Bitcoin has continued its corrective transfer this week, dropping from all-time highs and testing key trendline and help ranges. Whereas the broader macro construction stays bullish, the short-term outlook suggests consolidation and even deeper draw back if purchaser momentum fails to step in quickly.

Technical Evaluation

By Shayan

The Each day Chart

On the each day timeframe, BTC has damaged beneath the 100-day transferring common, positioned round $115K, however is at the moment sitting proper on the decrease trendline of the massive ascending channel and the crucial 200-day transferring common. This space additionally aligns with a earlier order block and is appearing as main help.

Nonetheless, RSI stays underneath 40, reflecting a transparent lack of bullish momentum, and until the value rebounds rapidly, this trendline may break, opening the door towards ranges beneath the important thing $100K zone, which may result in an total bearish shift in market pattern.

The 4-Hour Chart

Zooming in, it’s evident that BTC has shaped a minor base round $105K after the breakdown of $115K and $109K ranges. The asset is struggling to reclaim the $108K-$109K zone that has now become resistance. Furthermore, the RSI is barely bouncing however nonetheless lacks sturdy momentum, hovering round 38.

The general construction nonetheless favors the bears within the brief time period until a powerful reclaim of $110K adopted by larger lows materializes. In any other case, sellers may push BTC into the $100K area and even decrease.

Sentiment Evaluation

Futures Common Order Measurement

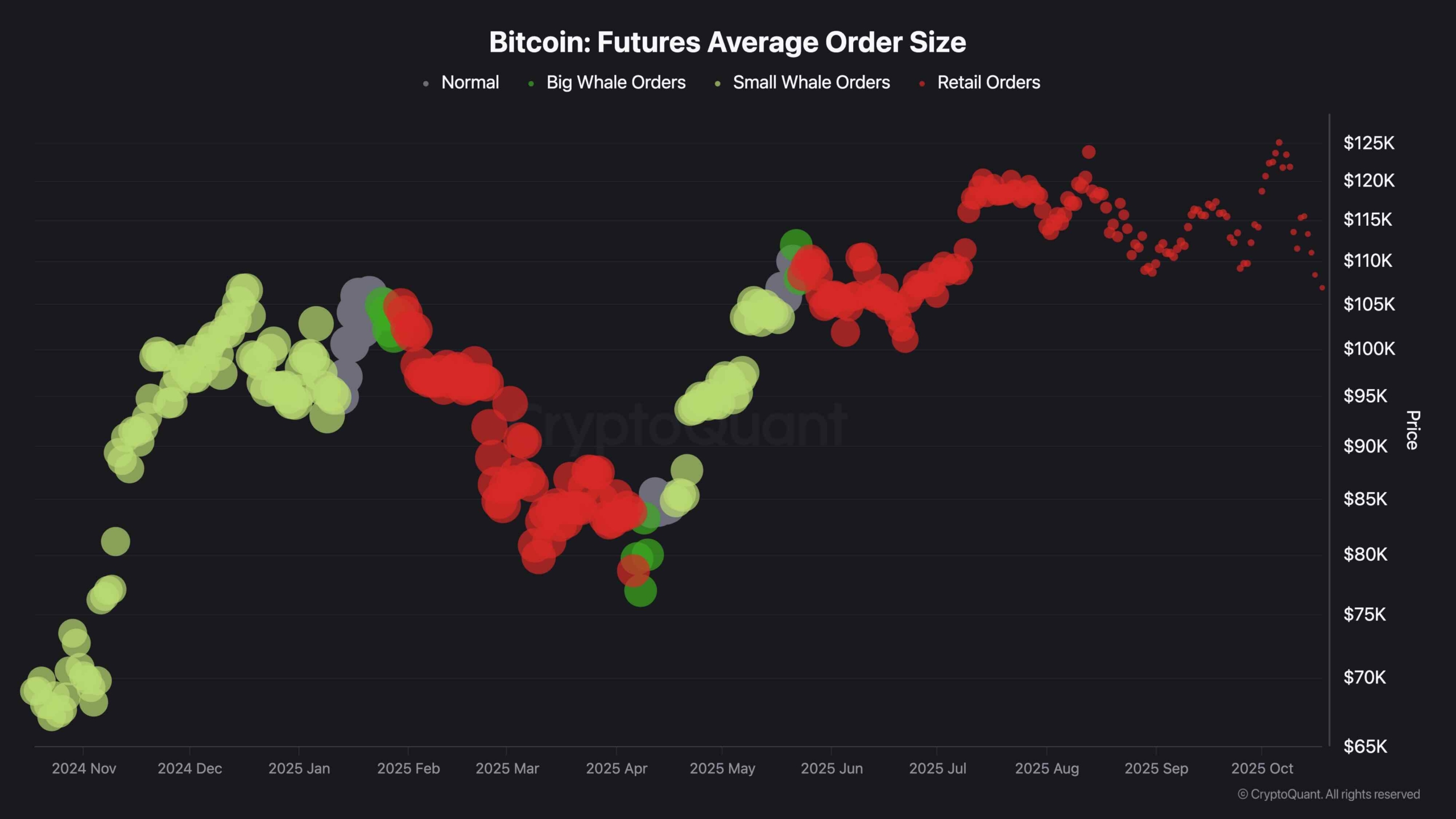

Futures order measurement knowledge exhibits a dramatic shift from whale exercise towards smaller, retail-driven positions over the previous few weeks. As the value started correcting in September, the variety of giant whale orders began to fade, changed virtually totally by smaller retail trades.

This means that the sensible cash has stepped except for leveraged positions, whereas retail merchants proceed to interact. This typically happens throughout pattern exhaustion phases and the latter levels of bull markets, which is a really regarding growth.

It reinforces the concept the current dip shouldn’t be pushed by sturdy accumulation, which will increase the danger of additional draw back until new institutional demand steps in.

The submit Bitcoin Value Evaluation: First Bearish Indicators Seem as BTC Falls by $20K From ATH appeared first on CryptoPotato.