Ethereum continues to point out indicators of weak point, failing to construct any vital restoration regardless of holding above native assist. Market members are exhibiting hesitation, doubtless on account of broader uncertainty and the shortage of bullish momentum from Bitcoin. Whereas ETH hasn’t damaged down but, it additionally hasn’t managed to flip any main resistances, which retains it in a weak, range-bound state.

Technical Evaluation

By Shayan

The Every day Chart

On the every day timeframe, ETH is presently buying and selling under the important thing $3,300–$3,700 provide zone, the place the 200-day (orange) and 100-day (blue) transferring averages are appearing as main dynamic resistance. This zone has persistently rejected the worth over the previous month, confirming it as a key battleground between patrons and sellers.

The RSI on the every day timeframe can be caught under the 50 stage, exhibiting weak momentum and continued bearish strain. If ETH can’t break above the talked about confluence space quickly, the likelihood of a deeper pullback towards the $2,700 assist zone will increase. A rejection right here would additionally affirm a decrease excessive on the macro construction, which isn’t an excellent look heading into 2026.

The 4-Hour Chart

On the 4-hour chart, the construction has turned fragile once more after ETH failed to carry the decrease channel trendline and broke again under the ascending channel. The uptrend try close to $3,100, adopted by a decrease excessive, alerts a transparent lack of bullish power.

Presently, the asset is hovering simply above the $2,800 assist stage, which is appearing as a short-term assist. However there is no such thing as a follow-through or aggressive shopping for. The RSI has additionally began to curve again down, indicating fading momentum on intraday timeframes. If the $2,800 assist zone breaks, a fast flush towards the $2,600 space can be doubtless.

Sentiment Evaluation

Open Curiosity

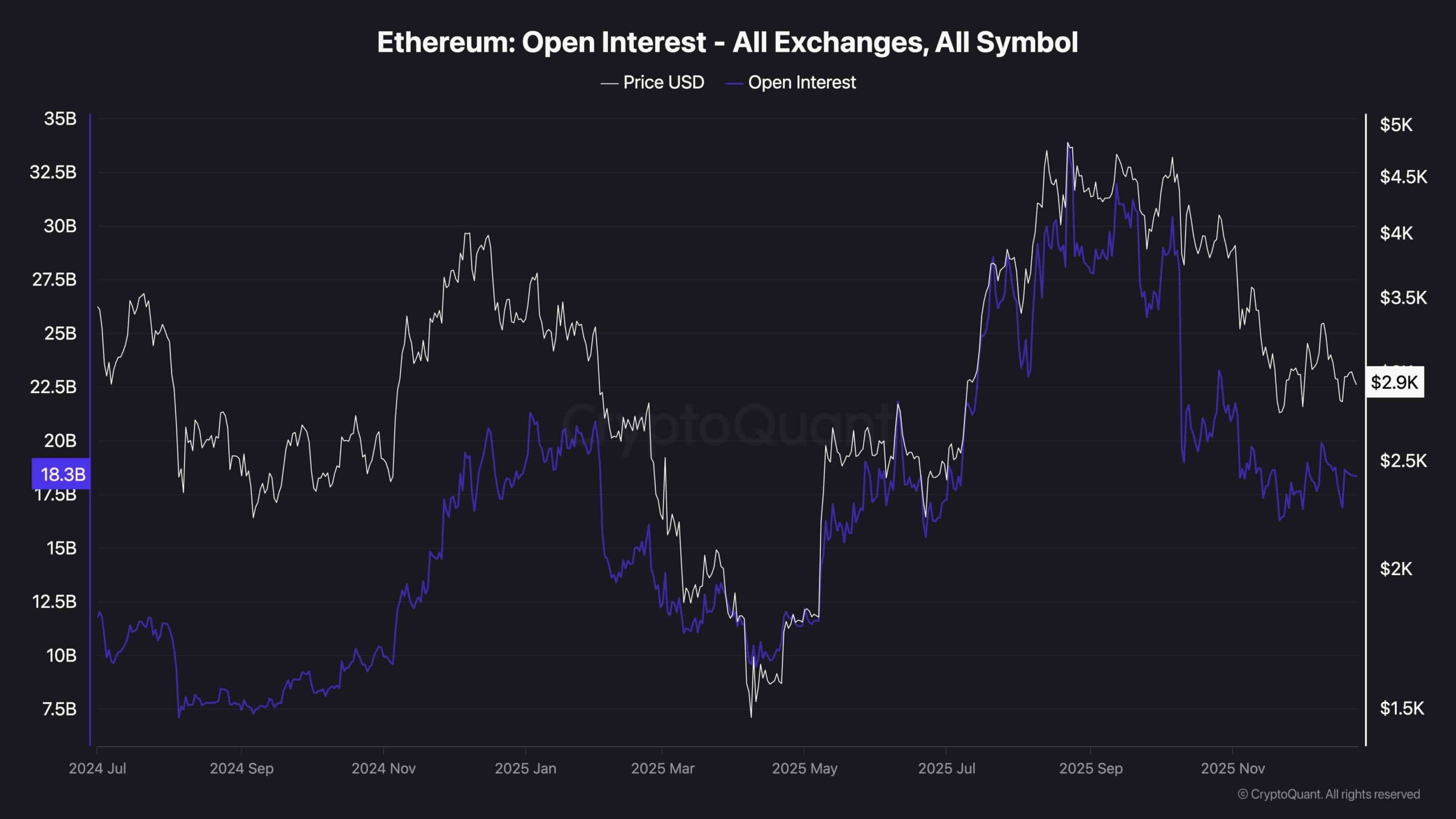

Ethereum’s open curiosity stays fairly excessive at round $18B throughout all exchanges, at the same time as the worth struggles to push greater. This disconnect between secure open curiosity and flat-to-downward worth motion typically alerts a build-up of speculative leverage, significantly from longs. With out a breakout or sturdy demand to again it, this sort of OI conduct turns into a threat issue, particularly if funding charges begin to present extremely constructive readings.

If ETH fails to carry key helps, this example opens the door for an extended squeeze, the place overly optimistic positions get forcefully liquidated, accelerating the drop. Subsequently, for patrons, it’s crucial that open curiosity begins dropping with the worth, or {that a} breakout confirms the build-up was justified.

The publish Ethereum Worth Evaluation: ETH Hasn’t Turned Fully Bearish, however It’s Shut appeared first on CryptoPotato.