plunges 20% as “Anti-CZ” Whale Scores $21M Revenue On Brief Bets appeared first on Cryptonews.