The G20’s prime monetary watchdog has warned that strict privateness and knowledge safety legal guidelines are hindering world regulators from successfully overseeing the fast-growing cryptocurrency sector.

In an in depth peer evaluate report launched on Thursday, the Monetary Stability Board (FSB), a worldwide authority funded by the Financial institution for Worldwide Settlements (BIS), stated inconsistencies in nationwide crypto frameworks are creating main boundaries to cross-border supervision and systemic threat monitoring.

Crypto-asset markets are inherently world, however a number of shortcomings at present stop an efficient and complete oversight by authorities and will delay a coordinated response to potential systemic dangers. Discover out extra: https://t.co/IdgZgErsKF#crypto #stablecoins

— The FSB (@FinStbBoard) October 17, 2025

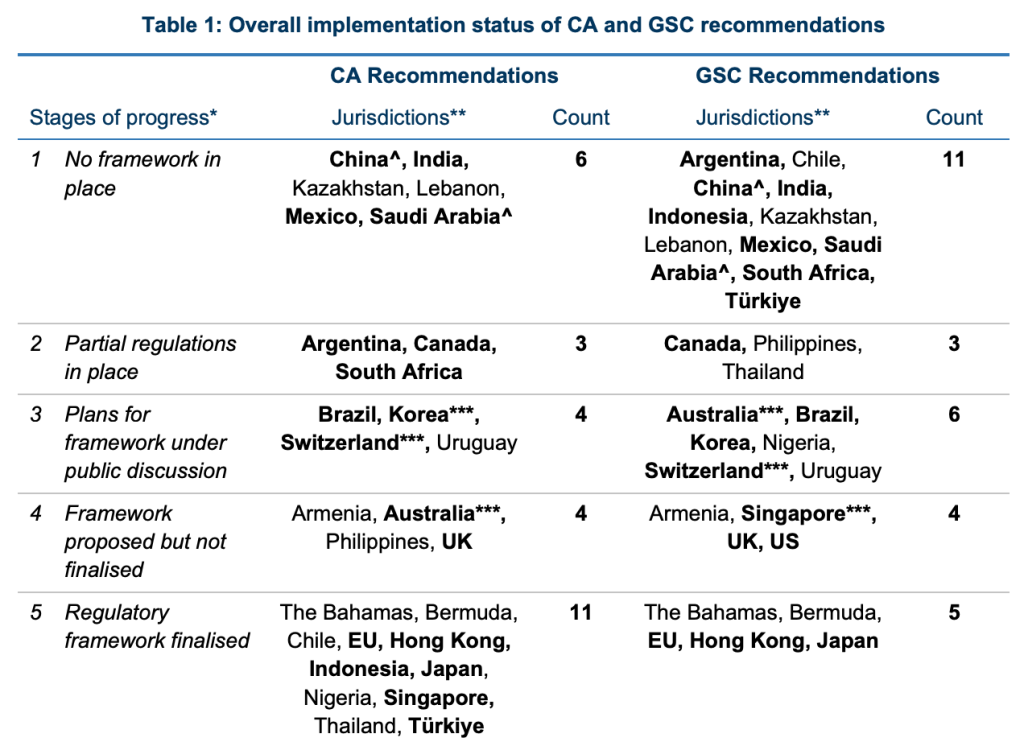

The FSB’s 107-page evaluate outlined persistent gaps in how nations regulate digital property akin to Bitcoin and stablecoins.

It famous that divided supervisory obligations, fragmented approaches, and particularly knowledge privateness legal guidelines are complicating information-sharing amongst regulators worldwide.

“Secrecy or knowledge privateness legal guidelines might pose vital boundaries to cooperation,” the FSB wrote, including that in lots of jurisdictions, confidentiality guidelines stop corporations from sharing transaction or risk-related knowledge with international regulators.

Lack of Information Entry Leaves Regulators “Blind” to Crypto Dangers, FSB Finds

This, the report stated, “results in delays in addressing cooperation requests” and in some instances “discourages participation in cooperation preparations altogether.”

The board stated privateness protections, whereas important for private and company rights, have develop into a double-edged sword for world oversight. With out constant and dependable knowledge entry, regulators are unable to establish potential systemic dangers within the crypto sector.

