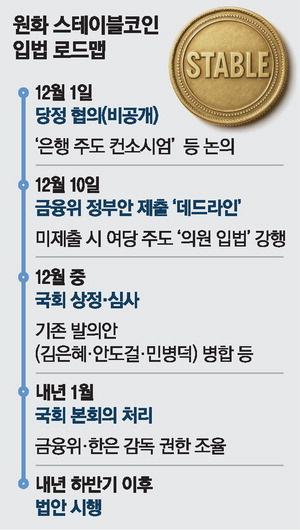

South Korea’s long-running effort to construct a stablecoin regulatory framework has reached a decisive second, with lawmakers setting a agency December 10 deadline for the federal government to ship a draft invoice.

If regulators miss that date, key legislators say they may transfer forward on their very own, ending months of stalled negotiations over how a won-pegged stablecoin ought to be issued and who ought to be allowed to manage it.

Seoul Divided Over Whether or not Banks or Tech Companies Ought to Lead Stablecoin Issuance

In response to reviews from Seoul, the ruling get together issued what it described as a remaining discover to monetary authorities, urging them to submit the federal government’s proposal for the so-called “Section 2 Laws on Digital Property,” which focuses particularly on stablecoin oversight.

Political and monetary officers held a closed-door assembly on the Nationwide Meeting on December 1, the place the most important level of rivalry resurfaced: whether or not banks should take the lead in issuing stablecoins or whether or not know-how companies ought to be allowed a extra lively position.

Some lawmakers have argued for a minimal 50% financial institution stake, citing the Financial institution of Korea’s long-standing warnings that privately issued digital received tokens may have an effect on financial coverage and destabilize the monetary system.

Others, together with elements of the ruling get together and the Monetary Providers Fee (FSC), favor reducing the barrier to permit fintech participation, saying extreme restrictions may restrict innovation.

The FSC later issued a public assertion clarifying that no remaining resolution had been made on whether or not a consortium or a 51% financial institution stake could be permitted.

The regulator confirmed that stablecoin laws was mentioned throughout Monday’s coverage session and that each side agreed to organize a authorities invoice as quickly as doable.

Nonetheless, specifics stay unsettled, prolonging a delay that has already pushed anticipated timelines a number of instances.

This debate has taken on broader urgency as rival political events race to introduce their very own drafts.

The Nationwide Meeting’s Political Affairs Committee is at the moment reviewing three separate payments, every proposing guidelines for issuance, collateral administration, inside controls, and minimal capital necessities of about 5 billion received.

The payments differ on points similar to whether or not stablecoin issuers ought to be allowed to supply curiosity on holdings, reflecting ongoing disparities in coverage route.

New AML and Journey Rule Measures Add Stress to South Korea’s Stablecoin Push

The strain is additional intensified by parallel regulatory developments throughout authorities. The Monetary Intelligence Unit is reorganizing its anti-money laundering protocols for stablecoins and making ready analysis that may form future AML pointers.

FIU has commissioned a complete report for December this yr; desires new AML pointers for stablecoin issuers.#SouthKorea #StablecoinRegulationshttps://t.co/CzXbun21ia

— Cryptonews.com (@cryptonews) August 19, 2025

South Korea can also be transferring towards a tighter journey rule regime, with plans to increase reporting necessities to transactions beneath 1 million received to forestall customers from bypassing id checks.

Authorities have indicated that enhanced KYC guidelines and stricter oversight will accompany any new stablecoin system.

South Korea will prolong its crypto Journey Rule to cowl sub-$700 transactions, closing a loophole used to evade id checks.#SouthKorea #Cryptohttps://t.co/LBJKNcmMQg

— Cryptonews.com (@cryptonews) November 28, 2025

In the meantime, the Financial institution of Korea has expressed contemporary considerations. In an October report, the central financial institution warned that improperly collateralized stablecoins may set off depegging occasions and disrupt capital circulation administration.

It argued once more that solely regulated monetary establishments ought to difficulty stablecoins, stressing that non-bank issuers may successfully interact in deposit-like actions with out the safeguards banks should comply with.

Regardless of regulatory disagreements, the home market is already transferring forward. Naver Monetary has accomplished improvement of a stablecoin pockets for Busan’s Dongbaek-jeon program, which is able to convert town’s pay as you go native foreign money right into a blockchain-based token.

Naver Monetary, the fintech arm of South Korean web big Naver, is making ready to roll out a stablecoin pockets in Busan.#SouthKorea #Cryptohttps://t.co/40QBNaXJ9C

— Cryptonews.com (@cryptonews) November 25, 2025

KakaoBank has begun constructing infrastructure for a KRW-denominated “Kakao Coin,” indicating rising company curiosity in digital received merchandise. Main banks have additionally explored a consortium-issued stablecoin focused for late 2025 or early 2026.

These developments present why lawmakers are decided to satisfy the present legislative window.

Nonetheless, the regulatory uncertainty mirrors different delays in South Korea’s digital asset agenda, together with the nation’s digital asset taxation regime.

Regardless of being accepted in 2020, Korea’s crypto tax legislation has been postponed a number of instances and stays scheduled for 2027, with lots of the required methods nonetheless incomplete.

South Korea's crypto tax implementation could face fourth delay as infrastructure gaps and regulatory uncertainties persist forward of 2027 deadline.#SouthKorea #CryptoTaxhttps://t.co/ZbbTDNBfnY

— Cryptonews.com (@cryptonews) November 24, 2025

South Korea has fallen behind main economies similar to america, the European Union, and Japan, all of which have already formalized stablecoin constructions.

Trade teams warn that additional delays may weaken competitiveness, particularly as dollar-based tokens like USDT proceed to dominate world markets.

The submit South Korea’s Stablecoin Invoice Faces Dec. 10 Deadline – or Lawmakers Act Alone appeared first on Cryptonews.