Ripple CEO Brad Garlinghouse says there’s a 90% probability the US CLARITY Act passes by the top of April. If that occurs, years of crypto regulatory grey zone might lastly shut.

Garlinghouse pointed to severe momentum constructing in Washington after months of Senate delays.

Lawmakers are pushing towards a March 1 negotiation deadline set by the White Home. If the invoice clears, it might give establishments the clear authorized definitions they’ve been ready for earlier than presumably getting into spot markets in measurement.

Key Takeaways

The Sign: Garlinghouse raises passage chance to 90% by April, exceeding prediction market estimates.

The Timeline: White Home concentrating on March 1 for last deal on stablecoin provisions.

The Impression: Defines clear lanes for CFTC and SEC oversight, eradicating headwinds for utility tokens.

Why Is The Readability Act Occurring Now?

The Digital Asset Market Readability Act, H.R. 3633, is at a turning level.

The Home already handed it in July 2025 with a powerful 294 to 134 bipartisan vote. However the Senate hit the brakes over jurisdiction fights. That’s the place issues obtained caught.

Nice to be again on with @MariaBartiromo discussing Ripple’s banner 12 months and accelerating momentum as we begin 2026.

Already, we’re actively seeing Boards and CEOs pushing their CFOs and treasurers to know how they’ll leverage and profit from stablecoins. For…— Brad Garlinghouse (@bgarlinghouse) February 19, 2026

Now momentum seems to be totally different. Garlinghouse says recent conferences with banking leaders and crypto execs helped clear the logjam.

Regulators appear prepared too. After the Senate Agriculture Committee moved a associated draft on January 29, SEC Chairman Paul Atkins stated the SEC and CFTC are coordinating via “Venture Crypto.”

The trade can’t run on enforcement alone anymore. It needs guidelines.

Breaking Down the US Readability Act Odds

Garlinghouse’s 90% odds are much more bullish than the market.

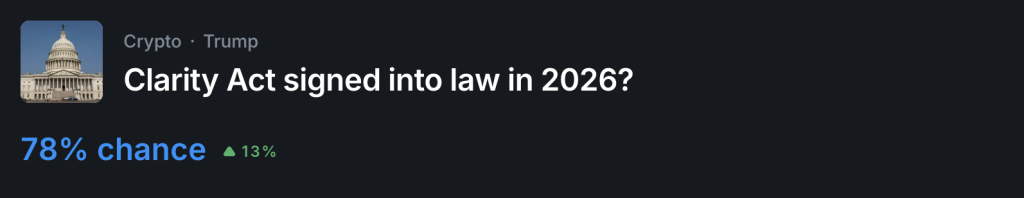

Prediction markets are pricing the invoice at round 78% by 12 months finish, which makes an April end really feel formidable. Nonetheless, he framed it as a needed transfer.

The primary sticking level is stablecoins. Lawmakers are debating whether or not platforms can supply yield model incentives. That challenge already slowed Senate Banking discussions earlier this 12 months.

Whereas Washington debates, Ripple isn’t ready. Since 2023, it has deployed $3B into acquisitions to strengthen custody and treasury infrastructure.

What Does This Imply for XRP Value?

For XRP merchants, actual laws is the final field to verify.

Ripple already gained a courtroom ruling that XRP isn’t a safety. However a federal regulation would lock that standing in. That form of readability might open the door for establishments at scale.

Xrp (XRP)24h7d30d1yAll time

Garlinghouse stated company treasurers are taking a look at stablecoins and cross border funds. The curiosity is there. What they want is federal guardrails earlier than transferring severe capital.

If April delivers, we might see a quick rotation again into massive caps with actual utility, particularly if it traces up with the present market pullback.

Uncover: Listed here are the crypto more likely to explode!

The submit Ripple CEO Predicts 90% Probability U.S. Crypto Invoice Passes by April – What It Means for XRP Value appeared first on Cryptonews.