The crypto market’s euphoric bull run has been brutally shattered as over $1.05 billion in liquidations swept by means of digital property following unexpectedly excessive U.S. inflation information.

On August 14, the U.S. Bureau of Labor Statistics (BLS) launched July Producer Worth Index (PPI) information exhibiting an annual fee of three.3%, with the earlier month’s determine revised upward from 2.3% to 2.4%.

This exceeded market expectations of two.5% and introduced the month-over-month PPI inflation to its hottest level since March 2022.

This week's inflation information was not ultimate.

Core CPI inflation is now as much as 3.1% and each headline and Core PPI inflation are above 3.0%.

As seen within the beneath chart, per Zerohedge, PPI inflation is clearly re-accelerating.

However, right here's the place it will get much more fascinating. pic.twitter.com/xOI6nYu778— The Kobeissi Letter (@KobeissiLetter) August 14, 2025

The shock inflation studying has had devastating penalties for crypto markets, which plummeted by 2.2% amid cascading liquidation waves hitting Bitcoin, Ethereum, XRP, Solana, and different main cryptocurrencies.

$1.05B Liquidation Bloodbath Signifies Pause within the Crypto Bull Run

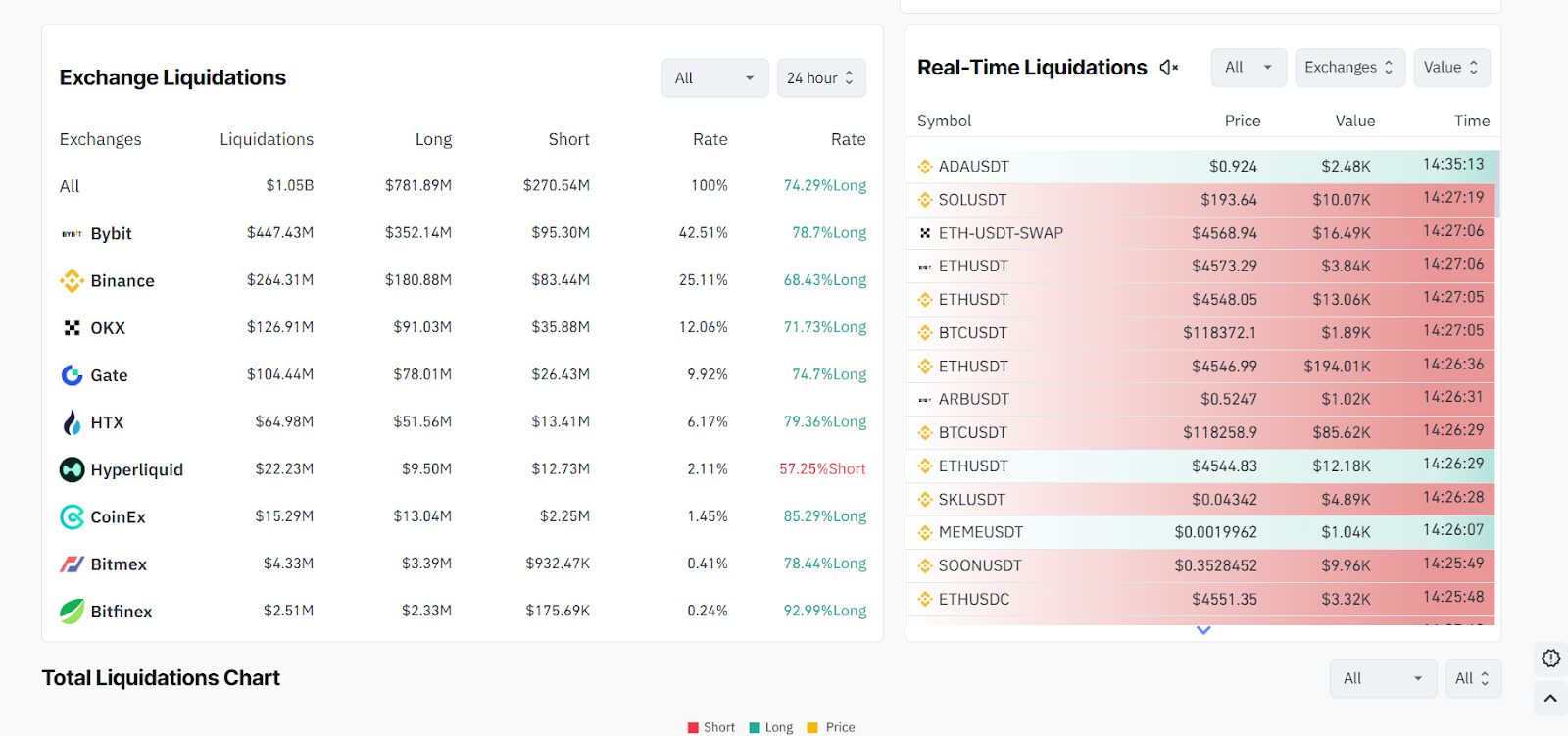

Knowledge from Coinglass reveals the extent of the bloodbath, exhibiting that over the previous 24 hours, greater than $781 million in lengthy positions have been obliterated whereas over $270 million in shorts have been concurrently worn out.

