Bitcoin continues to consolidate slightly below a serious resistance cluster after a robust restoration from the December lows. The worth chart reveals a transparent sequence of upper lows, whereas on-chain information signifies that the proportion of provide in revenue has undergone a deep reset and is now recovering.

Technically, the market is approaching an necessary determination zone: both a sustained breakout above the present ceiling opens the door to a brand new leg increased, or a rejection right here triggers a corrective part again towards not too long ago established assist ranges.

Bitcoin Value Evaluation: The Each day Chart

On the each day chart, BTC is buying and selling across the $95,000 resistance band, which coincides with the decrease boundary of a broader provide space and the 100-day transferring common. This zone has acted as a worth cap since November and is the important thing stage at present underneath take a look at.

Beneath the present ranges, an ascending construction has shaped from the $80,000 demand zone, making a sequence of upper lows. The latest advance has pushed the asset from that base into the present resistance space with none significant each day pullback, leaving the $90,000 short-term stage as the primary notable assist layer in case of a rejection.

Each day RSI has additionally cooled from latest overbought readings, however stays above the mid-line, in line with a market in early or mid-trend fairly than at a mature high. So long as the higher-low construction from the December backside holds, the broader bias on the each day timeframe stays constructive, even when short-term volatility emerges round resistance.

BTC/USDT 4-Hour Chart

The 4-hour chart highlights the latest breakout from an ascending triangle construction. The worth spent a number of weeks compressing between a flat resistance across the $95,000 mark and the rising trendline of the sample. This resistance has now been marginally exceeded, and the market is consolidating simply above the previous vary excessive, probably focusing on the $100,000 area subsequent.

But momentum on the 4-hour RSI factors to a downtrend, reflecting waning short-term energy and elevating the danger of a corrective part or no less than a interval of sideways consolidation.

If such a correction unfolds, $93,000–$94,000 varieties the fast breakout-retest zone, the place stability would protect the integrity of the bullish breakout. Additional under, the $90,000 area marks the prior consolidation band and mid-range assist, a logical space for a deeper however nonetheless wholesome pullback inside the prevailing uptrend.

On-Chain Evaluation

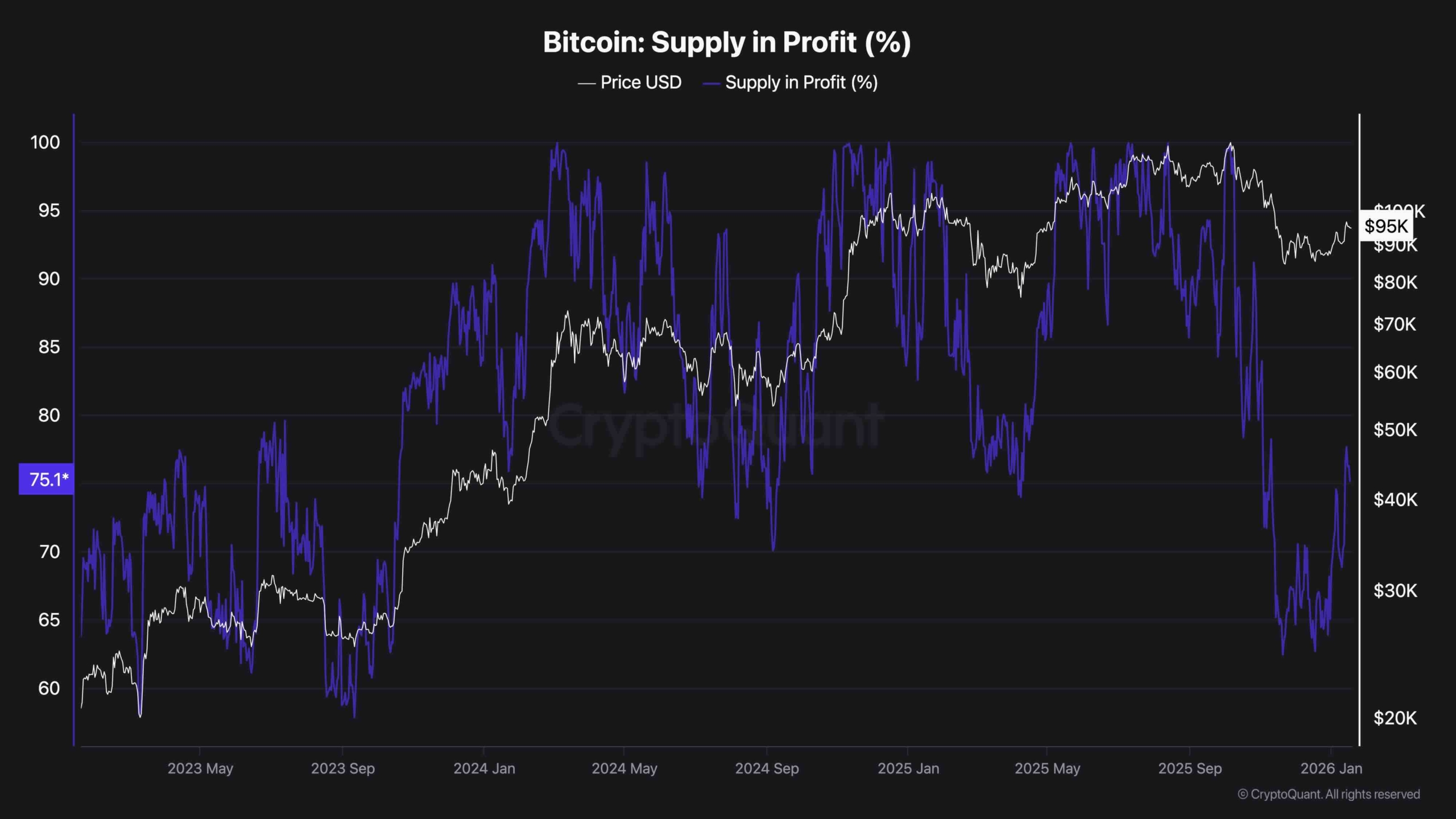

The Provide in Revenue (%) metric at present offers an necessary cyclical sign. Just lately, the proportion of circulating BTC that was in revenue dropped to ranges corresponding to these seen when the spot worth was under $30,000 earlier within the cycle. This occurred regardless of the present worth being within the $90,000+ area.

Such a deep reset in profitability at a a lot increased nominal worth signifies that a big portion of cash modified fingers or noticed unrealized positive aspects compressed throughout the latest correction. Traditionally, comparable resets have typically preceded new medium-term advances, as weaker fingers are flushed out and a extra strong holder base emerges.

The metric is now recovering again towards the mid-70% vary, suggesting that profitability is enhancing once more however has not but reached the acute ranges (above 95%) sometimes related to late-stage euphoric phases. This mixture will be interpreted as a constructive on-chain backdrop, in line with the early phases of a possible new rally, offered that key technical resistance on the chart is finally absorbed.

The put up Bitcoin Value Evaluation: Rally to $100K or Drop Beneath $90K Is Subsequent for BTC? appeared first on CryptoPotato.