It’s onerous to think about now that just some months in the past, bitcoin was using excessive, traders had been hopeful about ‘Uptober,’ and the bulls dominated the market.

In that not-so-distant previous, the cryptocurrency was buying and selling confidently inside a six-digit worth territory, and had simply printed a brand new all-time excessive above $126,000. The group was full of latest predictions about $150,000 or $200,000 by the top of the 12 months, based mostly on historic performances.

The Month-to-month Closures in Purple

The fact, although, was totally different. And brutal. As an alternative of going to these ranges, BTC nosedived on October 10/11 in a $19B-wipeout, and the development turned for the more serious because the cryptocurrency was by no means really capable of get better from that crash. Actually, bitcoin ended 2025 within the crimson for the primary time in a post-halving 12 months.

2026 started with extra hopes of a rebound and a renewed run, however they had been halted mid-month when BTC was stopped at $95,000 and pushed south onerous. It was first pushed beneath $90,000, however that was just the start because the losses saved coming.

It dumped to $81,000 throughout final week, bounced off to $84,000, solely to be rejected on Saturday. Within the span of simply a number of hours, bitcoin’s calamity worsened, and it slumped to roughly $75,000, leaving billions price of liquidations. This meant that it had misplaced $20,000 in lower than two weeks.

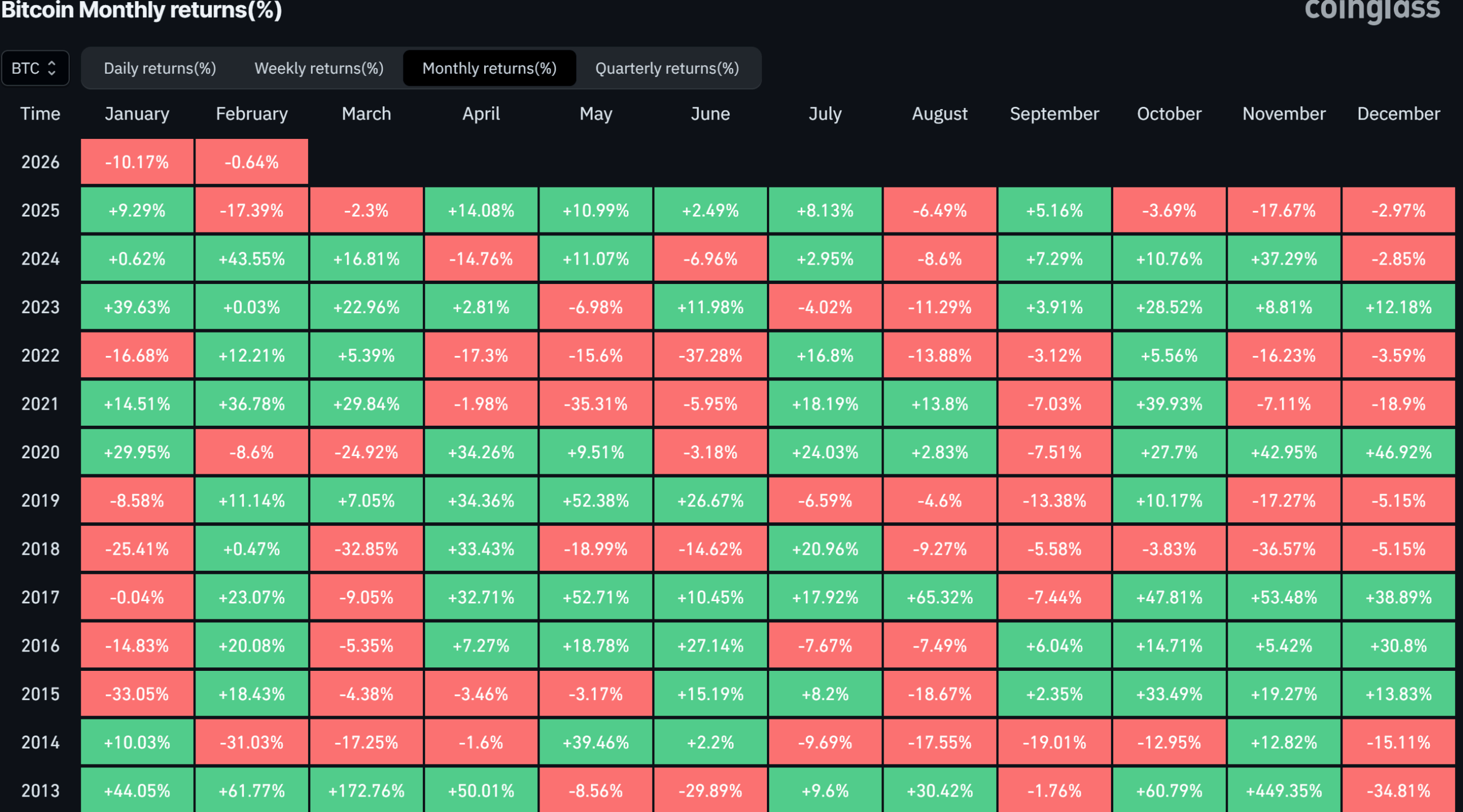

Knowledge from CoinGlass exhibits that bitcoin closed January with a ten.17% loss, though it rebounded barely from that low. This made it the fourth consecutive month closed within the crimson and the worst since November.

What Bull Market?

Most crypto analysts have been break up since October on whether or not the continued market part is definitely a bull market. However the information from above clearly demonstrates that BTC’s conduct is extra according to the way it performs throughout bear cycles. In any case, the final time it had 4 or extra consecutive months within the crimson was on the finish of 2018 and starting of 2019.

On the time, BTC was digging new lows time and time once more, earlier than it lastly bottomed in January after the sixth month within the crimson in a row. If historical past is to repeat itself now, the cryptocurrency has extra room for losses earlier than it lastly levels a notable restoration because it did seven years in the past.

Nonetheless, the sunshine on the finish of the tunnel exhibits that bitcoin is perhaps due for a extra favorable Q2 and Q3 if we depend on historical past. If we don’t, excellent news might come as quickly as February, as most analysts agree that the four-year cycle has been damaged and BTC now operates in a distinct method.

The publish What Bull Market? Bitcoin Closes 4 Consecutive Months within the Purple appeared first on CryptoPotato.