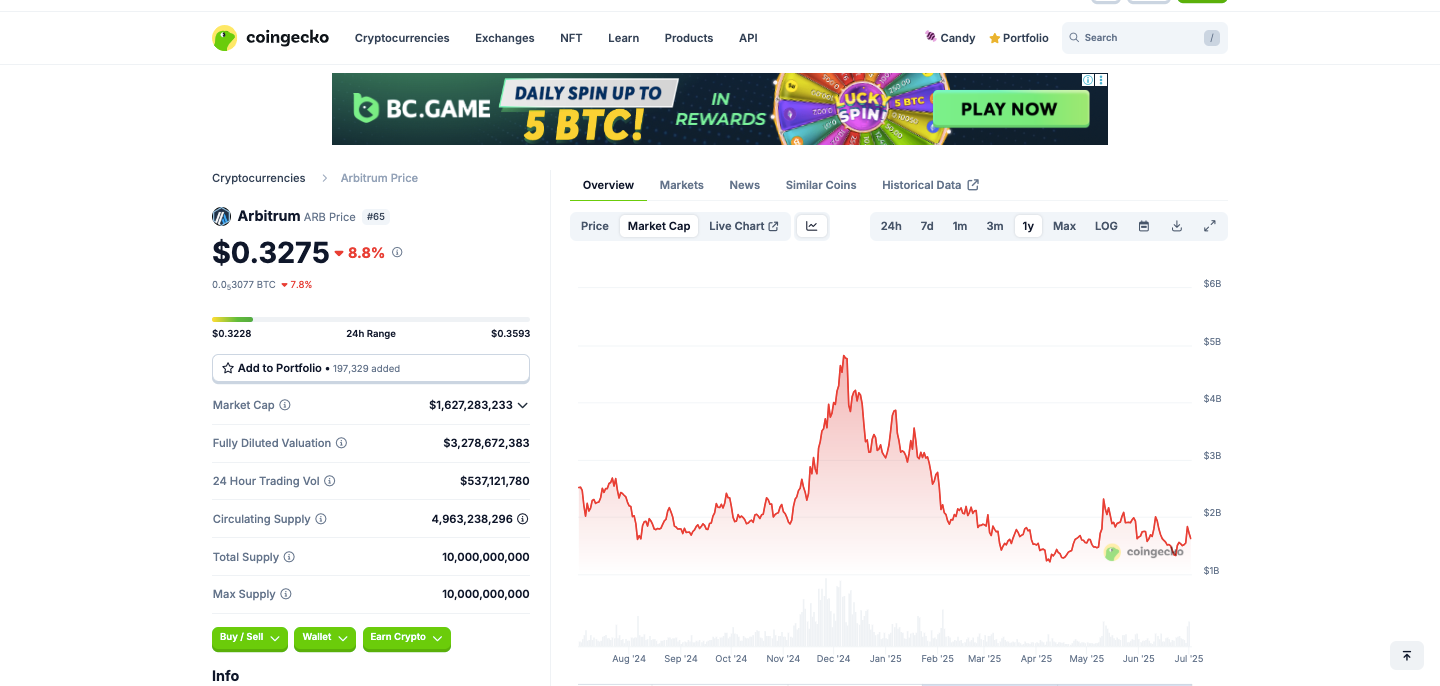

The Arbitrum ($ARB) token is climbing once more, slowly rising to $0.327 after a 7% drop from its 24-hour excessive of $0.3887. With a market cap of $1.62 billion and $506 million in each day buying and selling quantity, Arbitrum holds the forty seventh spot on CoinMarketCap. At press time, the asset is buying and selling at $0.3275.

Arbitrum’s Dominance: The Ethereum L2 Chief With $2.4B TVL

Arbitrum is without doubt one of the largest Ethereum Layer-2 networks, identified for its low charges and excessive scalability. These options have drawn each builders and customers to the platform.

The $ARB token was launched with an airdrop in March 2023 and has since skilled regular value development. Regardless of this, the token nonetheless trades 86% beneath its all-time excessive of $2.39.

Arbitrum holds a dominant place amongst Layer-2 options, with many anticipating its management to proceed. The community boasts a considerable $2.4 billion in complete worth locked, reinforcing its sturdy market presence.

Main decentralized protocols corresponding to Aave and Uniswap depend on Arbitrum as their major DeFi hub, processing transactions via its bridge. This institutional belief reinforces Arbitrum’s place because the main Layer 2 alternative for Ethereum.

