XRP has fallen to $2.40 after a 5% drop over 24 hours and eight% decline over the previous week. The current pullback started from the $2.70 degree, which analysts mark as the highest of a correction section.

Because the asset approaches key help zones, short-term strain continues whereas longer-term patterns stay intact.

Correction Nearing Key Assist Zone

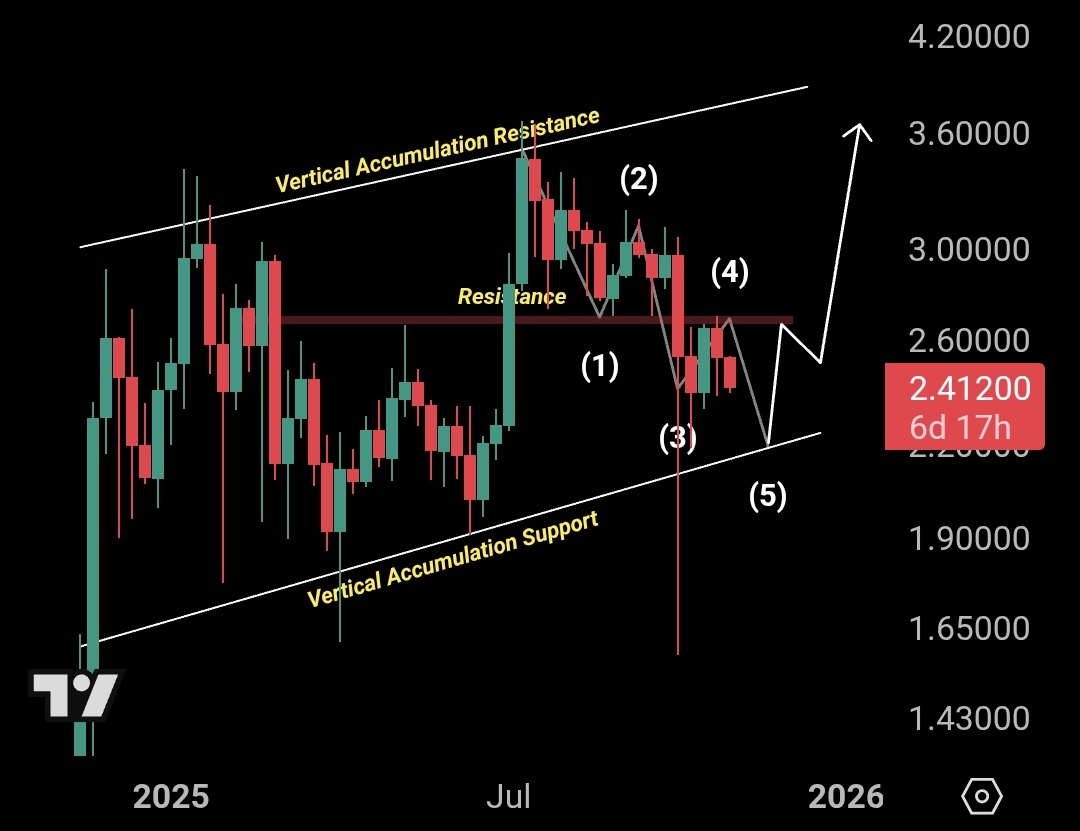

Analyst ChartNerd shared that the present drop aligns with the fifth wave of a bigger correction, which began after XRP reached $2.70. Value motion since then has adopted a five-wave construction, with the ultimate leg probably ending close to $2.00. The world simply above this degree, labeled as vertical accumulation help, has held throughout previous pullbacks. ChartNerd added,

“Potential wick to $2 doable,” whereas additionally noting that “no macro construction has been misplaced.”

This means the broader pattern has not been invalidated. The asset continues to commerce inside a rising channel, and help ranges from earlier cycles stay in place. A reversal close to $2.00 might affirm the completion of this wave.

In the meantime, XRP has now spent over a yr buying and selling above its 2021 highs and prior all-time excessive candle closes.

Brief-Time period Chart Factors to Weak spot

Separate evaluation from Ali Martinez reveals bearish motion within the short-term outlook. The 4-hour chart reveals XRP was rejected close to $2.57 and has since slipped under $2.45. A decrease excessive sample is forming, with downward strain from transferring averages contributing to continued weak point.

$XRP displaying indicators of weak point. A retest of $2.25 is likely to be subsequent! pic.twitter.com/RMYX15hbRt

— Ali (@ali_charts) November 2, 2025

His chart outlines a projected transfer via decrease help zones, probably reaching $2.25 earlier than any restoration. The construction factors to a short-term downtrend, although longer-range help ranges are nonetheless being revered.

ETF Expectations and Market Sentiment

As CryptoPotato just lately reported, curiosity in a possible spot XRP ETF has grown in current weeks. In accordance with prediction markets like Polymarket, approval is broadly anticipated, with present odds being at virtually 100%. The conclusion of Ripple’s authorized case with the SEC earlier this yr eliminated a serious barrier, clearing the way in which for doable regulatory progress.

XRP briefly moved above $2.65 following renewed optimism and broader market help from a current rate of interest reduce. Nonetheless, the value motion has since cooled. Market members are actually watching each the ETF timeline and key help zones to gauge the subsequent transfer.

The publish XRP at a Crossroads: Drop to $2 Subsequent or Breakout Brewing? appeared first on CryptoPotato.