A rising wave of analysis and market information is reshaping long-held assumptions about the way forward for buying and selling.

Analysts throughout conventional finance and crypto markets at the moment are debating a risk as soon as thought of far-fetched: the gradual disappearance of day buying and selling as Synthetic Common Intelligence (AGI) strikes nearer to actuality.

AGI doesn’t but exist, however progress in superior multimodal methods and autonomous buying and selling brokers is pushing markets towards an atmosphere the place machines dominate worth discovery and depart little room for human reactions.

Present buying and selling automation already reveals how shortly edges evaporate when machines take over.

As Algorithms Dominate 70% of Crypto Buying and selling, Analysts Say AGI Might Finish Retail Alpha

Excessive-frequency buying and selling remodeled equities years in the past, and its logic expanded into crypto markets with the rise of corporations resembling Leap, Wintermute, and GSR.

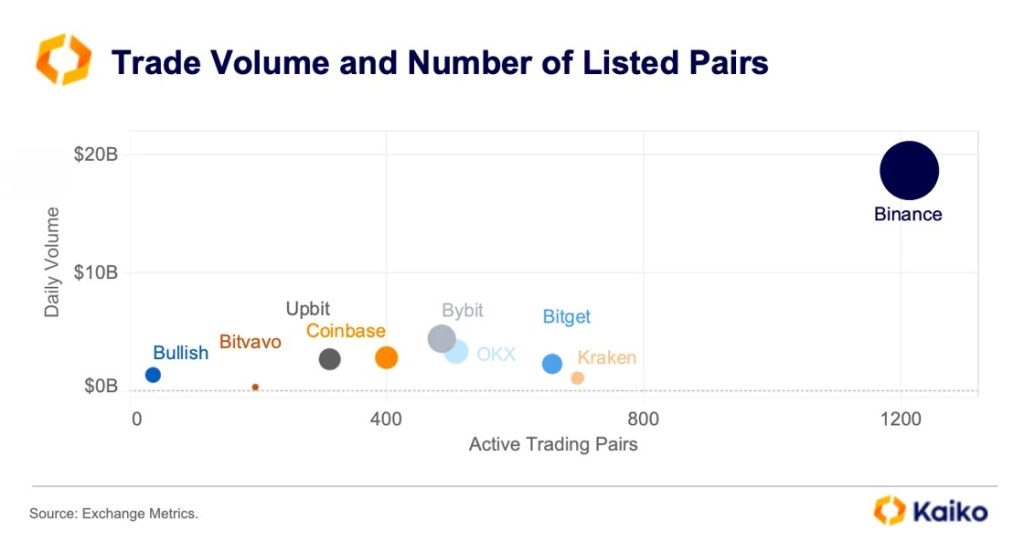

By 2024, Kaiko reported that greater than 70% of buying and selling circulation on exchanges like Binance and Coinbase was generated by algorithms relatively than people.

This shift has reshaped market construction from the underside up, lowering spreads and accelerating execution pace whereas additionally making it tougher for retail merchants to revenue throughout high-volatility durations.

Researchers level to those tendencies as early proof of rising effectivity.

Through the Solana memecoin surge in 2024, buying and selling bots, significantly “sniper” and “AI” bots, typically outperformed human merchants on account of their superior pace, automation, and lack of emotional bias.

Small AI methods designed to detect whale conduct and monitor blockchain flows reacted sooner than discretionary merchants and infrequently positioned themselves earlier than human members understood what was occurring.

Every advance in automation has persistently decreased the alternatives obtainable to retail members, and analysts argue that AGI would push this sample to its logical endpoint.

The distinction between at the moment’s slim AI and future AGI sits on the heart of this debate.

Present fashions excel at particular duties resembling scanning order books, studying market sentiment, or figuring out arbitrage. They can’t generalize throughout domains or apply human-like reasoning.

AGI, in contrast, is anticipated to be taught new duties with minimal instruction, adapt to unfamiliar environments, and mix info from many unrelated sources.

In monetary markets, this might imply studying blockchain flows, deciphering international macro indicators, assessing political threat, figuring out whale actions, and evaluating supply-chain disruptions, all inside a unified system able to producing real-time forecasts.

Market theorists describe the potential consequence because the “Excellent Effectivity Paradox.” If an AGI system turns into able to predicting worth route with near-perfect accuracy, the market adjusts immediately.

When each market participant is guided by the identical stage of intelligence, conventional buying and selling conduct collapses.

Costs transfer sooner than people can react, volatility falls, arbitrage disappears, and liquidity provision turns into a machine-driven course of relatively than a aggressive technique.

Analysts warn that this dynamic might create what they name a liquidity black gap, the place buying and selling continues however the edge that when made day buying and selling viable not exists.

AI Market Makers Transfer From Idea to Follow as Automation Surges

Warnings about this shift have circulated for years. DWF Labs famous in July that AI-driven market makers will improve liquidity, particularly in smaller crypto belongings with traditionally skinny order books and vast spreads.

Economist Alex Krüger described a way forward for hyper-efficient markets with little room for errors.

BitMEX founder Arthur Hayes wrote that AI would ultimately commerce higher than any human, whereas Ethereum co-founder Vitalik Buterin expressed concern that superior methods might dominate MEV extraction and cut back human participation in core market capabilities.

#BitMex co-founder and former CEO, @CryptoHayes, has set his sights on a futuristic idea that might revolutionize the DeFi trade: self-sovereign AI DAOs. #CryptoNews #DAO #DeFihttps://t.co/dEQ064RVOj

— Cryptonews.com (@cryptonews) August 1, 2023

These observations have been handled as hypotheticals on the time, however rising ranges of automation have since given them extra weight.

As automation accelerates, the human position on buying and selling desks is already altering.

Consultants argue that people is not going to disappear utterly however will shift towards threat supervision, regulatory oversight, and deciphering uncommon occasions that fall exterior mannequin expectations.

Execution itself strikes to autonomous methods. The expansion of AI buying and selling brokers displays this transition.

These instruments can analysis markets, select methods, alter threat parameters, execute trades via APIs, and be taught from outcomes with out handbook enter. Forecasts counsel the AI buying and selling bot market might attain roughly $75.5 billion by 2034.

The submit The Day Buying and selling Died: Why AGI May Be the Final Market Maker appeared first on Cryptonews.