The report additionally stated that “regulatory knowledge sources stay restricted,” forcing authorities to depend on incomplete info from industrial suppliers and surveys that always lack accuracy and consistency.

In response to the FSB, the uneven regulatory setting throughout main economies has led to regulatory arbitrage, permitting crypto corporations to shift operations throughout borders to take advantage of weaker oversight regimes.

The board urged governments to shut knowledge gaps and strengthen cooperation mechanisms to keep away from additional fragmentation of the worldwide crypto market.

The FSB’s warning comes as privateness debates intensify inside the crypto trade.

Advocates argue that privateness is crucial for shielding customers from surveillance and monetary exploitation, whereas regulators view the shortage of transparency as a significant impediment to combating cash laundering and illicit finance.

The stress displays a deeper divide between two monetary philosophies. For governments, knowledge entry is a cornerstone of economic stability and compliance enforcement.

Privateness is the lacking key to crypto's mass adoption. With out it, main buyers and establishments keep cautious. On this op-ed, @gegelz01 explores why privateness options should lead crypto's evolution.#Crypto #Privacyhttps://t.co/3YAUkh8M0C

— Cryptonews.com (@cryptonews) November 19, 2024

For the crypto group, privateness represents a basic proper and a crucial layer of safety in digital finance.

Privateness advocates be aware that transparency on public blockchains can expose folks and companies to aggressive and safety dangers.

Public pockets knowledge can reveal salaries, commerce volumes, and strategic holdings, info that, in conventional finance, stays strictly confidential.

Specialists say that with out privateness, enterprises and establishments stay hesitant to undertake blockchain for mainstream monetary operations.

Specialists, Particularly Ethereum, Say Lack of Privateness is Crypto’s Greatest Weak spot

Latest initiatives inside the Ethereum ecosystem present the trade’s efforts to deal with these privateness issues.

The Ethereum Basis lately launched a 47-member Privateness Cluster coordinated by Blockscout founder Igor Barinov. The group seeks to develop privacy-preserving applied sciences akin to personal reads and writes, selective disclosure for digital identities, and a brand new privacy-focused pockets referred to as Kohaku.

The inspiration warned earlier this 12 months that with out sturdy privateness safeguards, Ethereum may threat turning into “the spine of worldwide surveillance moderately than world freedom.”

Ethereum Basis's @PrivacyEthereum rebrands as PSE with a roadmap making privateness the default throughout the technical stack to stop surveillance dangers.#Ethereum #Privacyhttps://t.co/opTQ6LQaOc

— Cryptonews.com (@cryptonews) September 14, 2025

Ethereum co-founder Vitalik Buterin has additionally been vocal on the difficulty, describing privateness as “important to decentralization.”

In his essay “Why I Help Privateness,” Buterin argued that info asymmetry, when energy is concentrated amongst those that management knowledge, undermines democratic and monetary steadiness.

The talk over crypto privateness has additionally drawn consideration from regulators within the EU, U.S., and U.Ok., the place legal guidelines governing Know Your Buyer (KYC) procedures and the Monetary Motion Process Power’s (FATF) Journey Rule are tightening.

Builders of privateness instruments akin to mixers and zero-knowledge proof methods have confronted growing scrutiny, with some jurisdictions treating privateness applied sciences as potential instruments for prison exercise.

Regardless of regulatory stress, many inside the crypto trade preserve that privateness and compliance aren’t mutually unique.

Rising fashions akin to sensible contract privateness enable transactions to stay verifiable with out exposing delicate knowledge, a steadiness that might fulfill each regulators and establishments.

Finance veteran Petro Golovko, belief protector at British Gold Belief, advised Cryptonews that the shortage of privateness is “crypto’s largest undoing.”

He argued that no financial system can perform if “each transaction is completely public,” saying that with out privateness, crypto “won’t ever scale past a distinct segment.”

The FSB’s report concludes that addressing privateness boundaries can be key to supporting efficient cross-border cooperation.

The submit G20 Watchdog Sounds Alarm: Privateness Guidelines Are Handcuffing World Crypto Oversight appeared first on Cryptonews.