Despite a general drawdown in the broader crypto market, trading activity in altcoins and meme tokens has surged, notes an analyst from Kaiko, the Paris-based crypto market data provider.

Altcoins, short for “alternative coins,” refer to digital assets other than Bitcoin. They include a wide range of digital assets, from established ones like Ethereum to newer entrants like Solana trading under “SOL.”

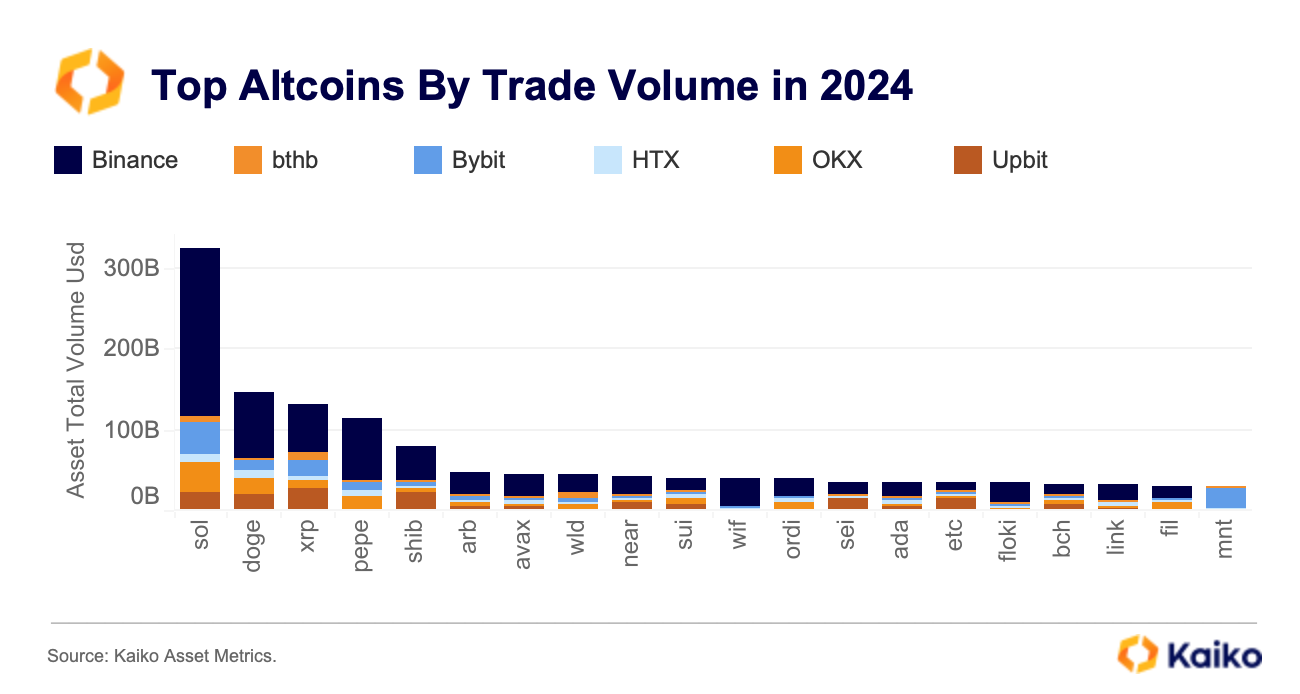

Altcoin SOL Leads in Trading Volume This Year

“SOL, which had a stellar performance earlier in the year, leads in trade volume this year. This is similar to US-based exchanges and is largely explained by SOL’s outperformance,” Dessislava Aubert, a Senior Research Analyst at Kaiko told CryptoNews.

Meme tokens are a subset of altcoins, and are inspired by internet memes and culture. This includes Dogecoin (DOGE), Shiba Inu (SHIB), and the more recent Pepe Coin (PEPE).

While they often lack technical fundamentals of other altcoins, meme tokens capitalize on their community-driven nature and viral marketing to gain popularity and speculative interest.

Binance Leading Platform for Meme Token Activity

“Meme Tokens are also performing well, showing resilience to the recent market drawdown. Binance stands out as the leading platform for meme tokens, capturing over 60% of the average market share for PEPE, DOGE, FLOKI, and SHIB,” said Aubert.

Korean exchanges, particularly Upbit and Bithumb, have also seen substantial volume spikes, especially in the first quarter of this year.

These platforms have been instrumental in driving trade volumes for altcoins like Sui (SUI), Sei (SEI), Ethereum Classic (ETC), and Bitcoin Cash (BCH).

However, volumes on these exchanges have declined significantly in the second quarter, suggesting that the initial momentum for these altcoins might be waning.

“Typically, offshore platforms show higher share of altcoin trading which suggests increased retail participation relative to US-available exchanges where BTC and ETH have a higher share of trading volume,” notes Aubert.

The overall crypto market is facing volatility following the approval of Eth spot exchange-traded funds. But altcoin and meme token trading remains vibrant. Factors such as technological advancements, community engagement, and platform dominance play crucial roles in sustaining this interest.

As the market evolves, these dynamics will continue to shape the trading landscape, highlighting the appeal of altcoins and meme tokens.

Here is a chart from Kaiko featuring top altcoins by trade volume this year on Binance, OKX, Bybit, Upbit, Bithumb and HTX.

The post Altcoin Trading Surges With Meme Tokens Showing Resilience in Market Drawdown: Kaiko appeared first on Cryptonews.