Ethereum is displaying a robust chart construction as some market analysts recommend a potential worth transfer to $7,000 by mid-2026.

In the meantime, the asset is holding key ranges after a latest pullback, with buying and selling exercise reflecting a part of consolidation. Analysts level to long-term patterns and investor conduct as causes for this forecast.

Weekly Chart Kinds Bullish Sample

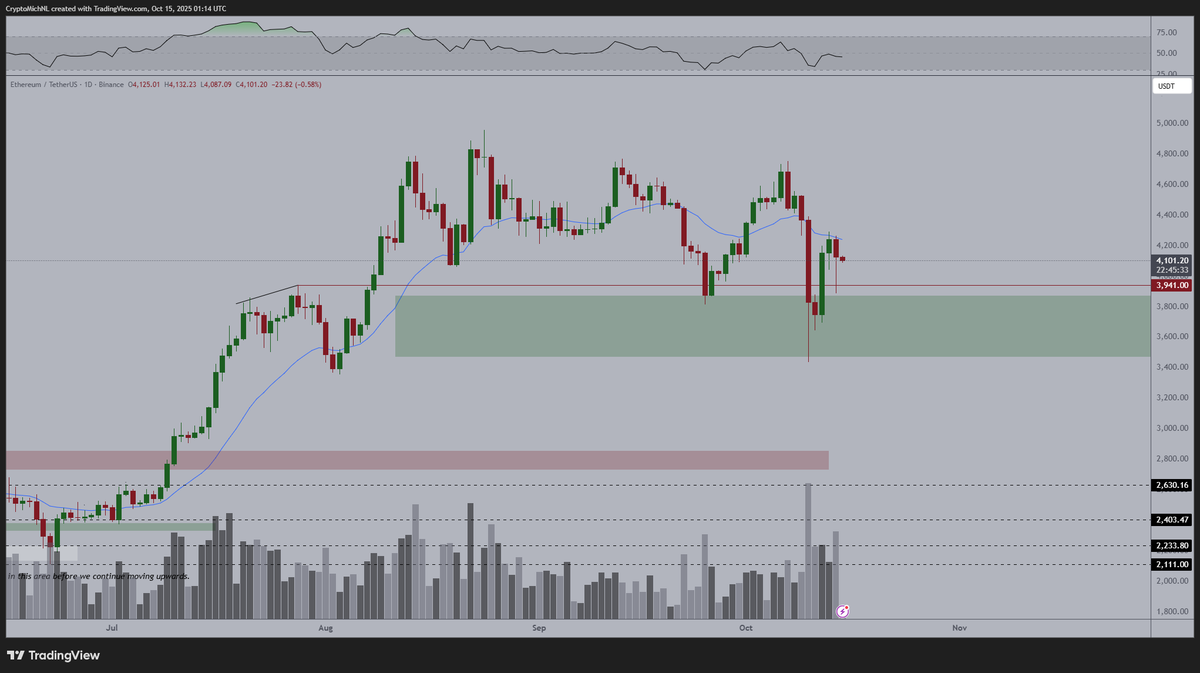

A technical chart shared by analyst Mike Investing reveals Ethereum buying and selling inside a flag formation on the weekly timeframe. The setup follows a gradual rise in worth from late 2024 into early 2025. After reaching above $4,400, ETH corrected barely and is now buying and selling close to $4,100.

$ETH is positioning inside an aggressive bullish flag and is about to see a euphoric squeeze.

With $ETH bottomed out and finishing its final laborious pullback under $4k this yr this chance is generational.

Bears are in main hassle now.

$7,000 by Could 2026.

Mark my phrases… pic.twitter.com/EDBIFtdY2R

— Mike Investing (@MrMikeInvesting) October 14, 2025

In accordance with the chart, this pullback stays inside a bullish construction. The 200-week transferring common, at the moment close to $2,447, continues to behave as a help line. ETH has stayed above this stage, maintaining its long-term pattern in place. The analyst tasks a transfer to $7,000 by Could 2026. He added that any drop under the $3,500–$3,600 zone would put the present setup in danger.

Furthermore, analyst Michaël van de Poppe has pointed to the next low formation within the latest worth motion. In a submit on X, he acknowledged:

“Greater low is created right here on $ETH. I believe that we’ll see a robust breakout within the coming 1–2 weeks and a brand new ATH.”

His chart reveals ETH rebounding from the $3,600–$3,900 zone, a variety that has held as help throughout previous assessments. On the time of the most recent replace, ETH was buying and selling close to $4,100 after pulling again from $4,600. Buying and selling quantity has began to rise once more, which can sign new demand.

