Hong Kong is increasing investor entry to gold by the launch of the Hold Seng Gold ETF, a bodily backed fund that additionally outlines future plans for tokenized unit lessons.

The Hold Seng Gold ETF (03170.HK) went dwell on the Hong Kong Inventory Alternate earlier at this time offering traders with publicity to gold costs by a regionally saved bodily construction.

Bodily Backed Gold ETF Launches in Hong Kong

The Hold Seng Gold ETF is backed by bodily gold bars with all bullion held in designated vaults positioned in Hong Kong. The fund goals to ship funding outcomes that, earlier than charges and bills, carefully correspond to the efficiency of the LBMA Gold Value AM benchmark.

The gold custodian is an entirely owned subsidiary of HSBC Holdings, underscoring the position of main monetary establishments in supporting the product’s infrastructure.

Hold Seng Funding mentioned the fund’s bodily gold bars might be saved by preparations involving HKIA Valuable Metals Depository Restricted and Brink’s Hong Kong Restricted, making certain that the underlying belongings stay throughout the metropolis’s monetary system.

Listed and Tokenized Unit Construction

Past its listed ETF models, the fund construction additionally contains tokenized and non-tokenized unlisted unit lessons. The Hold Seng Gold ETF contains Listed Class Models, Tokenized Unlisted Class Models, and Non-Tokenized Unlisted Class Models, although switching between these classes is not going to be accessible.

The tokenized models will not be but open for subscription and can solely develop into accessible topic to related regulatory approvals. Hold Seng mentioned disclosures relating to tokenized models are presently offered for reference solely.

Earlier this month the New York Inventory Alternate (NYSE), a part of Intercontinental Alternate (ICE) unveiled plans to develop a platform for buying and selling and on-chain settlement of tokenized securities, marking a step towards digitizing core market infrastructure.

Danger Disclosures Spotlight Blockchain and Custody Challenges

Hold Seng warned that traders face a variety of dangers throughout all unit lessons, together with gold market focus danger, monitoring error danger, foreign money danger, custody and insurance coverage danger, and reliance on gold sellers.

Extra dangers apply particularly to listed models, together with buying and selling dangers, market maker reliance, and potential variations in buying and selling hours between the Hong Kong trade and the London gold market.

Tokenized unlisted models carry additional dangers related to blockchain expertise, together with cybersecurity threats, digital asset safety points, regulatory uncertainty, operational challenges, and potential cryptographic dangers tied to future advances equivalent to quantum computing. Non-tokenized unlisted models are topic to redemption and foreign money hedging dangers the place relevant.

Tokenization Alerts Evolving Gold Funding Entry

The launch comes as Hong Kong continues to place itself as a hub for each conventional finance and controlled digital asset innovation.

By combining a standard bodily backed gold ETF with the potential for tokenized unit lessons, Hold Seng Funding is providing a construction that bridges established commodity funding merchandise with rising blockchain-based codecs.

Gold’s Bull Run Isn’t Over

Gold’s rally is exhibiting little signal of slowing as world markets head into 2026 with traders more and more searching for refuge in conventional safe-haven belongings amid geopolitical uncertainty.

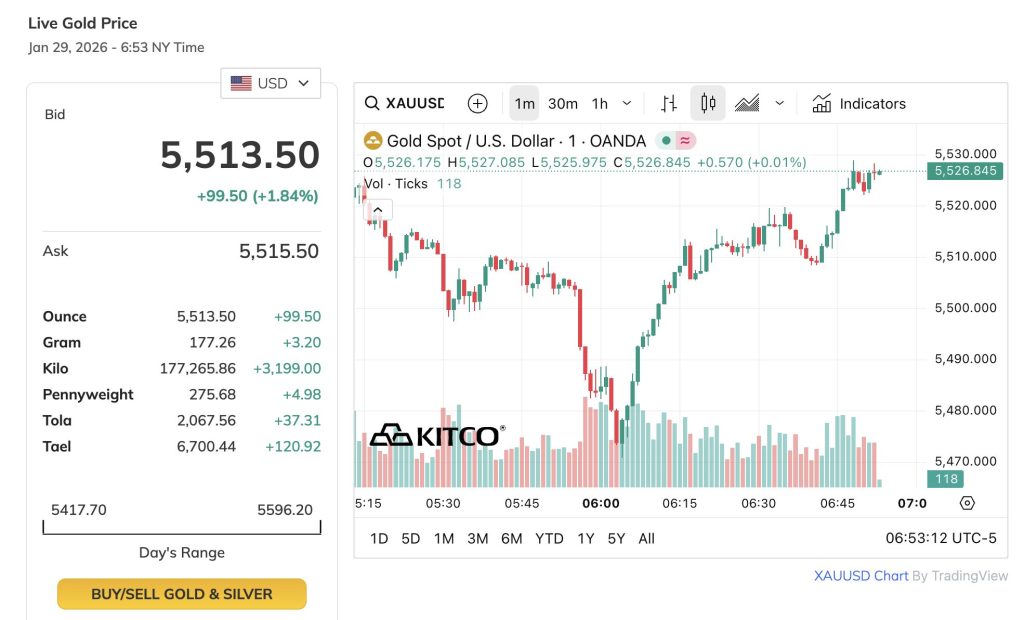

Gold costs have been buying and selling larger on Jan. 29, with spot gold rising about 1.8% on the day. In response to Kitco knowledge, the metallic was quoted at round $5,513 per ounce.

Gold’s surge previous $5,000 an oz and uncertainty round US crypto laws are shaping a crucial second for digital asset markets.#Gold #Cryptohttps://t.co/DzRjcDdpfY

— Cryptonews.com (@cryptonews) January 27, 2026

The submit Hong Kong Broadens Gold Market Entry By means of Hold Seng Gold ETF and Tokenized Models appeared first on Cryptonews.