The Hong Kong monetary regulator (HKMA) is about to approve the primary license for a stablecoin issuer in March, as proven by a report by Reuters.

The event happens following a interval of regulatory evaluate and the revealing of some of the complete stablecoin frameworks on the earth, which got here into drive in August final yr.

At a Legislative Council assembly on Monday, Hong Kong Financial Authority chief govt Eddie Yue stated that the evaluate course of is nearly completed, including that solely a really small variety of candidates can be accredited at first.

Yue added that assessments are specializing in core areas resembling stablecoin use instances, reserve backing, danger administration, and anti-money laundering controls.

Hong Kong’s Stablecoin Period Begins Slowly as Regulators Tighten the Bar

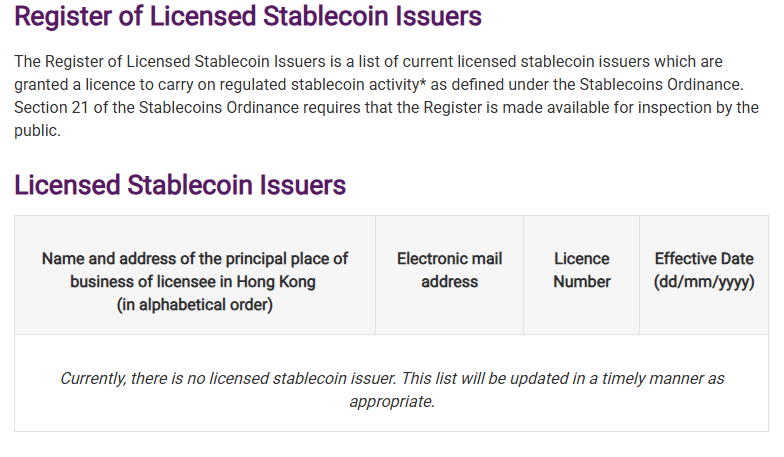

As of early February, no stablecoin issuer has but been accredited beneath Hong Kong’s new regime.

The HKMA has indicated that it’s assessing 36 purposes within the first spherical, although the broader business curiosity had greater than 40 potential candidates at one level.

The regulator has up to now been cautious and in July 2025 launched a public registry to observe licensed issuers, however the registry is at the moment empty.

The licensing regime carried out in August covers all issuers of fiat-referenced stablecoins in Hong Kong, in addition to overseas issuers of tokens pegged to the Hong Kong greenback.

The foundations allow licensed issuers to situation, administer, and redeem stablecoins, so long as they’ve full 1:1 reserve help of high-quality, liquid property beneath belief preparations with accredited custodians.

Issuers should honor redemption requests at par worth inside one enterprise day and are prohibited from paying curiosity to stablecoin holders.

Governance and compliance are additionally given nice focus by the regime.

In keeping with the foundations, issuers ought to be domestically integrated or approved organizations which have sturdy inside controls and have boards which have unbiased administrators with particular compliance capabilities.

They need to carry out due diligence of shoppers, undertake the usage of wallets, and cling to anti-money laundering and counter-terrorist financing necessities.

HKMA has a variety of supervisory authority and might add additional phrases to the license, introduce managers, or cancel the license in case of breach of necessities.

Hong Kong Sandbox Attracts Banks, Tech Giants, and Web3 Corporations

Quite a few high-profile firms have already turn into the most important members by making use of to the regulatory sandbox of the HKMA.

These embrace a three way partnership between Customary Chartered’s Hong Kong arm, Animoca Manufacturers, and telecoms supplier HKT, working beneath the title Anchorpoint Monetary.

@StanChart, @animocabrands, and HKT group as much as launch a Hong Kong dollar-backed stablecoin. #Stablecoin #HongKonghttps://t.co/6eWEGHcKCz

— Cryptonews.com (@cryptonews) February 17, 2025

Ant Group’s digital know-how unit has confirmed it’s pursuing a license, whereas Financial institution of China Hong Kong has been reported as an applicant.

HSBC and ICBC additionally signaled their intention to use final yr, though the HKMA has not confirmed the identities of any candidates and has warned that early approvals shouldn’t be seen as endorsements of particular enterprise fashions.

The stablecoin rollout sits inside a broader regulatory and strategic push by Hong Kong to develop a full digital asset stack.

The town already operates a licensing regime for digital asset buying and selling platforms beneath the Securities and Futures Fee, with 11 exchanges accredited up to now, together with OSL, HashKey, and Bullish.

The Securities and Futures Fee o Hong Kong has accredited 4 new digital asset suppliers!#HongKong #Cryptohttps://t.co/iUKmMVDSlk

— Cryptonews.com (@cryptonews) December 18, 2024

Authorities officers have repeatedly framed stablecoins as infrastructure reasonably than speculative merchandise.

On the World Financial Discussion board in Davos in January, Monetary Secretary Paul Chan stated Hong Kong’s method to crypto regulation is meant to be “accountable and sustainable,” describing digital finance as a strategic development pillar for the town.

On the identical time, business teams have cautioned that rising compliance prices may gradual institutional participation if guidelines turn into overly restrictive.

The submit Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In? appeared first on Cryptonews.