Bitcoin is buying and selling beneath sustained strain after dropping key higher-timeframe help ranges, with the value construction displaying a transparent transition from distribution to a creating downtrend. Momentum stays weak, and up to date rebounds seem corrective reasonably than impulsive, preserving draw back threat elevated within the close to time period.

Bitcoin Worth Evaluation: The Every day Chart

On the day by day timeframe, the asset continues to respect a descending channel whereas buying and selling under main shifting averages, confirming bearish market construction. The rejection from the mid-range resistance zone and subsequent sharp sell-off towards the low-$60K area reinforces that sellers nonetheless management pattern route.

Momentum indicators stay subdued, with RSI holding far under impartial and failing to supply sturdy bullish divergence. Until the value can reclaim the $75K–$80K resistance cluster and shut above the channel midpoint, the broader bias stays tilted towards continuation decrease or extended consolidation close to the $60K help stage.

BTC/USDT 4-Hour Chart

The 4-hour chart exhibits a steep impulsive drop adopted by uneven sideways motion, typical of a bear-flag or accumulation try after liquidation. Decrease highs proceed to type beneath descending dynamic resistance, signaling that consumers haven’t but regained short-term management.

Key help sits across the current wick low close to the $60K space, whereas speedy resistance is clustered between roughly $73K and $76K. A breakout above this vary can be the primary technical sign of a momentum shift, whereas a breakdown under the talked about help zone may speed up one other leg downward and result in one other spherical of huge liquidations.

Sentiment Evaluation

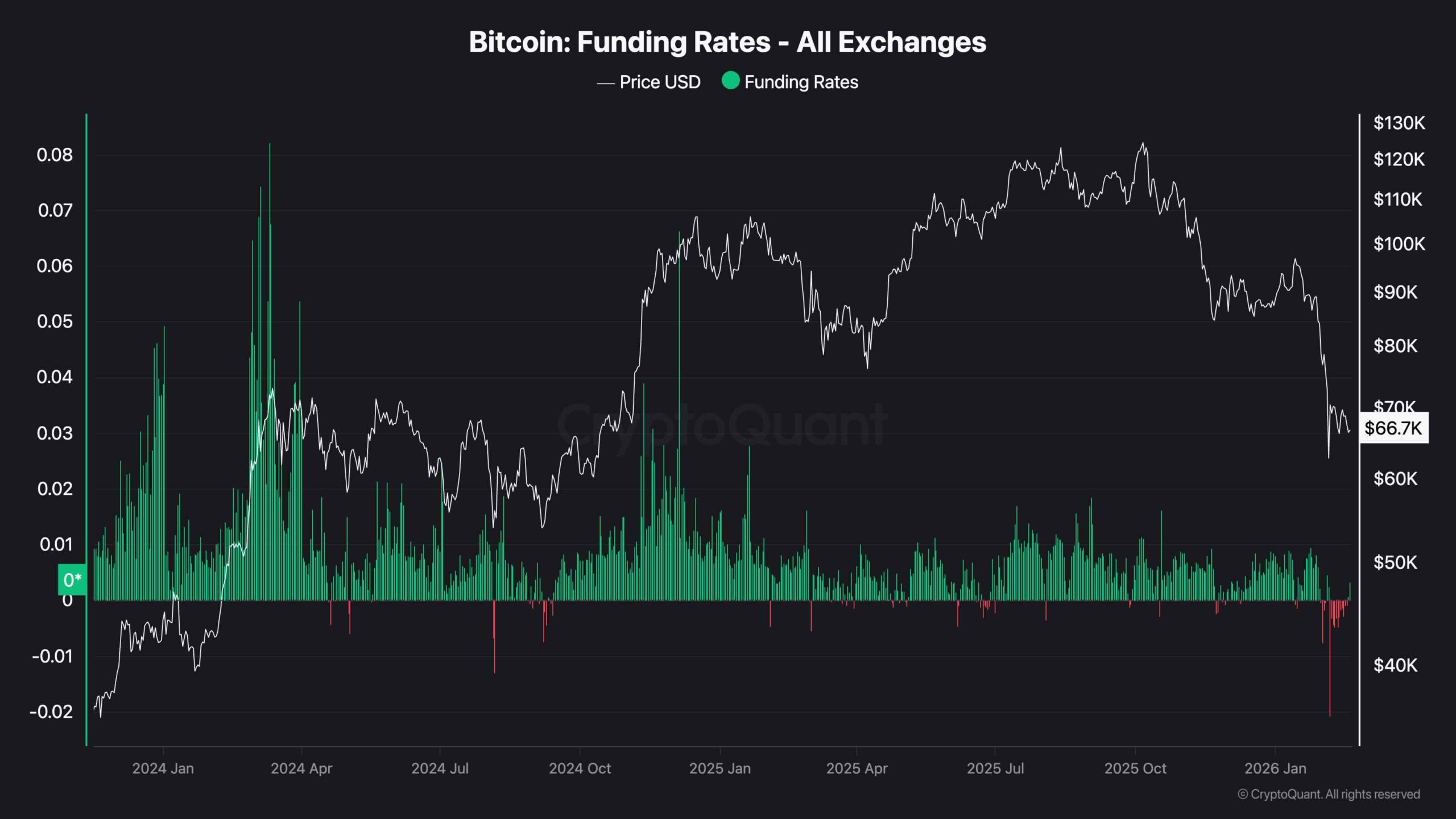

Funding charge knowledge exhibits sentiment cooling considerably in comparison with earlier overheated circumstances, with the current deeply damaging prints suggesting lowered long-side leverage. The sort of reset is constructive over the medium time period however doesn’t, by itself, verify a direct bullish reversal.

General market psychology seems cautious reasonably than euphoric, which regularly precedes vary formation earlier than the subsequent main transfer. For sentiment to flip decisively bullish, value energy should return alongside rising however managed funding and bettering momentum throughout timeframes.

The put up Bitcoin Worth Prediction: What Is the Most Possible Subsequent Transfer for BTC as Momentum Stays Weak? appeared first on CryptoPotato.