The proposed merger between Naver and the Upbit crypto alternate operator Dunamu may create a “mega firm” with income totaling $2.1 billion a yr, specialists declare.

Per stories from the South Korean media retailers Newsis and Wow TV, the Naver-Dunamu merger is “anticipated to generate KRW 3 trillion in consolidated working income.”

Nonetheless, specialists say that “regulatory uncertainties” stay, with others this month talking about 5 main authorized obstacles standing within the corporations’ manner.

Naver-Dunamu Crypto Merger: Positivity Surrounding Deal, Says Skilled

The retailers interviewed Jang Ho-yoon, a researcher on the securities supplier Korea Funding & Securities.

The researcher defined that Naver “has at all times been comparatively undervalued” on the South Korean market, regardless of its rival Kakao “receiving a excessive valuation by way of enterprise growth.” He defined:

“The acquisition of Dunamu will permit Naver to totally enter the crypto trade. Stablecoins, specifically, may generate vital synergy with Naver’s present promoting, commerce, and fintech companies.”

The Kospi surged previous 3,600 mark for the primary time ever in early buying and selling Friday as Korean markets reopened after the lengthy Chuseok vacation, fueled by a rally in semiconductor and biotech shares following robust momentum from U.S. chipmaker Nvidia. https://t.co/HMv6UQaJXd

— The Korea JoongAng Day by day (@JoongAngDaily) October 10, 2025

Naver is the nation’s largest web firm. Its subsidiary Naver Monetary already operates a number of banking and e-pay platforms.

The agency hopes to merge Naver Monetary with Dunamu, the proprietor of South Korea’s largest crypto buying and selling platform. The transfer would create Asia’s largest fintech firm. Jung defined:

“The trade expects the brand new agency to create a stablecoin ecosystem centered on Dunamu’s alternate enterprise and its GIWA protocol [Upbit’s Layer-2 Ethereum-based chain]. Combing this with Naver’s present companies will let it safe an advantageous place over opponents in each the crypto and basic fee spheres.”

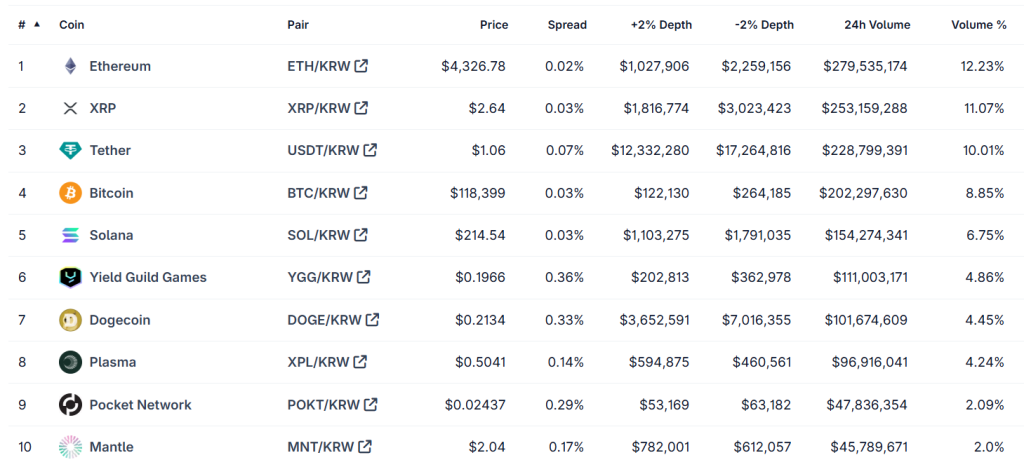

We're thrilled to announce that $YGG is now listed on @official_Upbit spot (KRW).

Thanks to our unimaginable Korean Group!https://t.co/g5WGmmxvJU

— Yield Guild Video games (@YieldGuild) October 15, 2025

Buying and selling Growth Incoming?

The researcher additionally predicted a coming growth in crypto buying and selling exercise. He stated that as the US enters “a rate-cut cycle,” crypto buying and selling volumes are prone to improve. Jung defined:

“As superior blockchain-powered companies, reminiscent of stablecoins and tokenized securities, change into common in Korea, numerous enterprise alternatives will open up for Naver.”

Jung opined that the merger would “open up varied potentialities for Naver,” which has seen its valuation decline resulting from “a scarcity of latest development engines.”

And whereas some proceed to say that regulatory approval for the merger remains to be up within the air, the researcher stated there was a “comparatively constructive ambiance” across the deal.

Whereas laws nonetheless stop banks from participating in crypto-related enterprise, some say that these guidelines don’t apply to e-pay suppliers like Naver.

Jung stated that there’s uncertainty over the query of whether or not fintech corporations reminiscent of Naver Monetary must be thought-about conventional monetary corporations. He stated:

“The degrees of uncertainty surrounding the merger will not be very excessive.”

The researcher concluded that the proposed merger meant Naver can be “essentially the most notable web large-cap inventory to observe subsequent yr.”

Naver Monetary final month introduced a plan to successfully take over Dunamu in a proposed complete inventory swap deal.

Upbit has cornered over 70% of the South Korean market share, per current estimations. The merger speak has stoked hypothesis that Naver Monetary-Dunamu may look to go public on the NASDAQ alternate.

The publish Naver-Dunamu Crypto ‘Mega-Firm’ Might Be Value $2.1B a Yr – Consultants appeared first on Cryptonews.