Bitcoin and gold have been on extremely disparate worth trajectories for the previous half-year, which spells hassle for the world’s largest cryptocurrency.

The yellow steel has constantly registered contemporary peaks and is near breaking above $3,000/oz for the primary time ever – in the meantime, BTC has been caught beneath $100,000 for many of February.

Gold Runs Wild

Specialists have outlined quite a few causes behind the valuable steel’s ascent in 2025. Maybe probably the most possible one is the rising inflation within the US and different nations, coupled with the worldwide uncertainty prompted by President Trump’s controversial actions since he assumed workplace for the second time in mid-January.

Being the go-to world asset in instances of rising inflation and financial uncertainty, buyers and central banks turned to gold in an unprecedented method, maybe final seen throughout the early days of the COVID-19 crash in 2020.

Monetary gurus at the moment are dashing to reward the yellow steel after years of disregarding it, claiming that the $3,000 price ticket will fall inevitably and will likely be simply the beginning of an much more spectacular rally. Whether or not that will come to fruition is anybody’s guess in the mean time, but it surely’s true that the steel has expanded its dominance over different belongings previously few months.

Gold stands unchallenged on the first place with a complete market capitalization of just about $20 trillion. This quantity is larger than the following seven monetary belongings mixed (which embrace BTC).

BTC Struggles

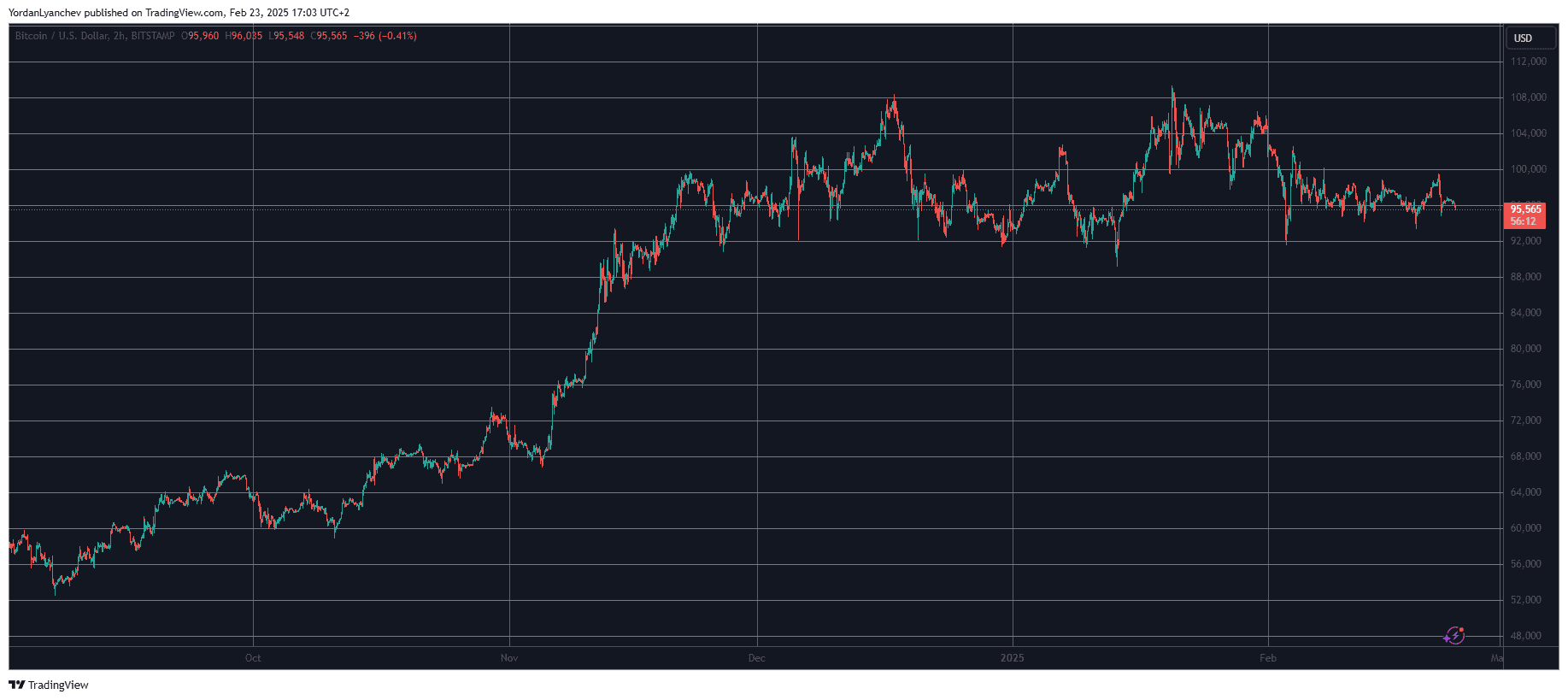

Gold’s worth chart reveals a contrasting image in comparison with BTC’s (beneath). The dear steel really tumbled after Trump’s win on the 2024 presidential elections in early November, whereas most riskier belongings, equivalent to bitcoin, exploded. It took three months for gold to recuperate the misplaced floor, which occurred in early February.

In distinction, the first cryptocurrency skyrocketed instantly after the elections and, after some ups and downs in late 2024 and early 2025, peaked on Trump’s inauguration day at nearly $110,000. Since then, it has corrected laborious and at present stands nearly 15% away from its all-time excessive.

In distinction, the yellow steel has solely solidified its sturdy run in February. It marked a brand new all-time excessive on Thursday, and although it retraced barely, it’s about 1-2% away from it.

So, do these fully completely different worth actions spell much more hassle for BTC? In spite of everything, consultants are satisfied that gold will maintain climbing and charting contemporary peaks. Does that imply that bitcoin will proceed to wrestle?

Nicely, there’s no easy reply to this query. The actual fact is that demand for BTC has pale in current weeks, particularly within the US, which is obvious by the declining Coinbase Premium metric and the lackluster efficiency of the native ETFs.

Nevertheless, the monetary markets, and crypto specifically, are extremely irrational and unlogical locations to be. It’s tough to make even educated predictions, however bitcoin typically does the other of what folks count on of it. As such, don’t be too shocked if it reverses its trajectory within the following weeks and months and heads for brand new peaks no matter gold’s efficiency.

The submit As Gold Costs Method $3K, Why Is Bitcoin Failing to Hold Up? appeared first on CryptoPotato.