TL;DR

- Certain on-chain metrics suggest overbought conditions, flashing the sell signal on BTC.

- The Fear and Greed Index is currently in the “Extreme Greed” zone, which could indicate a local top and a subsequent price decline.

The Bearish Signals

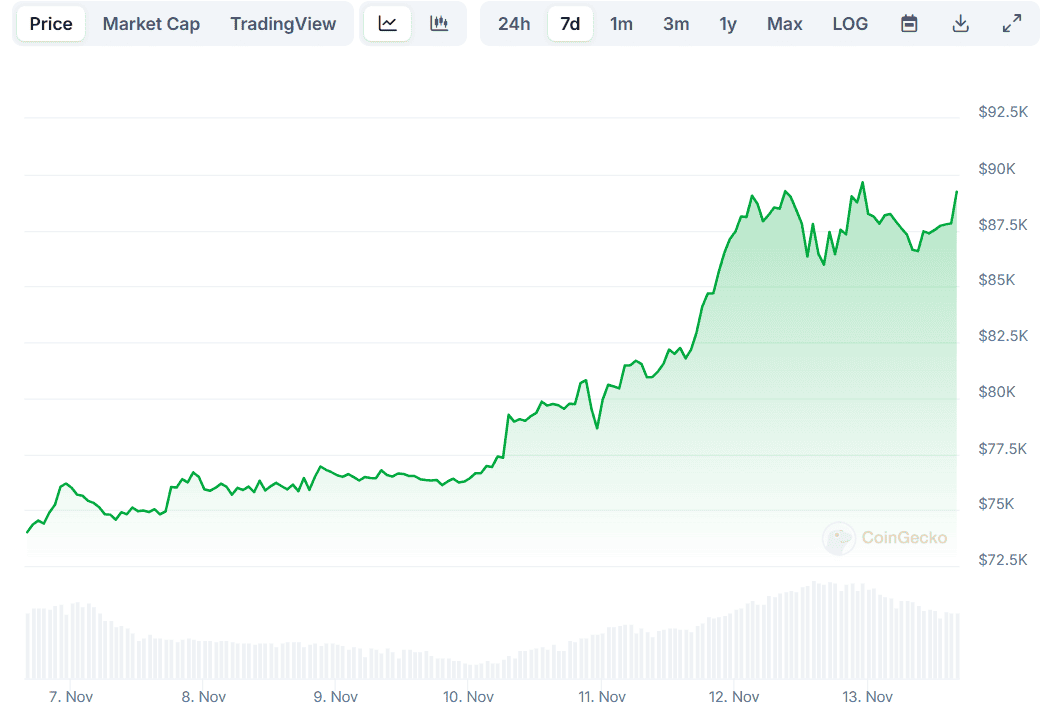

Bitcoin (BTC) has been the talk of the town recently. It entered a massive bull run mode since Donald Trump’s win in the US presidential elections last week, with its price reaching a record high of $92,000 on November 13. However, some important factors suggest that it could pull back from these heights.

The first element we will focus on is BTC’s Relative Strength Index (RSI). The technical analysis tool measures the speed and change of price movements, varying from 0 to 100.

Readings above 70 show that the asset might be overbought and headed for a correction. On the other hand, a drop below 30 typically indicates a potential buying opportunity. As of the moment of writing these lines, the RSI is hovering at around 77, flashing the sell signal.

Next on the list is BTC’s Market Value to Realized Value (MVRV), which, like the aforementioned metric, helps traders examine overbought or oversold conditions. A high ratio might be a precursor of a price retreat, with the MVRV currently standing at approximately 2.6.

“Historically, values between 2.6 and 5 have aligned with market tops, yet each cycle has seen progressively lower peaks,” IntoTheBlock stated.

The third element is the Network Value to Metcalfe (NVM) ratio. It evaluates BTC’s market capitalization relative to its network activity, specifically the number of active addresses.

It employs Metcalfe’s Law, a principle that suggests the value of a network is proportional to the square of the number of its users. By applying this principle, the NVM offers insights into whether the asset is overvalued or undervalued. According to CryptoQuant’s data, the index is currently set at roughly 1.24, leaning toward a bearish outlook.

