The European Central Financial institution (ECB) has warned that the fast growth of stablecoins—regardless of their still-limited footprint within the euro space—poses rising financial-stability dangers, particularly as interlinkages with world markets deepen.

Do stablecoins make Europe much less financially secure?

They will trigger volatility if their values sharply deviate from underlying asset costs or if traders withdraw funds quickly.

Learn our Monetary Stability Assessment to learn the way regulation may help.— European Central Financial institution (@ecb) November 24, 2025

The findings come from the ECB report Stablecoins on the rise: nonetheless small within the euro space, however spillover dangers loom, ready by Senne Aerts, Claudia Lambert and Elisa Reinhold, which examines structural vulnerabilities, use circumstances and cross-border dangers tied to the accelerating stablecoin ecosystem.

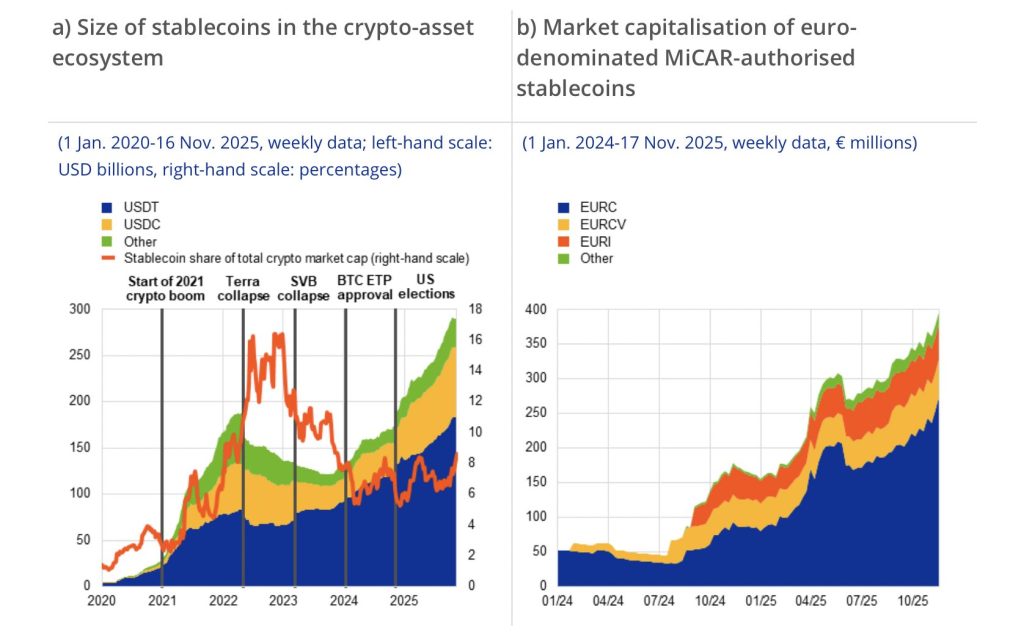

Stablecoin Market Hits $280 Billion, Dominated by USDT and USDC

In response to the authors, the mixed market capitalisation of all stablecoins has surged previous $280 billion, reaching an all-time excessive and accounting for roughly 8% of the entire crypto-asset market. Two US dollar-denominated stablecoins dominate overwhelmingly: Tether (USDT) with $184 billion and USD Coin (USDC) with $75 billion.

Against this, euro-denominated stablecoins stay negligible at solely €395 million, highlighting the acute forex imbalance out there. The ECB attributes the demand surge partly to world regulatory readability, together with the EU’s latest implementation of the Markets in Crypto-Belongings Regulation (MiCA) and the US GENIUS Act.

Crypto Buying and selling Stays the Major Use Case

The ECB report stresses that at present’s stablecoin market is overwhelmingly pushed by buying and selling exercise somewhat than real-world funds. Round 80% of buying and selling exercise on centralised crypto exchanges entails stablecoins, underscoring their function because the core settlement asset in crypto finance.

Whereas stablecoins are sometimes cited as instruments for cross-border funds or shops of worth in high-inflation economies, the ECB notes restricted proof of broad client use. Solely 0.5% of stablecoin volumes look like natural retail transactions, suggesting real-world adoption stays minimal.

De-Pegging, Runs and Treasury-Market Spillovers Spotlight Key Dangers

The authors warn that stablecoins face vital structural vulnerabilities, with de-pegging occasions and redemption runs posing probably the most quick threats. As a result of main stablecoins are backed by giant reserves of conventional monetary property—primarily US Treasury payments—their progress has tied them on to world monetary markets.

Each USDT and USDC now rank among the many largest holders of US Treasuries, with reserve portfolios comparable in scale to the world’s high 20 cash market funds. A sudden run may set off hearth gross sales of US treasuries, doubtlessly disrupting the functioning of the world’s most necessary funding market.

The report notes that if stablecoin provide continues rising at its present tempo, market capitalisation may method $2 trillion by 2028, amplifying spillover dangers—particularly given the acute focus, with simply two issuers controlling about 90% of provide.

Regulatory Arbitrage Stays a Main Concern

Regardless of MiCA’s strict framework within the EU, world inconsistencies create alternatives for cross-border regulatory arbitrage. The ECB highlights the chance of multi-jurisdiction issuance of fungible tokens, which may depart EU regulated issuers under-reserved relative to world redemption calls for.

The authors conclude that whereas stablecoins stay small within the euro space, fast worldwide progress—and deepening ties to conventional markets—justify shut monitoring. They name for world regulatory alignment, in keeping with the G20 roadmap and Monetary Stability Board suggestions, to mitigate cross-market contagion dangers.

The submit ECB Warns Stablecoins Are Rising Quick With Spillover Dangers appeared first on Cryptonews.