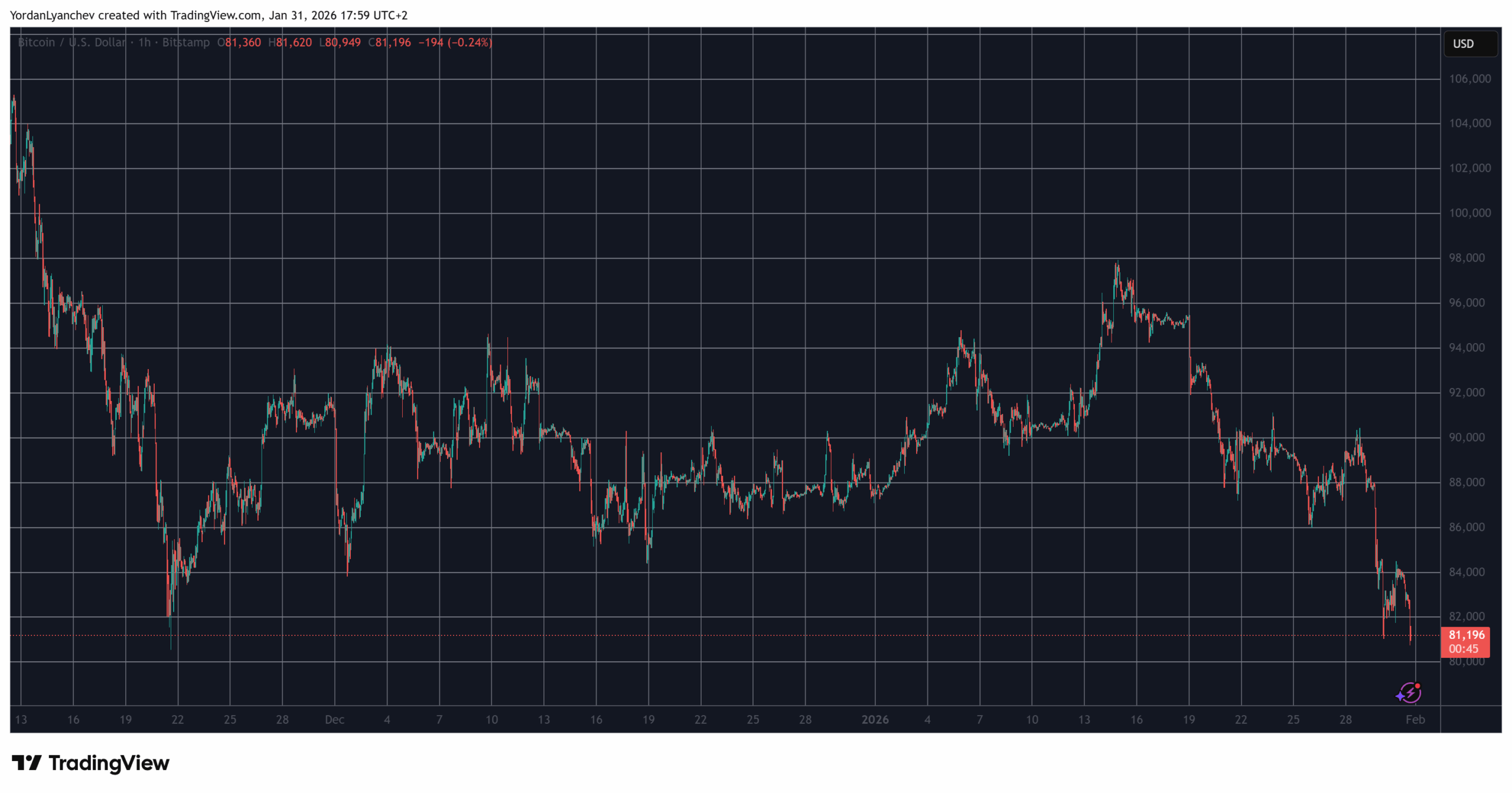

After a comparatively calm and untypical Friday, by which BTC stays sideways round $83,000 and $84,000 whereas the valuable steel market tanked, the cryptocurrency is dumping exhausting as soon as once more on Saturday.

Recall that the asset’s general calamity started on Thursday when it was rejected at $90,000. Within the following hours, it dropped by 9 grand to a then-two-month low of $81,000.

It recovered some floor yesterday when it rebounded to $84,000, which now seems as a dead-cat bounce. On the identical time, silver and gold plunged by 40% and 16%, respectively, erasing roughly $7 billion of their respective market caps inside only a day.

Nonetheless, the previous few hours have introduced extra ache to the bulls, with BTC slipping to simply underneath $81,000. This turned its lowest price ticket since November 21.

Most altcoins are additionally deep within the purple now. Ethereum is down by 7% previously 24 hours alone, slumping towards $2,500. BNB and XRP have plummeted by 5-6% every day as properly.

It’s no marvel that the overall worth of wrecked positions is on the rise, approaching $1 billion previously 24 hours alone. Naturally, longs are chargeable for the lion’s share (over $850 million), whereas the variety of liquidated merchants has shot as much as roughly 240,000, reveals information from CoinGlass.

The only-largest wrecked place occurred on Hyperliquid and was price over $13 million. Curiously, it concerned ETH, which is among the many poorest performers previously day.

The publish Bitcoin (BTC) Value Tanks Towards $80K as Liquidations Method $1B appeared first on CryptoPotato.