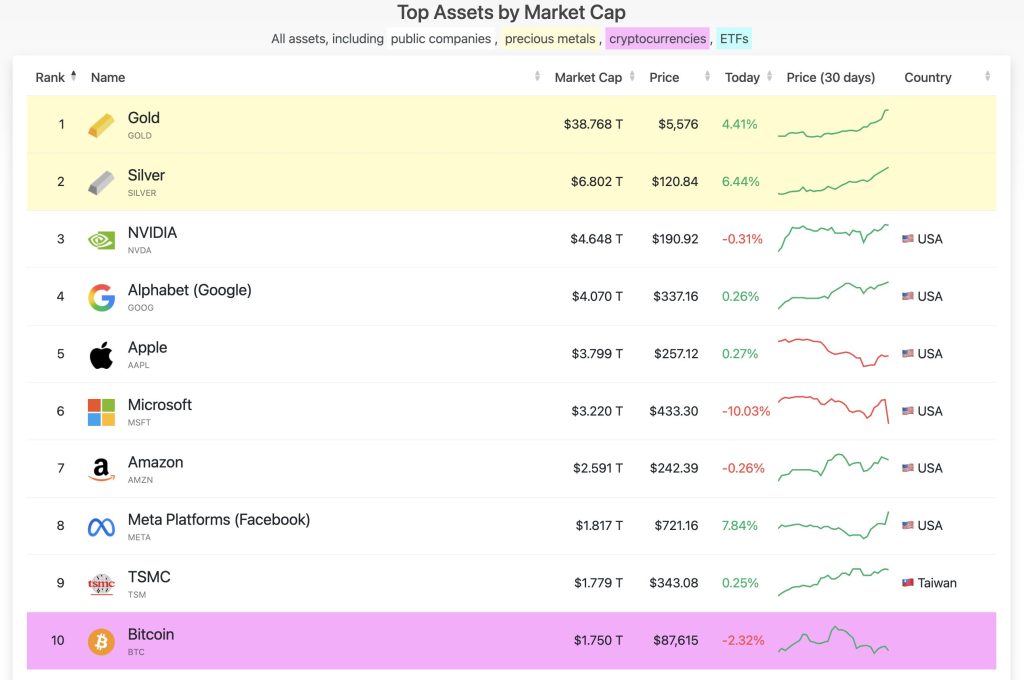

For years, Bitcoin has been championed as “digital gold” — with ardent believers arguing it’s far superior to the dear metallic. Sadly, it appears the market disagrees.

Gold’s extraordinary bull run exhibits no signal of slowing down. It’s surged by 25% over the previous month, 66% over the previous six months, and is up 200% in contrast with 5 years in the past.

That formally implies that it’s outperforming the world’s greatest cryptocurrency by a big margin. In contrast, BTC is down 2.5% from a month in the past, and has misplaced 25% of its worth prior to now six months. In the meantime, its returns since 2021 stand at a extra modest 156%.

Different commodities have additionally been on a tear. A flight to protected haven belongings noticed spot silver hit a recent document of $120 this week.

An almighty flippening has occurred in current months. Again in April 2025, Bitcoin had a much bigger market capitalization than silver — $1.85 trillion versus $1.84 trillion. Quick ahead to now, and the image couldn’t look any totally different: silver has rallied to $6.7 trillion, as BTC languishes behind on $1.75 trillion.

Even copper has been getting in on the motion. Official figures present 2025 was its best-performing yr for a decade, with a worldwide scarcity and a push into renewable vitality propelling costs past $14,000 a tonne.

Certainly, Bitcoiners could also be trying on enviously as valuable metals expertise “excessive greed” — one thing that the crypto world hasn’t seen for fairly just a few months now. And for an thought of the size of the rally, take into account this: gold added $1.6 trillion to its market cap on Wednesday alone — that’s nearly as a lot as all the world’s BTC put collectively.

So… what offers? Properly, analysts argue that this can be a symptom of Bitcoin maturing as an asset following the arrival of exchange-traded funds two years in the past. Wall Road inflows have diminished the volatility that after made this cryptocurrency so interesting to buyers. Whereas we aren’t seeing dizzying “God candles” anymore, this additionally means much less danger to the draw back.

Bitcoin (BTC)24h7d30d1yAll time

Some additionally level to excessive wariness following the dramatic and sudden crash on October 10, when hypothesis surrounding a recent wave of Donald Trump’s tariffs brought on mass sell-offs — and Binance’s infrastructure to buckle below the pressure.

There are additionally explanation why gold specifically is being favored proper now. Trump’s persistent assaults on Jerome Powell have triggered fears about how the Federal Reserve’s independence might be undermined throughout the remainder of his second time period. Invesco’s Christopher Hamilton instructed Bloomberg:

“The velocity with which gold is breaking milestones underscores how rapidly confidence in conventional coverage instruments is eroding.”

Bitcoin is starting to take pleasure in wider acceptance amongst institutional buyers, as evidenced by spectacular inflows into exchange-traded funds monitoring its spot value on Wall Road. Nevertheless, as NYDIG notes, gold continues to learn from a lot wider model recognition.

“Gold advantages from a long time of institutional precedent and a well-established position as a strategic allocation throughout market cycles, whereas Bitcoin stays earlier in its adoption curve. Consequently, many allocators proceed to view Bitcoin tactically somewhat than structurally, limiting its use as a portfolio hedge.”

And given Bitcoin’s tendency to function in four-year cycles, you could possibly argue there’s a diploma of wariness about piling into this cryptocurrency proper now. BTC painfully contracted by 74% again in 2018, with a 64% drawdown in 2022. Whereas there are early indicators of modifications out there’s dynamics, an analogous pullback in 2026 can’t be dominated out.

However similar to BTC tends to chill after a sudden surge upwards, issues are starting to develop that “ugly and sustained reversals” might be on the playing cards for gold and silver — and the dear metals commerce is starting to look exceptionally overcrowded.

Within the short-term, issues may worsen for Bitcoin earlier than they get higher. Bloomberg just lately ran a report suggesting that “longtime believers want to equities, valuable metals and prediction markets” for returns now — an indication that BTC is not the quickest horse within the race.

One analyst mentioned that Bitcoin might solely be capable of show its relevance if it is ready to commerce meaningfully above $100,000 for a protracted time period. However given $90,000 is proving elusive proper now, that might be an enormous ask.

The publish Why Gold is Rallying and Bitcoin Isn’t appeared first on Cryptonews.