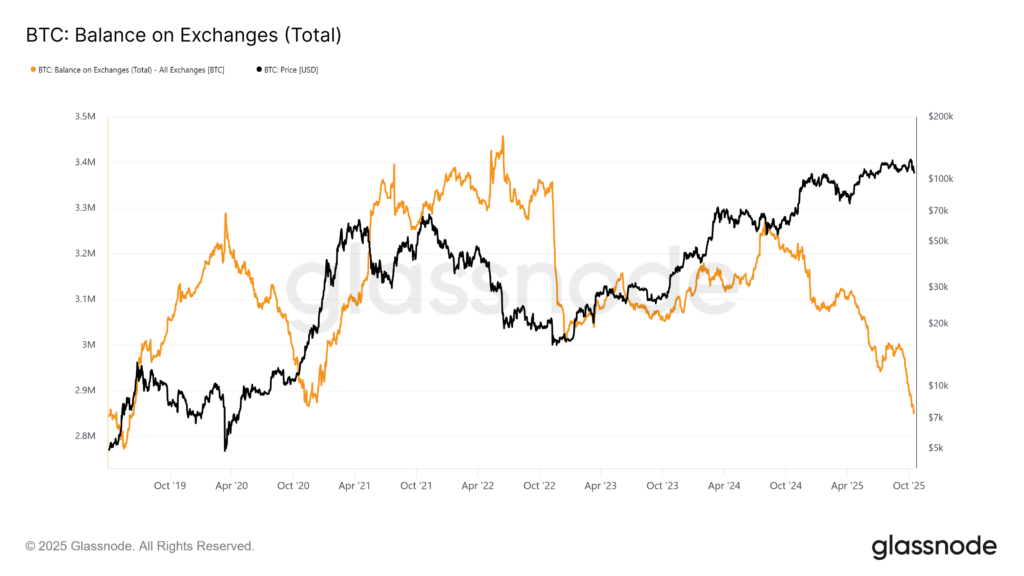

Bitcoin’s trade balances have dropped sharply, highlighting a deepening provide squeeze as long-term holders tighten management over circulation. Over 45,000 BTC, price almost $4.8 billion, has been withdrawn from centralized exchanges since early October, signaling that traders are transferring belongings into chilly storage reasonably than conserving them out there for buying and selling.

Bitcoin Provide on Exchanges Declines Sharply

A decrease trade steadiness typically means fewer cash can be found on the market, decreasing speedy market provide. When mixed with steady or rising demand, this creates circumstances that may speed up upward value strikes. The most recent withdrawal pattern factors to rising investor confidence in Bitcoin’s long-term potential, regardless of current volatility.

Against this, inflows to exchanges are likely to rise throughout uncertainty, when merchants search liquidity. The other is now occurring: outflows are rising at the same time as costs stay subdued. This conduct means that many contributors see the current correction as an accumulation alternative, not a threat occasion.

On the time of writing, Bitcoin trades at $108,417, up 1.34% in 24 hours, with a complete market capitalization of $2.16 trillion. The circulating provide stands at 19.93 million BTC, leaving fewer than 1.1 million cash but to be mined earlier than the community reaches its exhausting cap of 21 million.

Lengthy-Time period Holders Keep Management

On-chain metrics present that long-term traders stay lively regardless of short-term uncertainty. In accordance with Santiment, the 30-day Market Worth to Realized Worth (MVRV) ratio is -7.56%, indicating that current patrons are holding small unrealized losses.

Traditionally, destructive MVRV readings have marked accumulation phases, the place Bitcoin trades beneath perceived truthful worth.

In earlier cycles, comparable setups preceded value recoveries as promoting strain eased and confidence returned. Knowledge additionally exhibits that leveraged positions are at multi-year lows, decreasing the danger of pressured liquidations. With derivatives markets displaying extra balanced sentiment, the setting helps gradual accumulation and consolidation earlier than a broader restoration section.

BTC Value Evaluation: Restoration Inside Attain

From a technical standpoint, Bitcoin value prediction is popping barely bullish because it’s forming a symmetrical triangle sample on the two-hour chart. This construction typically alerts a possible breakout. The worth is testing the 200-EMA resistance at $108,500, whereas sustaining increased lows for the reason that $104,500 backside on October 17.

The RSI has climbed from 35 to 59, indicating bettering momentum with out getting into overbought territory.

A breakout above $110,850 may open the trail towards $113,500 and $115,960, key resistance zones throughout the earlier descending channel. Failure to carry above $107,400, nevertheless, may set off a pullback towards $104,550 or $102,000.

For merchants, an extended place above $108,800 with a cease beneath $107,400 presents a measured alternative focusing on $113,500. If energy persists, Bitcoin may method $116,000 earlier than year-end.

With trade provide tightening and long-term holders accumulating, Bitcoin’s structural setup seems more and more bullish. As institutional demand rebuilds and macro pressures stabilize, the availability squeeze could set the stage for the following main value enlargement.

Bitcoin Hyper: The Subsequent Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a brand new section to the Bitcoin ecosystem. Whereas BTC stays the gold customary for safety, Bitcoin Hyper provides what it all the time lacked: Solana-level velocity.

Constructed as the primary Bitcoin-native Layer 2 powered by the Solana Digital Machine (SVM), it merges Bitcoin’s stability with Solana’s high-performance framework. The outcome: lightning-fast, low-cost good contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Seek the advice of, the venture emphasizes belief and scalability as adoption builds. And momentum is already robust. The presale has surpassed $23.9 million, with tokens priced at simply $0.013125 earlier than the following enhance.

As Bitcoin exercise climbs and demand for environment friendly BTC-based apps rises, Bitcoin Hyper stands out because the bridge uniting two of crypto’s largest ecosystems.

If Bitcoin constructed the inspiration, Bitcoin Hyper may make it quick, versatile, and enjoyable once more.

Click on Right here to Take part within the Presale

The submit Bitcoin Value Prediction: Onchain Accumulation Hits Six-Yr Low – What Does the Provide Squeeze Imply for BTC? appeared first on Cryptonews.