On-chain knowledge spells bother for Ethereum as the overall holdings of whales have been repeatedly declining for the reason that begin of the yr, reported in style analyst Ali Martinez.

On the identical time, the underlying asset’s value has tumbled by double digits over the previous week or so and is at present struggling beneath a couple of key ranges that would result in much more retracements.

Whales and ETF Buyers Cut back Holdings

Citing knowledge from Santiment, Martinez posted on X a chart indicating that whales’ ETH holdings really elevated barely at first of the brand new yr, going towards 31 million tokens. Nonetheless, it has been largely downhill since then, with the quantity plummeting to simply over 29 million as of January 23. Which means that they’ve “redistributed 1.63 million Ethereum (ETH)” since 2026 began, Martinez stated.

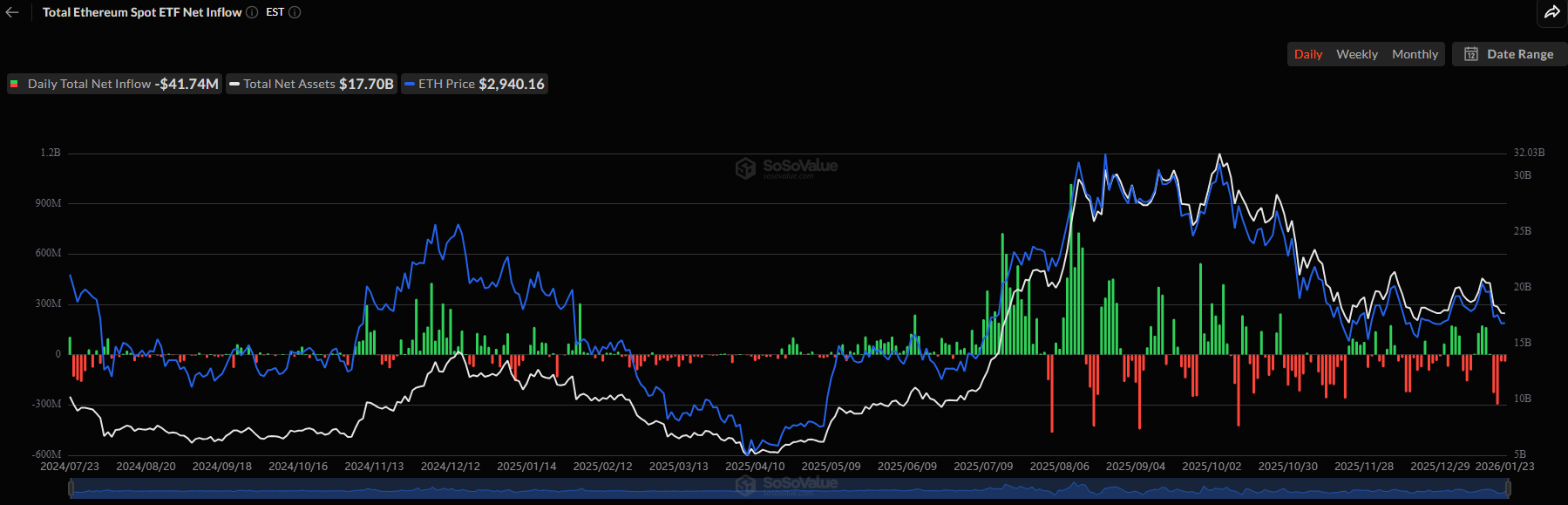

The state of affairs with the spot Ethereum ETFs is equally disturbing. The funds attracted over $400 million by January 6, misplaced an identical quantity by January 9, after which went on a powerful five-day streak in the course of the month, gaining almost $500 million.

Nonetheless, the earlier shorter buying and selling week noticed over $600 million being pulled out, with the overall cumulative internet inflows dropping to $12.30 billion – the bottom ranges since mid-August.

ETH Worth Breakdown?

Ethereum’s token ended 2025 with a extremely unfavourable style regardless of charting a brand new all-time excessive mid-year. It began 2026 with a powerful run that drove it above $3,300 inside per week and to over $3,400 inside two weeks. Nonetheless, it adopted the broader market’s efficiency and slumped beneath the essential $3,000 help, the place it at present struggles.

Additional knowledge from Martinez suggests the asset must reclaim the $3,085 degree to stage a extra pronounced bullish breakout. For now, although, ETH stays miles beneath it.

$3,085.

That’s the extent Ethereum $ETH wants to carry to have an opportunity of a bullish breakout. https://t.co/W9cA0qcRgM pic.twitter.com/tmS88G0lhQ

— Ali Charts (@alicharts) January 19, 2026

Merlijn The Dealer highlighted the importance of the 200-day transferring common (at present positioned at round $3,300). Each time it has rejected ETH’s breakout makes an attempt, it has led to a double-digit value correction. The analyst warned that ETH is in the course of one other such retracement that would drive it additional south by round 20%.

ETHEREUM IS STILL STRUGGLING BELOW THE 200D MA.

Each rejection on the MA200 has triggered a pointy selloff:

Dump 1: -27%

Dump 2: -21%

Dump 3: -14% (up to now)Now $ETH is rejecting the MA200 once more…

If historical past rhymes, one other ~20% reset isn’t off the desk.

Watch this degree… pic.twitter.com/fQzbYGFHkC

— Merlijn The Dealer (@MerlijnTrader) January 23, 2026

The submit Ethereum Whales’ Holdings Decline Steadily as ETH Worth Falls Under Essential Assist appeared first on CryptoPotato.