The 21-day EMA is now flattening. If the asset closes above it, it may result in a retest of the latest excessive. RSI ranges stay within the center vary, permitting room for additional motion in both route. The present sample helps the thought of regular accumulation, so long as the value stays above help.

Trade Balances Attain Multi-Month Lows

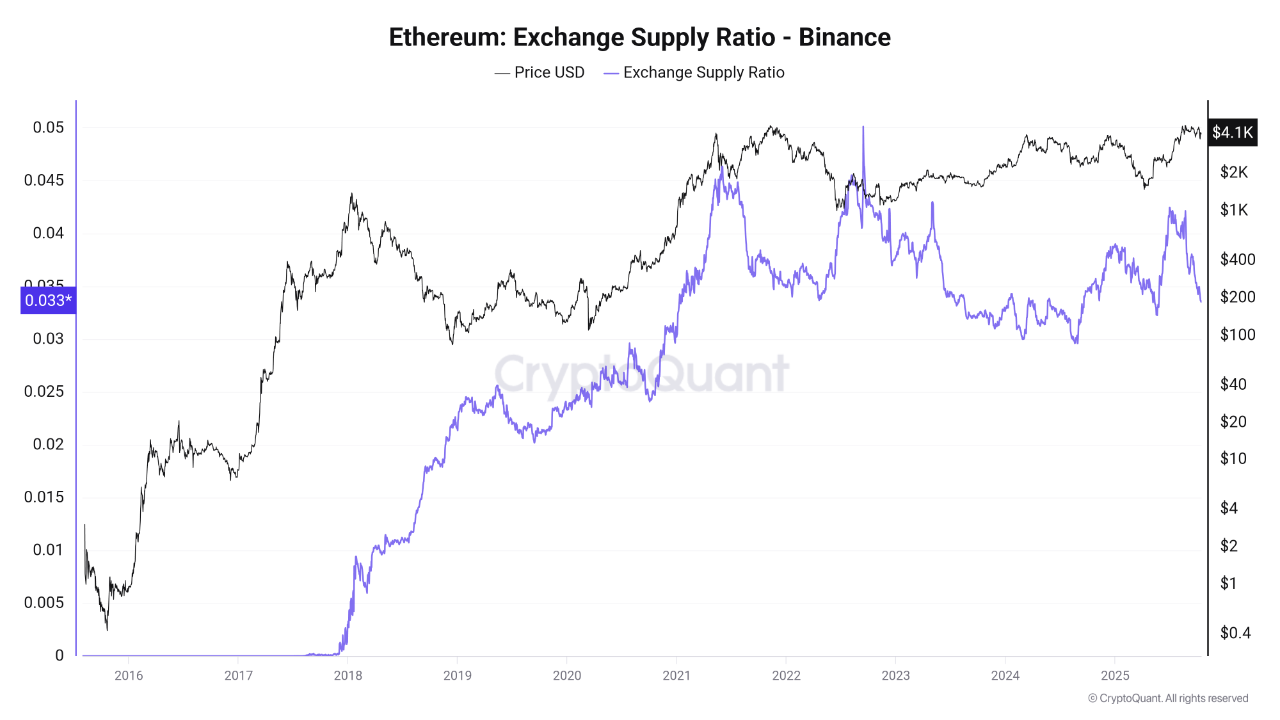

In accordance with knowledge from CryptoQuant analyst Arab Chain, the Ethereum provide on Binance has reached a multi-month low. The availability ratio is now round 0.33. This means that extra ETH is being moved off exchanges and into self-custody wallets.

Such strikes usually point out decrease short-term promoting exercise. In earlier market cycles, comparable tendencies have been adopted by worth will increase. Buyers look like taking a longer-term view, eradicating cash from exchanges and decreasing out there provide within the open market.

Whale Exercise Rises as Retail Steps Again

Retail is fading $ETH.

Whales are loading up.

I’m following the good cash! pic.twitter.com/iiLb55BXj8

— CryptoGoos (@crypto_goos) October 15, 2025

The submit displays a rising distinction in conduct between smaller buyers and bigger holders. That is backed by latest knowledge. There was a lower in retail buying and selling quantity, whereas accumulation of ETH by giant pockets holders has been happening concurrently.

Together with this, the institutional curiosity in self-storage and staking has continued to extend. The centralized platforms are holding fewer cash, which is contributing to reducing market liquidity and indicating long-term holding methods.

The submit $7K Ethereum by 2026? Analyst Explains the Bullish Case appeared first on CryptoPotato.