Ethereum continues its correction part after failing to take care of momentum above $4,200. The market’s sentiment stays cautious as ETH trades round $3,700, displaying weak point each technically and sentiment-wise. Patrons are seemingly shedding management, and the main focus now shifts to key assist zones beneath.

Technical Evaluation

By Shayan

The Day by day Chart

On the day by day timeframe, ETH has damaged beneath the long-term ascending channel construction and the 100-day shifting common, situated across the $4,100 mark. The value is at the moment shifting towards the 0.5 Fibonacci retracement stage at $3,530. This zone is a important space that beforehand acted as assist, and is the bottom of the newest rally in August.

The RSI round 37 signifies bearish momentum however hasn’t reached oversold territory but, implying that extra draw back remains to be doable. A clear breakdown beneath $3,500 may open the way in which towards the 0.618 retracement stage at $3,200, whereas reclaiming the final value excessive round $4,200 could be the primary signal of restoration.

The 4-Hour Chart

The 4-hour chart reveals clear bearish order stream because the downtrend is aggravating after shedding the $4,200 stage and failing to reclaim it. The latest rejection from this zone has confirmed a shift within the short-term market construction to bearish.

Momentum stays weak with RSI close to 33, suggesting sellers nonetheless dominate. The following demand zone lies round $3,500–$3,400, the place consumers lately held their floor through the huge liquidation occasion. Nonetheless, failure to carry this stage may speed up the transfer towards $3,200 and even $3,000 in a deeper decline.

Sentiment Evaluation

Lengthy Liquidations

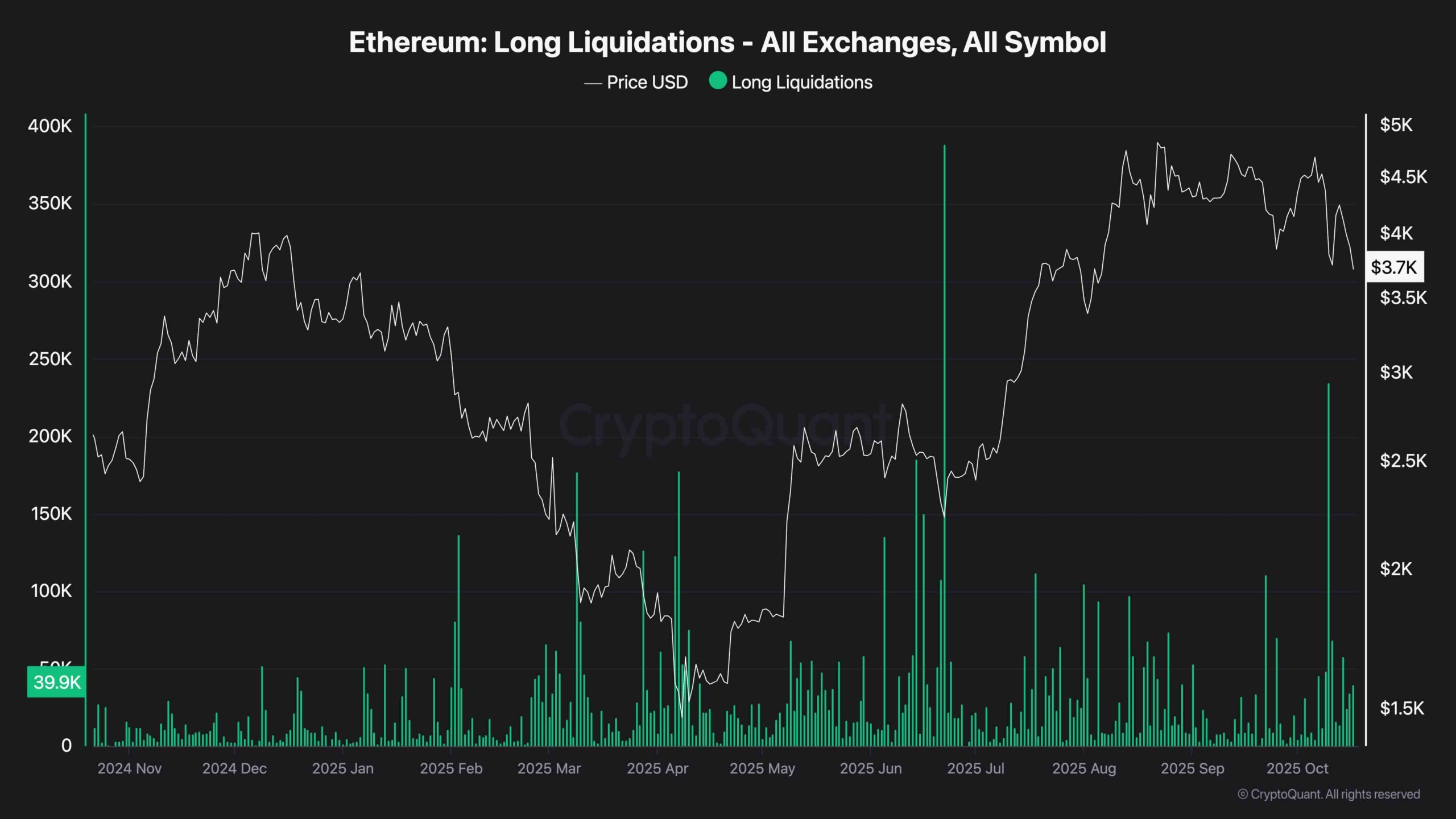

Ethereum’s newest drop triggered a notable spike in lengthy liquidations throughout all exchanges, marking one of many largest deleveraging occasions in latest months. This surge in compelled promoting displays how overconfident lengthy merchants have been caught off guard by the market’s swift reversal.

Traditionally, such liquidation spikes usually seem close to native bottoms as leveraged positions get flushed out. Nonetheless, the magnitude of this newest transfer suggests panic amongst retail merchants, whereas establishments are probably ready for clearer affirmation earlier than re-entering.

General, the sentiment stays fearful and risk-averse, with merchants preferring warning over aggressive lengthy publicity within the brief time period.

The publish Ethereum Worth Evaluation: Is $3.5K Subsequent for ETH After 13% Weekly Drop? appeared first on CryptoPotato.