Key Takeaways:

- Bitcoin is underneath strain after failing to carry above $100,000, with geopolitical tensions and Trump’s tariffs weighing on sentiment.

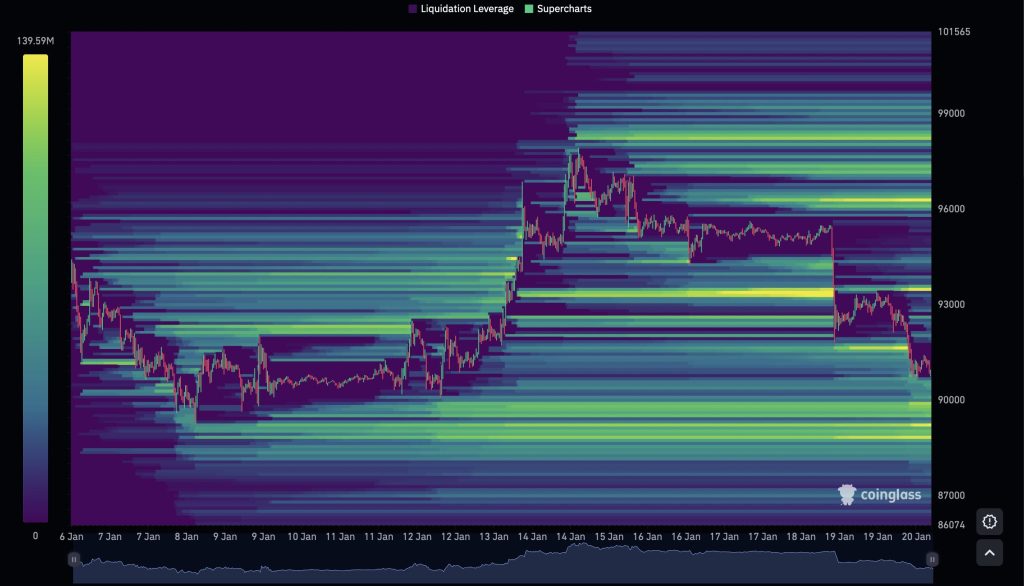

- Liquidation knowledge exhibits a heavy cluster round $88,000-89,000, making this zone a key short-term goal for worth motion.

- Some analysts warn of a deeper pullback, doubtlessly towards $74,000, the place Bitcoin’s 2025 rally started.

- Regardless of short-term weak spot, on-chain knowledge suggests institutional gamers and whales proceed to build up BTC.

Bitcoin worth continues to slip. After a latest rally and an try to carry above $100,000, BTC has come underneath renewed strain. Geopolitical tensions and Trump’s tariffs have added to the pressure.

Liquidation heatmaps present a dense cluster forming across the $88,000-89,000 vary. This implies a lot of lengthy positions with liquidation ranges near these costs. In such circumstances, these zones usually act as a magnet. The market tends to maneuver towards areas the place liquidity could be cleared.

If Bitcoin drops into this vary, the subsequent transfer will rely upon purchaser response. A fast bounce would level to underlying demand. A sustained break under $88,000, nonetheless, would elevate the danger of a deeper correction.

The place Is Bitcoin Worth Backside?

Some analysts consider Bitcoin’s native pattern has turned bearish. Even so, lots of them nonetheless anticipate BTC to get well and transfer greater in a while. The principle disagreement is how deep the pullback might go.

Bitcoin’s 2025 rally began close to the $74,000 degree. A return to that zone isn’t being dominated out. For now, opinions stay break up.

Ki Younger Ju, founding father of CryptoQuant, says institutional curiosity in Bitcoin stays intact:

Institutional demand for Bitcoin stays sturdy. US custody wallets sometimes maintain 100-1,000 BTC every. Excluding exchanges and miners, this provides a tough learn on institutional demand. ETF holdings included. 577K BTC ($53B) added over the previous yr, and nonetheless flowing in.

These figures counsel Bitcoin could also be in a distribution part. Giant gamers seem like reallocating liquidity. To get readability on the subsequent main transfer, the market seemingly must see a clearer accumulation part first.

Trump’s Tariffs and Geopolitics Put Bitcoin to the Check

Regardless of optimistic forecasts from some analysts, who nonetheless anticipate a brand new Bitcoin all-time excessive in Q1–Q2 2026, political and financial instability might simply disrupt that outlook.

The US Supreme Courtroom was anticipated to overview the legality of Trump’s tariffs. Two periods have already handed with out a choice. In the meantime, Donald Trump launched a brand new 10% tariff bundle on chosen international locations, set to take impact on Feb. 1. The transfer was framed as a response to these international locations supporting Greenland.

Greenland has now grow to be a focus of rising world pressure. Because the begin of the yr, Trump has repeatedly acknowledged that Greenland ought to grow to be a part of the USA. Given the occasions in Venezuela earlier in January, this rhetoric has raised issues.

Bitcoin confirmed little speedy response to the state of affairs in Venezuela. In truth, the worth continued greater and briefly touched $98,000. That raised a key query. Was the response merely delayed, or had the danger already been priced in?

As tensions round Greenland intensified and new tariffs have been introduced, Bitcoin lastly confirmed indicators of weak spot. BTC dropped sharply towards the $90,000 degree. This can be a key psychological zone. If sellers handle to push the worth under it, the danger of additional draw back will increase.

Liquidation knowledge factors to the subsequent main ranges round $88,000-89,000. As soon as once more, purchaser response might be essential. If demand holds there, Bitcoin might stabilize and transfer again into its earlier vary.

Disclaimer: Crypto is a high-risk asset class. This text is supplied for informational functions and doesn’t represent funding recommendation.

The put up Bitcoin Worth Dangers a Drop Beneath $88,000 appeared first on Cryptonews.