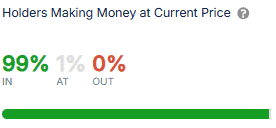

Last but not least, we will touch upon the asset’s profitability. The latest data shows that a whopping 99% of all BTC investors are sitting on some paper profits. 0% are underwater, whereas a mere 1% are break-even.

While this might sound like good news for holders, it may also signal a short-term pullback. In October this year, nearly 95% of BTC’s supply was in profit as the price surpassed $69K. Shortly after, though, a substantial correction caused the valuation to drop below $65.5K briefly. Similar scenarios were observed in September and March.

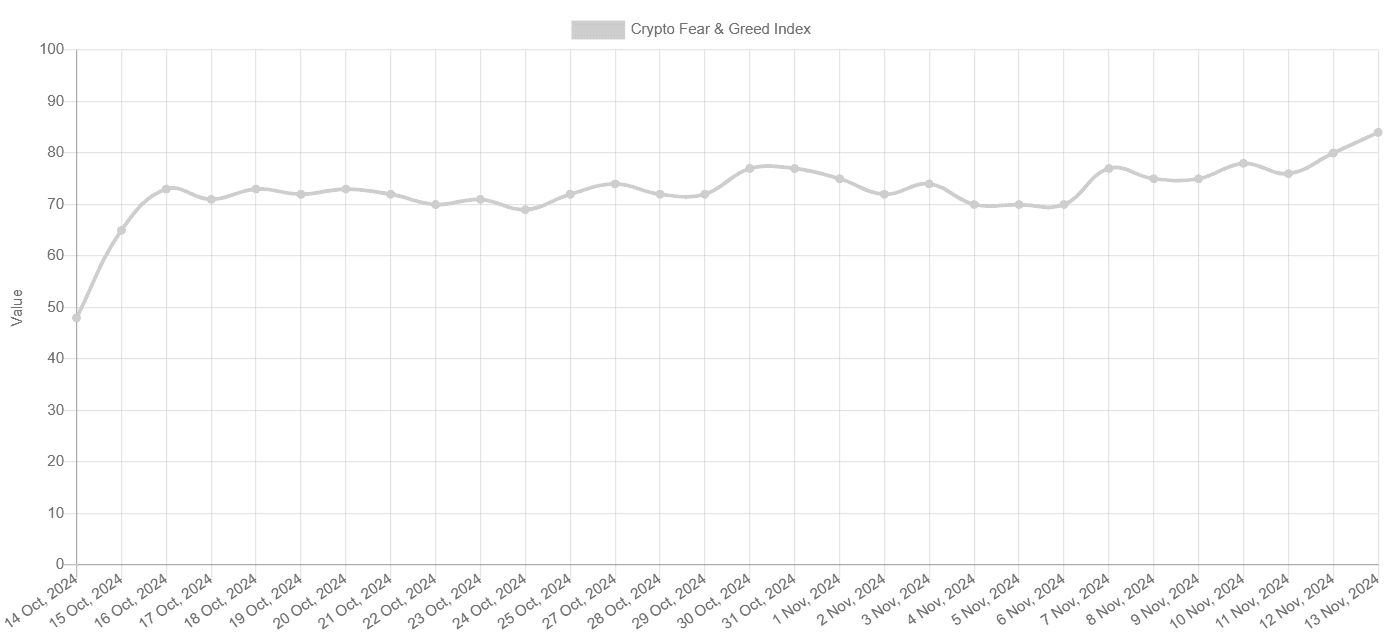

Bonus: The Extreme Greed

One additional element that also hints at an incoming downturn for bitcoin’s price is the Fear and Greed Index, which has recently entered “extreme greed” territory. This development indicates that the ongoing sentiment in the market is strongly bullish.

However, “extreme greed” is sometimes associated with enthusiastic buying and a potential Fear of Missing Out (FOMO) effect. It may signal a point where BTC’s valuation has reached a local peak just before experiencing a pullback.

After all, one of Warren Buffett’s investment advice states that people should be greedy when others are fearful and vice versa.

The post 4 Reasons Why Bitcoin’s (BTC) Price Might See a Short-Term Correction appeared first on CryptoPotato.