Arbitrum leads different Layer-2 networks, corresponding to Base, Starknet, and Optimism, by way of each day exercise and complete worth locked (TVL). Nevertheless, it nonetheless falls behind bigger altcoins, corresponding to Polygon and Avalanche, in market capitalization. Earlier this yr, Arbitrum briefly entered the highest 40 however misplaced floor as a consequence of market shifts towards meme tokens and gaming initiatives.

As of July 1, the community helps over 1 million energetic wallets and has processed 1.89 billion transactions. Past DeFi, NFT platforms like Magic Eden are driving exercise on Arbitrum, showcasing its versatility throughout numerous blockchain sectors.

Magic Eden and Ubisoft launch gaming NFT assortment on Arbitrum based mostly on Captain Laserhawk anime

NFT market Magic Eden, online game firm Ubisoft and blockchain improvement group Arbitrum Basis have collaborated to launch a web3 gaming NFT assortment on… pic.twitter.com/EjkzniUXzy— EchoeWeb (@Echoeweb) October 5, 2024

Arbitrum has additionally partnered with Robinhood, a significant U.S. buying and selling platform. The replace was confirmed throughout a fireplace chat in France, which featured Ethereum co-founder Vitalik Buterin and Arbitrum builders.

Beginning as we speak, @RobinhoodApp will launch tokenized shares on Arbitrum One, and later – a Robinhood Layer 2 blockchain using the Orbit stack.

Robinhood will probably be issuing 200+ US inventory and ETF tokens on Arbitrum One, for EU prospects straight of their Robinhood app.

To their…— Arbitrum (@arbitrum) June 30, 2025

The buying and selling app will launch a tokenized inventory product on Arbitrum One and in a while a customized Robinhood L2 blockchain in its bid to supply EU customers tokenized U.S. shares and ETF tokens.

Binance, the world’s largest crypto trade, has additionally launched new $ARB buying and selling merchandise. These embrace an algorithmic buying and selling bot for the ARB/USDC pair, providing methods like dollar-cost averaging.

Whale exercise on Arbitrum is growing. A pockets linked to the Gelato Community just lately transferred $5 million price of $ARB tokens (roughly 20 million tokens) to market maker GSR. These tokens had been later deposited on Binance, indicating attainable accumulation by a whale.

Can $ARB Climb to $0.59?

The $ARB/USD chart reveals a regarding rounded prime formation following its rejection on the $0.389 resistance degree. This bearish sample emerged on June 30 as shopping for momentum pale, evidenced by progressively decrease highs and diminishing buying and selling quantity—basic indicators of distribution.

The following value motion unfolded in three distinct phases: an preliminary decline to $0.35, a short bullish counterattack that lifted costs to $0.37, and in the end a rejection that drove ARB down to ascertain new assist at $0.321.

Market construction at present presents a transparent battleground. Bulls are pushing for a rebound, concentrating on the important thing resistance degree at $0.37. A decisive breakout above this level, particularly with strong buying and selling quantity, might disrupt the bearish development and pave the best way for a transfer towards $0.40.

But on-chain information reveals a slowdown in whale accumulation, indicating hesitation amongst main buyers. This warning might cap upward momentum, leaving the rally susceptible to resistance.

$ARB W1 TF

(quoted submit)

Drop into the primary decrease vary and a 35% bounce up to now.

Projection appears to be like good, nevertheless it nonetheless wants bullish confirmations (to reclaim $0.51 as assist).

NFA

Updates on https://t.co/yNsxRvQK1A https://t.co/NRm1SgRauQ pic.twitter.com/jhlYhXegsM— GL Crypto (@glcrypto1618) June 30, 2025

Conversely, failure to carry the $0.321 assist would verify the bearish state of affairs, seemingly triggering a cascade of liquidations that might propel $ARB towards the $0.30 psychological degree. In a extra extreme downturn, the $0.28-$0.26 zone might turn out to be the following main assist space.

Merchants ought to monitor each quantity patterns and order e book depth round these key ranges, as the present technical setup presents a high-probability inflection level for ARB’s medium-term trajectory.

The submit Arbitrum ($ARB) Defies Market Stoop: Can the Ethereum L2 Chief Hit $0.59 Subsequent? appeared first on Cryptonews.