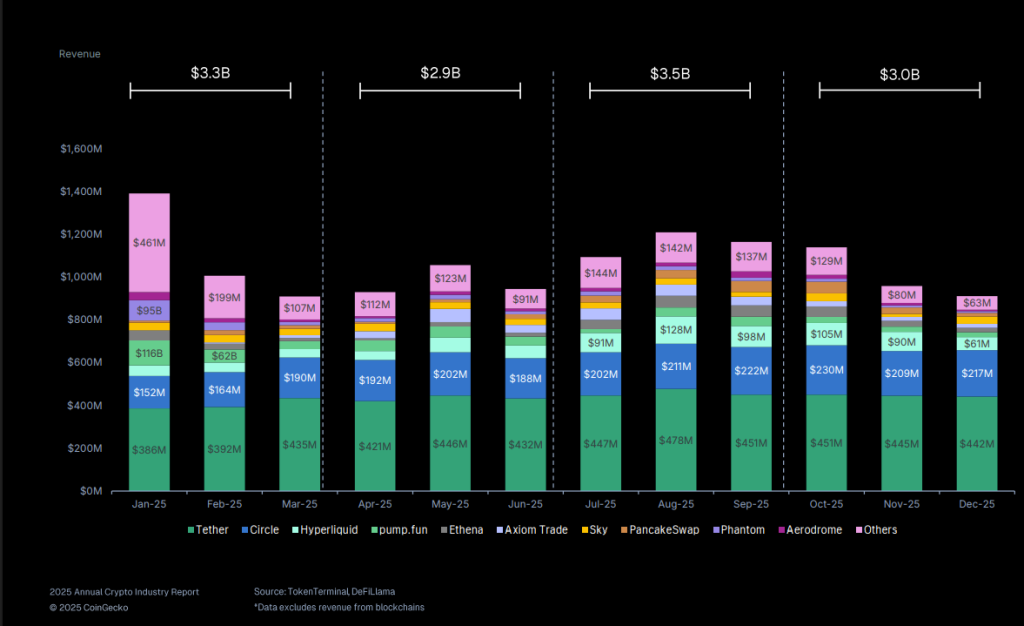

Tether emerged as probably the most worthwhile crypto entity in 2025, producing an estimated $5.2 billion in income as stablecoins overtook all different protocol classes in earnings.

In accordance with the newest Coingecko annual crypto business report, Tether alone accounted for 41.9% of all stablecoin-related income in 2025, outpacing opponents reminiscent of Circle, Hyperliquid, Pump.enjoyable, Ethena, Axiom, Phantom, and PancakeSwap.

The outcomes present that dollar-backed digital currencies have turn into probably the most sturdy income engine in crypto, at the same time as market circumstances fluctuated all year long.

Tether Leads Stablecoin Issuers To Seize Crypto Income Crown

Amongst greater than 168 crypto protocols tracked in 2025, stablecoin issuers collectively generated the best income, with Tether firmly on the heart.

INSIGHT: Stablecoins generated $5.2B in income in 2025, accounting for 41.9% of whole protocol income. pic.twitter.com/fjJrAn9k7B

— CoinGecko (@coingecko) January 25, 2026

Its $5.2 billion haul positioned it properly forward of Circle and different main gamers, reinforcing USDT’s place because the business’s major settlement asset.

Throughout the high ten revenue-generating protocols, simply 4 entities, led by Tether and Circle, produced 65.7% of whole earnings, equal to roughly $8.3 billion.

The remaining six protocols within the high ten have been all trading-focused platforms, highlighting a pointy divide between secure income streams and market-dependent revenue.

That distinction grew to become clear as buying and selling revenues swung broadly with investor sentiment throughout the yr.

Phantom, for instance, recorded $95.2 million in income in January on the peak of the Solana meme coin frenzy, solely to see earnings fall to $8.6 million by December as speculative exercise cooled.

USDT Claims 60% Share Of $311B Stablecoin Market

The broader stablecoin market expanded quickly, with whole market capitalization rising by $6.3 billion within the fourth quarter alone to succeed in a document $311.0 billion.

That marked a 48.9% year-over-year enhance, including $102.1 billion as adoption accelerated throughout areas.

Tether maintained clear management with 60.1% of the overall stablecoin market cap, or about $187.0 billion, adopted by Circle’s USDC at 24.2%, equal to $72.4 billion.

Tether is now the world’s third-largest digital asset by market worth at $186.8 billion, up roughly 50% from a yr earlier.

Whereas the highest gamers strengthened their grip, shifts throughout the high 5 mirrored altering threat appetites.

Ethena’s USDe skilled the sharpest reversal, with its market cap plunging 57.3%, or $6.5 billion, after a mid-October depeg on Binance undermined confidence in high-yield looping methods.

Different stablecoins posted combined however notable strikes as capital rotated throughout the sector.

PayPal’s PYUSD surged 48.4%, including $1.2 billion to succeed in $3.6 billion and briefly claiming the fifth spot earlier than World Liberty Monetary’s USD1 reclaimed it by practically $1.

Extra high-growth tokens included Ripple’s RLUSD, which expanded 61.8% so as to add $488.2 million, and USDD, which climbed 76.9% with a $366.8 million enhance.

Inside Tether’s $500B Valuation Path and Increasing Funding Empire

Wanting forward, Bitwise CIO Matt Hougan not too long ago urged that Tether may turn into the world’s most worthwhile firm if its trajectory continues.

“There’s an opportunity that many rising market international locations will convert from primarily utilizing their very own currencies to utilizing USDT,” Hougan stated, pointing to Tether’s near-total dominance exterior Western markets.

Primarily based on projected curiosity revenue, calculations point out that custody of $3 trillion in belongings may generate annual income exceeding the $120 billion earned by Saudi Aramco final yr.

Tether CEO Paolo Ardoino beforehand advised Cryptonews he stays assured USDT will retain its lead as a result of firm’s deep understanding of real-world utilization.

Past stablecoins, Tether has expanded aggressively into conventional belongings and investments.

@Tether_to has launched an all-cash bid to accumulate Italy’s @juventusfcen, a proposal that was reportedly swiftly turned down.#Tether #Cryptohttps://t.co/4iTBXWjo5V

— Cryptonews.com (@cryptonews) December 13, 2025

The corporate not too long ago grew to become the second-largest shareholder in Italian soccer membership Juventus and has reportedly explored elevating $20 billion for a 3% stake, a deal that will suggest a valuation close to $500 billion and place Tether among the many world’s most respected corporations.

The submit Tether Posts Largest Crypto Income in 2025: $5.2B From Stablecoin Dominance appeared first on Cryptonews.