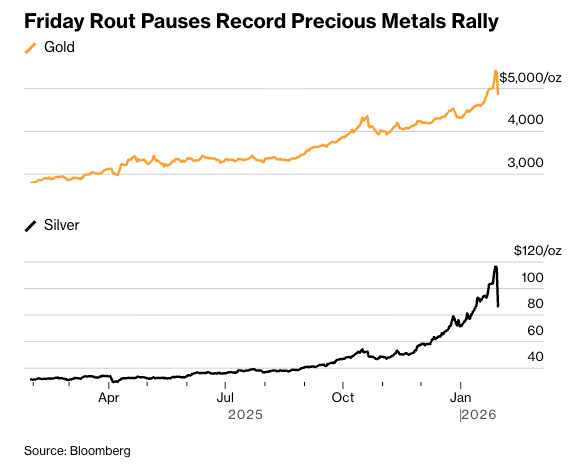

Valuable metals suffered a catastrophic collapse on January 30 as gold plunged over 12% beneath $5,000 an oz whereas silver recorded its largest intraday drop in historical past, falling as a lot as 36%, in accordance with Bloomberg.

The selloff was triggered by President Donald Trump’s nomination of Kevin Warsh as Federal Reserve chair, which despatched the greenback hovering and sparked large profit-taking throughout commodities markets.

The crash worn out greater than $15 trillion from the gold and silver markets in 24 hours, an quantity equal to half the dimensions of your entire U.S. financial system.

Regardless of the brutal correction, each metals nonetheless completed January with beneficial properties (gold up 12% and silver up 16%), whereas Bitcoin tumbled to a nine-month low of $82,000, elevating questions on whether or not the digital asset will comply with treasured metals’ trajectory or chart its personal path.

Historic Selloff Pushed by Warsh Nomination and Technical Elements

Spot gold costs crashed greater than 12% at one level, hitting a low of $4,682 per ounce in its largest single-day decline because the early Nineteen Eighties, closing down 9.25% at $4,880.

Silver skilled an much more dramatic collapse, plummeting 36% intraday to $74.28 per ounce earlier than settling 26.42% decrease at $85.259, marking its worst day since March 1980.

Gold and silver have misplaced a mixed $6.52 trillion over the past 48 hours.

That’s equal to Bitcoin's complete market cap practically 4 occasions over.

Wild. pic.twitter.com/7tNipGt19e— Joe Consorti (@JoeConsorti) January 30, 2026

“Trump saying Warsh as his choose for subsequent Fed Chair has been a US greenback optimistic and treasured metals unfavourable,” Aakash Doshi, world head of gold and metals technique at State Avenue Funding Administration, instructed Bloomberg.

“This has most likely been exacerbated by month-end rebalancing as each brief greenback and lengthy treasured metals has been the consensus macro commerce over the previous two to a few weeks.“

The selloff accelerated via pressured promoting and margin calls as leveraged positions unwound.

“That is getting loopy,” stated Matt Maley, fairness strategist at Miller Tabak, including, “Most of that is most likely ‘pressured promoting.’ This has been the most popular asset for day merchants and different short-term merchants lately. So, there was some leverage constructed up in silver. With the large decline at present, the margin calls went out.“

Bloomberg additionally famous that technical components amplified the crash as a gamma squeeze pressured sellers to promote futures contracts as costs fell via key choices ranges at $5,300, $5,200, and $5,100 for gold.

Gold’s relative-strength index had lately hit 90, the best in a long time, signaling that the dear steel was severely overbought and due for a correction.

Main mining firms suffered devastating losses, with Newmont down 11.52%, Barrick Gold falling 12.09%, and AngloGold plunging 13.28%.

Copper additionally retreated 3.4% from Thursday’s file excessive above $14,000 per ton, whereas silver ETFs noticed their worst days on file, with the iShares Silver Belief shedding 31%.

Bitcoin Faces ‘Two-Path’ Dilemma as Markets Reassess Fed Coverage

Bitcoin dropped to $82,000 following Warsh’s nomination, with spot Bitcoin ETF outflows accelerating to roughly $1 billion this month and whole liquidations approaching $800 million to $1 billion, in accordance with Bitfinex analysts.

The digital asset is now buying and selling at a nine-month low as traders reassess financial coverage trajectories.

Jeff Park, CIO at Bitwise, outlined a essential framework for understanding Bitcoin’s divergent path from treasured metals in his “Two Bitcoin Thesis.”

“Metals are telling you notice debasement is occurring; Bitcoin will let you know when the yield curve itself breaks,” Park defined, distinguishing between “unfavourable rho Bitcoin” that performs higher when charges fall and “optimistic rho Bitcoin” that thrives when monetary system assumptions collapse.

Park argued the present surroundings represents the worst situation for Bitcoin’s “unfavourable rho” thesis.

“We’re at the moment experiencing good deflation in know-how sectors whereas avoiding unhealthy deflation in credit score markets,” he wrote.

“That is the worst attainable surroundings for Bitcoin: productive sufficient to maintain development property enticing, secure sufficient to maintain Treasuries credible, however not catastrophic sufficient to interrupt the system.“

https://t.co/9aCcpwV6YO pic.twitter.com/XeWgnP55H0

— Jeff Park (@dgt10011) January 31, 2026

Talking with Cryptonews, Aurélie Barthere, Principal Analysis Analyst at Nansen, recognized a number of unfavourable catalysts driving Bitcoin decrease: “Fed Chair Powell guiding for no Fed reduce in its remaining mandate until June 2026, President Trump seemingly selecting the extra hawkish candidate as the brand new Fed Chair, Kevin Warsh, and a BTC correlation with US equities turning optimistic once more.“

Movement information exhibits “gradual capitulation in ETFs, choices, and miner exercise,” she famous.

Eric Jackson, incoming CEO of EMJX-SRX Well being, supplied a contrarian view on Warsh’s nomination.

“The nomination of Kevin Warsh for Federal Reserve Chairman seems constructively neutral-to-positive for crypto over the medium time period, even when the preliminary market response is cautious,” Jackson instructed Cryptonews.

“His emphasis on steadiness sheet self-discipline and clearer boundaries between Treasury and the Fed factors to much less reflexive quantitative easing and higher transparency round liquidity situations.“

those that nonetheless dont perceive why warsh gained merely dont perceive the unstated fact that the fed-treasury relationship is essentially the most highly effective lever to have an effect on the type of generational change that this method now requires

it was at all times warsh and bessent

extremely optimistic— Jeff Park (@dgt10011) January 30, 2026

Park’s evaluation suggests the Warsh appointment might in the end show bullish for Bitcoin’s “optimistic rho” situation by accelerating a systemic reckoning.

“For those who imagine the debt trajectory is unsustainable, for those who imagine fiscal dominance will finally override financial orthodoxy, for those who imagine the risk-free charge will finally be revealed as a fiction, you then need Warsh,” he wrote.

He concluded that whereas he can’t verify if “$82k was certainly the underside,” traditionally, “bottoms are virtually at all times famous by a radical shift in market regime that basically resets investor habits.“

The publish Silver Plunges File 36% as Valuable Metals Endure Historic Collapse – Bitcoin About to Rally? appeared first on Cryptonews.