Ripple’s XRP is buying and selling at $2.51 at press time, displaying a slight enhance over the previous 24 hours. The worth motion follows a serious breakout from a long-term technical sample that had saved the asset in a spread for seven years.

Since that transfer, XRP has been buying and selling inside an outlined vary, with sturdy curiosity holding it above earlier resistance ranges.

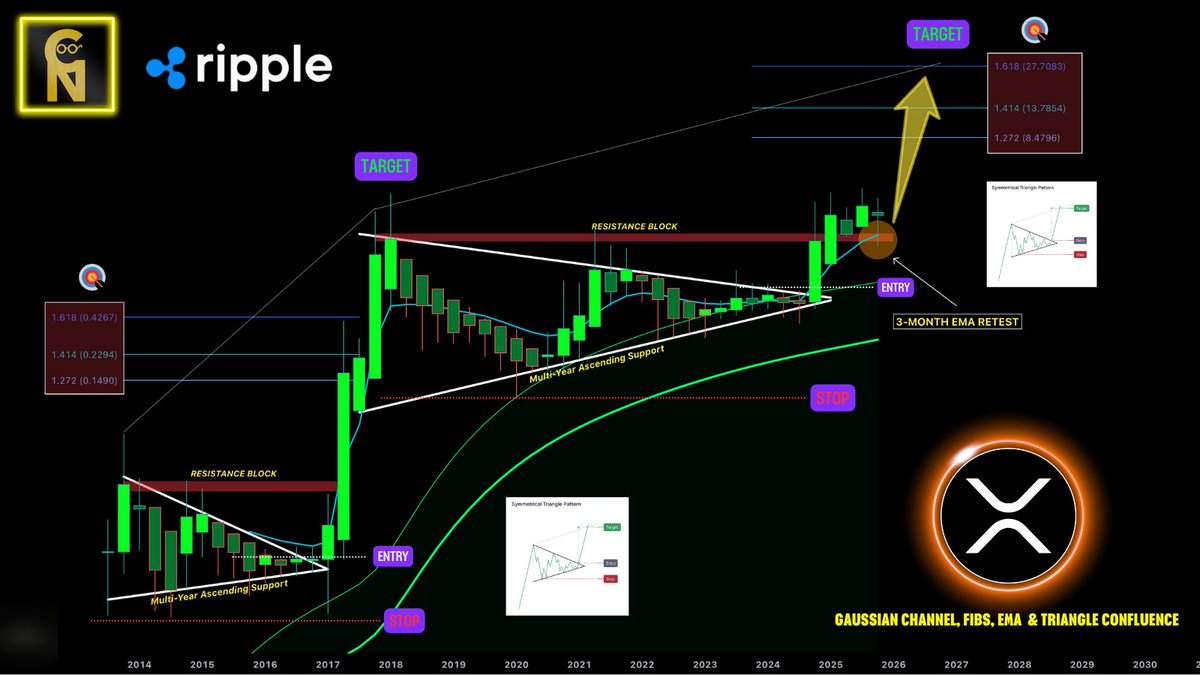

Breakout From Lengthy-Time period Chart Sample

XRP just lately moved above the higher trendline of a symmetrical triangle that had formed its worth for practically a decade. This transfer pushed the asset previous key ranges, together with the all-time excessive candle closes and 2021 peaks. For the reason that breakout, the market has entered a gradual section, with the value consolidating between $2.00 and $3.00.

In line with market analyst ChartNerd, this space now acts as a key vary for accumulation. The previous resistance has was a assist zone, which might type the bottom for future worth strikes. The analyst famous that this construction has remained secure for nearly a 12 months and reveals no signal of weak point thus far.

$XRP broke out of a 7 12 months symmetrical triangle and has since been accumulating above the prior ATH candle closes & the prior highs from 2021 for practically 12 months. Signalling vital power and momentum. Tieing up with bullish developments and regulatory readability = HIGHER pic.twitter.com/HurHJ77nTw

—

ChartNerd

(@ChartNerdTA) October 31, 2025

As beforehand reported, analysts have in contrast the present XRP construction to 2017, with fashions nonetheless pointing to a transfer above $5 this cycle.

Moreover, worth fashions constructed on Fibonacci extensions are pointing to doable future ranges at $8, $13, and $27. These are drawn from previous worth exercise and the peak of the earlier triangle sample. As well as, a long-standing ascending trendline and a 3-month exponential shifting common proceed to information the market upward.

ChartNerd stays assured within the outlook so long as the asset stays above the breakout zone. “The macro construction stays intact,” the analyst posted, suggesting that the longer-term chart nonetheless helps upward continuation.

Quick-Time period Uncertainty Round Key Worth Ranges

Whereas the long-term image stays secure, short-term charts are displaying blended indicators. CRYPTOWZRD identified that XRP closed the final every day candle barely decrease and mentioned the approaching month-to-month shut might affect the subsequent transfer. Including that any drop under that stage might result in extra sideways motion, the analyst mentioned,

“Holding above $2.55 is bullish territory.”

In the meantime, there may be near-term resistance at $2.75, which might result in a pointy transfer greater if damaged. On the draw back, $2.27 is being watched as the subsequent stage of assist.

Exercise within the Market and ETF Replace

Latest technical indicators, together with the TD Sequential instrument, have issued a promote sign following the latest rally. This instrument has been used to forecast worth adjustments and has labored properly in earlier XRP cycles. Alongside that, information reveals that giant holders have been lowering their positions over the previous few weeks, as CryptoPotato reported.

Remarkably, there may be additionally renewed consideration on the potential launch of a spot XRP exchange-traded fund. Canary Capital just lately up to date its submitting with the US Securities and Trade Fee. The removing of a key delay clause suggests the ETF might go stay as early as November 13.

The submit Ripple’s XRP Nears Key Ranges After Historic Technical Breakout appeared first on CryptoPotato.