Cryptocurrency’s conventional four-year cycle has collapsed, changed by a brand new market construction the place liquidity focus and investor positioning now decide worth motion, in keeping with a complete year-end evaluation from main OTC desk Wintermute.

The agency’s proprietary buying and selling knowledge reveals that 2025 marked a basic shift in how digital property commerce, with the 12 months’s muted efficiency indicating crypto’s transition from speculation-driven rallies to a extra institutionally anchored asset class.

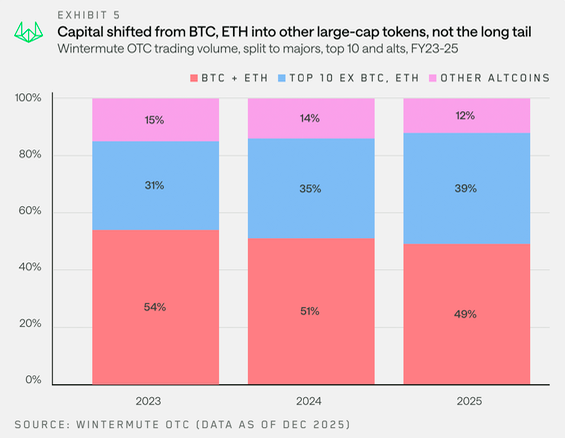

Wintermute’s OTC movement knowledge exhibits the historic sample of Bitcoin beneficial properties recycling into Ethereum, then blue chips, and at last altcoins has weakened dramatically.

Change-traded funds and digital asset treasury firms advanced into what the agency describes as “walled gardens,” offering sustained demand for large-cap property with out naturally rotating capital into the broader market.

With retail curiosity diverted towards equities, 2025 turned a 12 months of utmost focus the place a handful of main tokens absorbed the overwhelming majority of recent capital whereas the remainder of the market struggled.

Conventional Seasonality Shattered by Structural Shifts

Buying and selling exercise in 2025 adopted a distinctly totally different sample than earlier years, breaking what had felt like seasonal rhythms.

Early-year optimism across the pro-crypto U.S. administration rapidly disenchanted as threat sentiment deteriorated sharply by means of the primary quarter when memecoin and AI-agent narratives light.

Trump’s tariff announcement on April 2 additional pressured markets, concentrating exercise early within the 12 months earlier than broad softening by means of spring and summer time.

The late-year pickup seen in 2023 and 2024 did not materialize, shattering narratives around “Uptober“ and year-end rallies.

Wintermute’s knowledge reveals these had been by no means true seasonal patterns however relatively rallies pushed by idiosyncratic catalysts like ETF approvals in 2023 and the brand new U.S. administration in 2024.

Markets turned more and more uneven as macro forces took management, with flows turning reactive and episodic round headlines with out sustained momentum.

Altcoin rallies shortened dramatically, averaging roughly 19 days in 2025, down from 61 days the prior 12 months.

Themes together with memecoin launchpads, perpetual DEXs, and the x402 meta sparked temporary exercise bursts however did not grow to be sturdy market-wide rallies, largely as a result of uneven macro situations and market fatigue after 2024’s excesses.

Institutional Engagement Deepens Regardless of Muted Returns

Regardless of modest worth exercise, institutional counterparties confirmed endurance by means of 2025.

Wintermute noticed 23% year-over-year development amongst institutional contributors, together with crypto-native funds, asset managers, and conventional monetary establishments.

Engagement deepened materially, with exercise turning into extra sustained and centered on deliberate execution relatively than exploratory positioning.

The agency’s derivatives knowledge additionally reveals choices exercise greater than doubled year-over-year, with systematic yield and threat administration methods dominating movement for the primary time relatively than one-off directional bets.

By the fourth quarter, choices notional reached 3.8 occasions first-quarter ranges, whereas commerce counts doubled, indicating sustained development throughout each ticket dimension and frequency.

Each institutional and retail buyers rotated again into majors by year-end following the October 10 deleveraging occasion that triggered roughly $19 billion in liquidations over 24 hours.

Altcoin open curiosity additionally collapsed by 55%, from round $70 billion to $30 billion by mid-December, as pressured unwinding flushed out extra leverage concentrated outdoors Bitcoin and Ethereum.

Three Catalysts Might Broaden 2026 Restoration

Wintermute identifies three eventualities that would wish to materialize for market breadth to recuperate past large-cap focus.

First, ETFs and DATs should broaden their mandates, with early indicators rising within the Solana and XRP ETF filings.

Second, sturdy rallies in Bitcoin or Ethereum might generate wealth results that spill over into the broader market, just like 2024’s sample, although capital recycling stays unsure.

Third and least doubtless, retail investor mindshare might rotate again from equities and AI themes towards crypto, bringing contemporary capital inflows and stablecoin minting.

“2025 fell in need of the anticipated rally, however it might mark the start of crypto’s transition from speculative to a longtime asset class,” Wintermute’s evaluation concludes.

Unbiased evaluation from Adler Asset Administration reinforces the continuing deleveraging theme, extending into 2026.

Adler identified that the Bitcoin Superior Sentiment Index collapsed from the Excessive Bull zone round 80% to 44.9%, breaking beneath impartial 50% and signaling a market regime shift.

The biggest lengthy liquidation cascade over their whole remark interval occurred on January 19, with over $205 million liquidated in a single hour as the value dropped from $95,400 to $92,600 inside 24 hours.

Whether or not focus persists or liquidity broadens past a handful of large-cap property will decide 2026 outcomes, with understanding the place capital can movement and what structural adjustments are wanted proving essential for navigating the post-cycle crypto market.

The publish Wintermute Says Crypto’s Bull Cycle Is Over – Three Forces Will Drive 2026 appeared first on Cryptonews.