The American Bankers Affiliation positioned stablecoin rewards on the forefront of its 2026 coverage agenda, escalating an industry-wide marketing campaign towards digital-dollar incentive packages that banks declare threaten deposit bases and group lending capability.

The commerce group’s newly launched Blueprint for Progress explicitly calls on Congress to “cease cost stablecoins from turning into deposit substitutes that slash group financial institution lending by prohibiting paying curiosity, yield or rewards whatever the platform.“

ABA President and CEO Rob Nichols stated the priorities had been developed by way of collaboration with all 52 state bankers’ associations to advance insurance policies that “bolster the financial system, develop entry to credit score and improve competitors within the monetary companies market.“

The doc positions stablecoin yield restrictions because the affiliation’s main financial precedence forward of fraud prevention, regulatory threshold indexing, and help for minority-serving monetary establishments.

Simply launched – ABA’s 2026 Blueprint for Progress outlines key coverage priorities: https://t.co/KsOScu1Lgs pic.twitter.com/C3gMrXQn84

— American Bankers Affiliation (@ABABankers) January 20, 2026

Banking Trade Intensifies Stress on Lawmakers

The coordinated push comes as Senate Banking Committee negotiations over digital asset market construction laws stay deadlocked over stablecoin reward provisions.

Banking executives have spent months warning that yield-bearing tokens might set off huge deposit outflows, with Financial institution of America CEO Brian Moynihan estimating that $6 trillion in deposits might migrate into stablecoins below permissive regulatory frameworks.

JPMorgan CFO Jeremy Barnum additionally warned in the course of the financial institution’s fourth-quarter earnings name that interest-bearing stablecoins threat creating “a parallel banking system that type of has all of the options of banking, together with one thing that appears quite a bit like a deposit that pays curiosity, with out the related prudential safeguards.“

@JPMorgan backs blockchain innovation however warns yield-bearing stablecoins mimic financial institution deposits with out oversight.#JPMorgan #Stablecoinhttps://t.co/4Fbu8pMOwk

— Cryptonews.com (@cryptonews) January 14, 2026

Group bankers have been significantly vocal, with the Group Bankers Council urging Congress in early January to shut what it known as a “loophole” permitting stablecoin issuers to not directly fund yield by way of change companions.

The group warned that large-scale deposit outflows might scale back credit score availability for small companies, farmers, college students, and homebuyers in native communities.

Senator Tim Scott’s draft crypto market construction invoice launched January 9 consists of language prohibiting digital asset service suppliers from paying curiosity or yield solely for holding stablecoins, although the availability permits activity-based rewards tied to capabilities like staking and liquidity provision.

Crypto Coalition Mobilizes Towards Expanded Restrictions

A coalition of 125 crypto and fintech organizations, together with Coinbase, PayPal, Stripe, Ripple, and Kraken, delivered a forceful rejection of expanded yield restrictions in December.

The Blockchain Affiliation-led group argued that banking {industry} efforts signify “overtly protectionist” measures relatively than shopper safety, noting that banks face no comparable restrictions on bank card rewards regardless of partaking in riskier balance-sheet actions.

“The push to limit stablecoin rewards past that agreed to in GENIUS isn’t a technical refinement or a shopper safety repair,” the coalition acknowledged.

“It will prohibit the identical varieties of incentive packages for stablecoin funds that banks have lengthy supplied on bank cards and different varieties of cost companies.“

Simply yesterday, Circle CEO Jeremy Allaire known as banking considerations “completely absurd” throughout a World Financial Discussion board panel, drawing parallels to historic opposition to cash market funds.

Circle CEO rejects financial institution warnings on stablecoin yields as "absurd," citing cash market precedent as transaction volumes attain $33 trillion in 2025.#Stablecoin #Circlehttps://t.co/kPQw5xYpBh

— Cryptonews.com (@cryptonews) January 22, 2026

“The very same arguments had been made,” Allaire acknowledged, noting that roughly $11 trillion in cash market funds has grown with out stopping lending exercise.

He emphasised that each one main stablecoin laws prohibit issuers from paying curiosity immediately, whereas accomplice platforms could supply rewards based mostly on business preparations.

“Rewards round monetary merchandise exist in each stability that you’ve with a bank card that you just use,” Allaire stated.

The crypto coalition disputed Treasury projections suggesting yield-bearing stablecoins might lead to as much as $6.6 trillion in deposit flight, citing evaluation that discovered no proof of disproportionate deposit outflows from group banks.

The teams questioned how banks can declare deposit constraints whereas holding $2.9 trillion in reserve balances on the Federal Reserve.

Coinbase CEO Brian Armstrong stated the change couldn’t again Scott’s draft invoice, citing provisions that may get rid of stablecoin rewards.

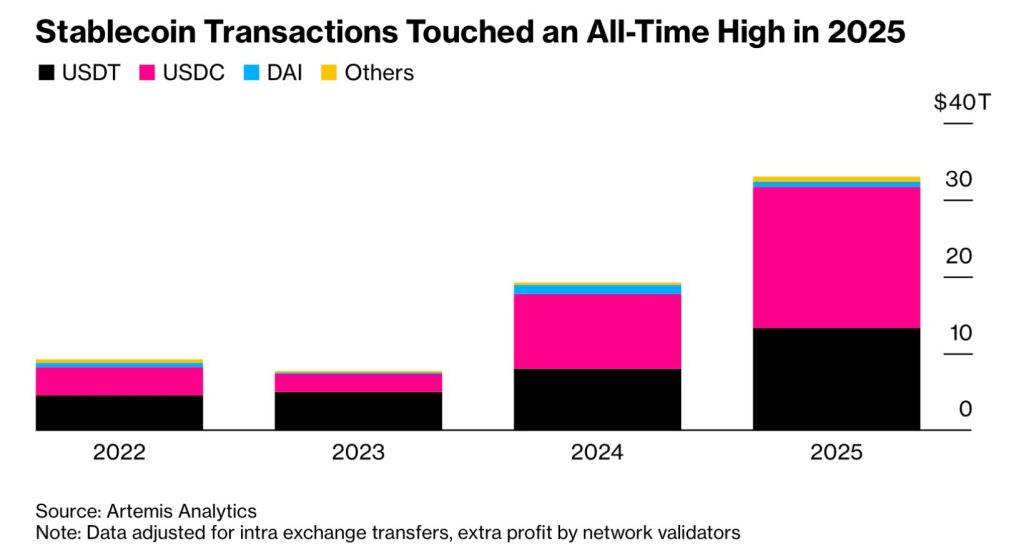

These divisions come as international stablecoin transaction volumes reached $33 trillion in 2025, up 72% from the earlier 12 months, with USDC processing $18.3 trillion.

Bloomberg Intelligence predicted that flows might attain $56 trillion by 2030 as institutional cost infrastructure adoption accelerates.

For now, the Banking Committee could postpone additional work till late February or March, following Coinbase’s withdrawal of help and divided consideration to the brand new housing coverage agenda demanded by Trump.

Nonetheless, the Senate Agriculture Committee has scheduled a markup of competing laws for January 27 that takes a essentially totally different strategy by excluding cost stablecoins from CFTC authority completely and deferring regulation to frameworks just like the GENIUS Act relatively than setting particular yield guidelines.

The publish Banks Make Killing Stablecoin Yields Their High 2026 Precedence appeared first on Cryptonews.