Bybit bore the heaviest casualties, accounting for over 42% of liquidations with roughly $447 million in leveraged positions destroyed. Different main centralized exchanges, together with Binance, OKX, and Gate.io, recorded mixed liquidations totaling $495 million.

Analyzing asset efficiency, Ethereum (ETH) suffered probably the most extreme injury, falling 3.78%, with over $229 million in lengthy positions and $80.22 million briefly positions annihilated.

Bitcoin (BTC) declined 2.98%, erasing over $253 million in leveraged positions. Different main casualties included SOL (-5.12%), XRP (-6.63%), DOGE (-8.90%), and SUI (-6.73%).

Solely Cardano (ADA) managed to remain in constructive territory among the many high 20 cryptocurrencies, gaining 3.96%.

The liquidation frenzy claimed notable victims, together with fashionable dealer AguilaTrades, who misplaced 18,323 ETH ($83.56 million), leaving solely $330,000 of their account.

Caught out there crash, AguilaTrades(@AguilaTrades) was liquidated for 18,323 $ETH($83.56M) once more.

His whole losses exceeded $37M, leaving him with solely $330K in his account.https://t.co/LeSb2QO0PX pic.twitter.com/wNf4JNwemb— Lookonchain (@lookonchain) August 14, 2025

The large sell-off comes as a surprising reversal, provided that Bitcoin simply achieved a brand new all-time excessive of $124,457 within the early hours of August 14.

Ethereum was merely $120 away from setting its personal report, whereas Solana appeared set to problem earlier peaks after breaking above $208.

The trio now trades at drastically lowered ranges, with Bitcoin at $118,089, Ethereum at $4,586.76, and Solana at $194.18.

Treasury Secretary Crushes Crypto Bull Run Desires

Including gasoline to the bearish fireplace, Treasury Secretary Scott Bessent declared on FOX Enterprise Reside that “THE U.S. WILL NOT BE BUYING ANY BITCOIN.”

He clarified that the federal government will solely retain the $15-$20 billion in Bitcoin at the moment held and any extra property obtained by means of confiscation.

JUST IN:

Treasury Secretary Bessent says the US Authorities is "not going to be shopping for" Bitcoin. pic.twitter.com/vL79P531CP

— Watcher.Guru (@WatcherGuru) August 14, 2025

This assertion instantly contradicts earlier guarantees relating to a U.S. Bitcoin stockpile and a Strategic Bitcoin Reserve, dealing one other blow to market sentiment.

Whereas Bessent indicated the federal government would stop promoting its Bitcoin holdings, the gloomy revelation has propagated the “market has topped” narrative, prompting many traders to exit positions at losses or breakeven factors.

Market psychology has undergone a dramatic transformation, mirrored within the crypto Concern and Greed Index, which at the moment stands at 66.

This represents a significant journey from the intense concern stage of 15 recorded in March.

Only one week in the past, the index registered a impartial 51, however Ethereum’s spectacular rally and Bitcoin’s overlapping surge rekindled hopes of a generational bull run.

The sudden liquidation occasion has crushed these aspirations, leaving market contributors in a state of exhaustion.

Crypto analyst “TradeWithThanos” warns {that a} bear market could also be imminent and advises excessive warning, notably forward of the following FOMC assembly in September.

Nevertheless, distinguished key opinion chief Ansem maintains optimism, asserting that 2025 and 2026 will show most rewarding for crypto property, suggesting the market high has not but been reached.

sentiment on altcoins is in any respect time lows with $BTC & $ETH @ all time highs and probably the most consideration *ever* on the area from outsiders

my wager is 2025 & 2026 would be the most fruitful for cryptoassets, and will likely be pushed by progressive protocols gaining significant traction https://t.co/uj1dqh5CYS— Ansem (@blknoiz06) August 14, 2025

Bitcoin Technical Evaluation Factors to Additional Draw back

From a technical perspective, the BTC/USD each day chart signifies that the value not too long ago swept liquidity right into a rejection block and failed to interrupt larger, indicating a possible reversal zone.

The present stage of round $119,000 has established itself as a formidable resistance, with the value rejecting after tapping into a good worth hole (FVG).

Chart evaluation means that if this rejection persists, Bitcoin might retrace towards the mid-$110,000 area.

The unfilled hole round $108,000–$110,000 presents a powerful value magnet, aligning with the final unfilled hole from the current rally.

Ought to this assist stage fail, deeper purple assist zones might face testing.

General, the technical bias favors a corrective downward motion earlier than any renewed try to reclaim current highs.

The submit $1.05B Liquidation Tsunami Wrecks Crypto Bulls Following Scorching US Inflation Knowledge – Bull Run Over? appeared first on Cryptonews.